The market was eagerly awaiting a slowdown in the pace of retail sales growth in the United States from 1.5% to 1.0% that the pound started to rise even before this report was released. And even after the retail sales report, which showed that sales increased 3.2% in July, and that retail trade sales were revised higher by 0.6%, the pound continued to rise for some time. Likely due to the momentum. Afterwards, the exchange rate returned to the levels where it was at the beginning of the trading day.

The main item on today's agenda is the UK inflation report. And judging by the forecasts, the pace of consumer price growth may cool from 7.9% to 6.9%. Such a sharp slowdown in inflation may force the Bank of England to slightly reduce the pace of monetary tightening, which will undoubtedly have a negative impact on the pound.

However, after the opening of the US session, the pound will be able to recover some of its losses due to the accelerated pace of decline in US industrial production. And it is expected to intensify from -0.4% to -0.7%. So the overall weakening of the pound will not be as drastic. Especially since yesterday's macro data pointed to a sharp fall of the pound, which didn't actually happen. It is time to talk about the dollar's growth potential, which limits the possibilities for the pound's decline.

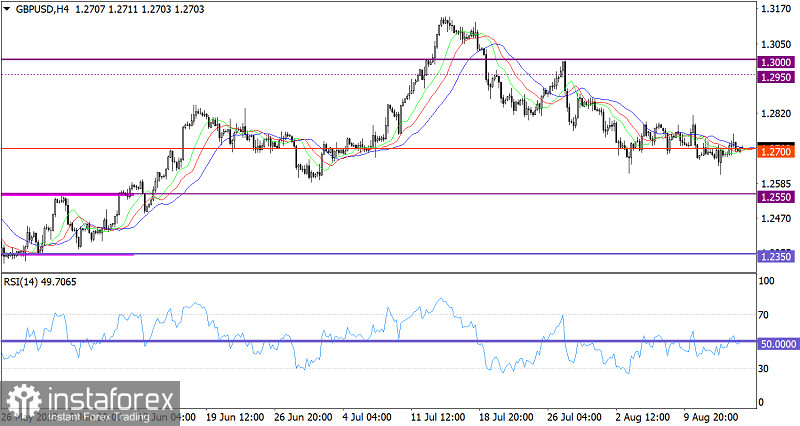

The GBP/USD currency pair retreated after updating the August low. However, the pound didn't rise as much, and the volume of long positions fell around the 1.2700 level, leading to stagnation.

On the four-hour chart, the RSI technical indicator is moving around the mid line 50, which shows that the pair is moving sideways.

On the same time frame, the Alligator's MAs are intersecting each other, which points to the back-and-forth action.

Outlook

In order to raise the volume of short positions, the exchange rate should be kept below the 1.2650 mark. This could extend the corrective cycle. As for the alternative scenario, the current stagnation may lead to the 1.2700/1.2800 range, which has previously taken place.

The comprehensive indicator analysis in the short-term and intraday periods points to a mixed signal due to the sideways price movement.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română