At this time, both instruments that I review daily may begin building corrective waves. An upward corrective wave for the British pound is most likely. However, the euro and the pound often trade similarly, so I have no doubt that if the pound rises, the euro will too. Also, I don't think that both instruments will rise for too long, as it's only a corrective wave. Of course, there's always a backup plan - both instruments may build new upward waves under certain circumstances, but this is unlikely at the moment. Now let's figure out why the speeches of FOMC members, which have meant little to the markets in recent months, are now very important.

July's US consumer price index rose by 3.2% year-on-year, while core inflation remained unchanged at 4.8%. Of course, we're talking about just one month that ended with higher inflation, not lower. However, the FOMC, along with Federal Reserve Chair Jerome Powell, has repeatedly indicated that the central bank aims to return inflation to 2% as quickly as possible. Therefore, the Fed may respond to the latest inflation data with new monetary tightening in September.

The only obstacle could be the August inflation report, which may show a slowdown. And if this slowdown is greater than the acceleration in July, then the Fed may go for a pause. It's no secret that the Fed is already preparing to end the tightening procedure, as inflation has dropped to 3.2%. It would not only be impractical to raise the rate further but also dangerous, as the economy may begin to slow down more quickly. Why allow this if inflation has almost reached the target? Thus, a pause in the rate hike would not be surprising.

But if inflation grows in August as well, the Fed will not sit idly by and will tighten the rate for the second time in a row after the only pause so far. And the market may react by increasing demand for this decision of the US central bank. In terms of timing, this could coincide with the end of the upward corrective wave and the beginning of a new downward wave for both instruments.

Based on the conducted analysis, I came to the conclusion that the upward wave pattern is complete. I still consider targets around 1.0500-1.0600 quite realistic, and with these targets in mind, I recommend selling the instrument. The a-b-c structure looks complete and convincing. Therefore, I continue to advise selling the instrument with targets located around the 1.0836 mark and even lower. I believe that we will continue to see a bearish trend.

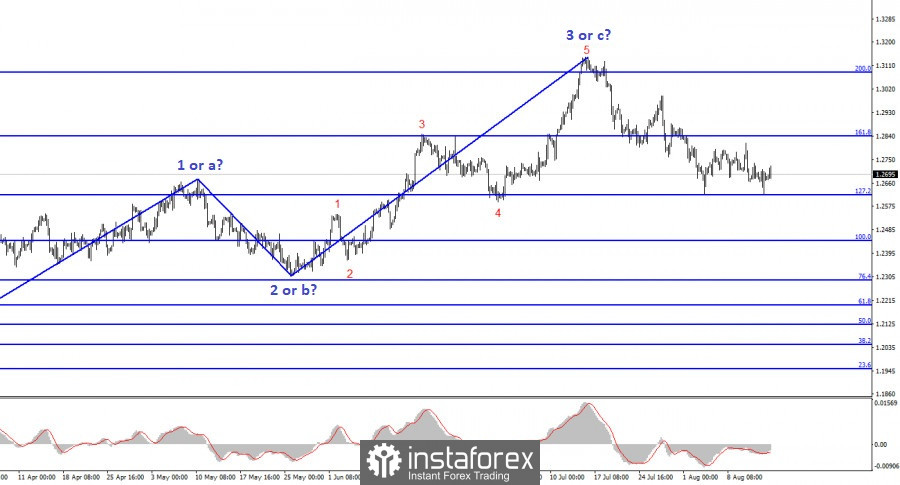

The wave pattern of the GBP/USD pair suggests a decline. You could have opened short positions a few weeks ago, as I advised, and now traders can close them. The pair has reached the 1.2620 mark. There's a possibility that the current downward wave could end if it is wave d. In this case, wave 5 could start from the current levels. However, in my opinion, we are currently witnessing the construction of a corrective wave within a new bearish trend segment. If that's the case, the instrument will not rise further above the 1.2840 mark, and then the construction of a new downward wave will begin.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română