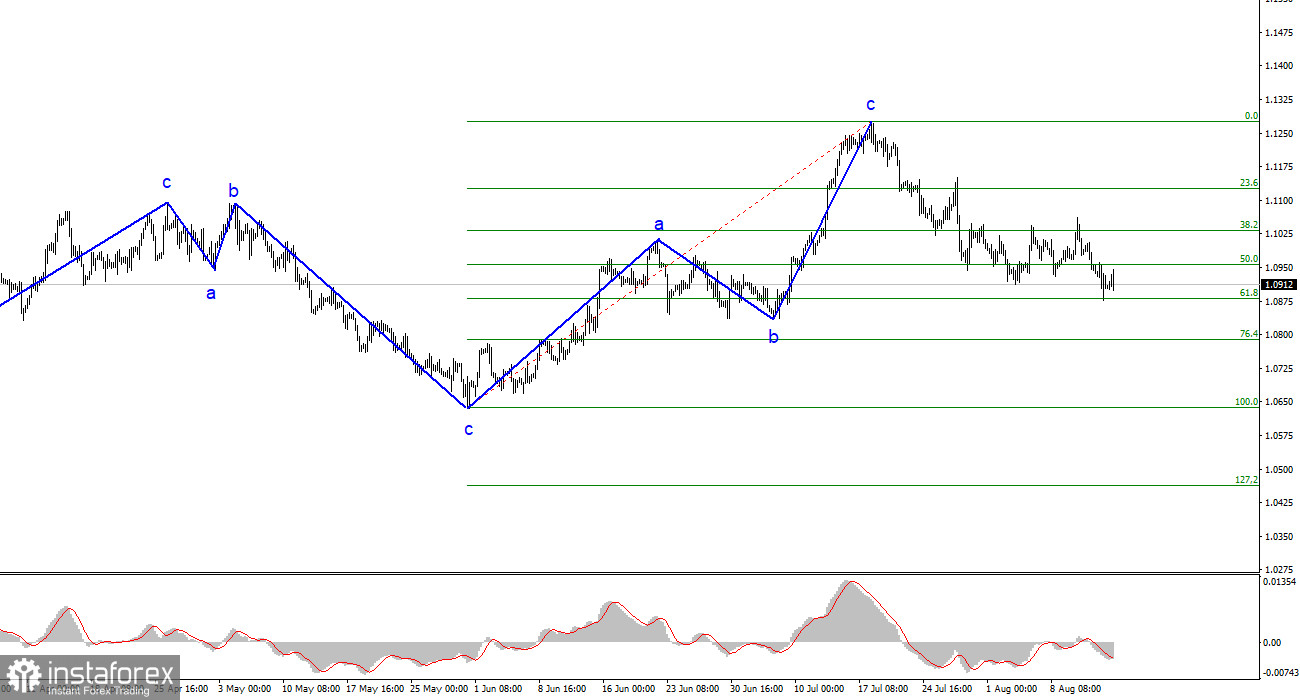

The wave analysis of the 4-hour chart for the euro/dollar pair remains quite clear. The entire ascending segment of the trend, which began its construction last year, has taken on a complex structure, and for the past six months, we have only seen three-wave structures alternating with each other. Over the past period, I have repeatedly said that I expect the pair to reach around the 5th figure, from where the construction of the last upward three-wave structure began. I stand by my words. I believe that the next ascending three-wave structure is completed, so the market has now begun to build a downward segment of the trend.

Theoretically, the segment of the trend that began on May 31 could take on a five-wave form with the structure a-b-c-d-e, but the chances of this happening decrease with each passing day. Most likely, we will see another downward wave set, at least three-wave. The news background is not strong enough for the euro (and sometimes frankly weak) for the demand for it to remain consistently high. The failed attempt to break through the 1.1032 mark, which corresponds to 38.2% on Fibonacci, indicates the market's readiness to sell again.

Retail sales in the US are growing

The euro/dollar rate increased by 30 basis points on Tuesday. There was some news today, unlike yesterday, but the market was more active on Monday, not today. Yesterday's and today's movements did not affect wave patterns. Price changes are insignificant. Based on this, we can assume that there is no reason to expect the completion of the construction of the descending wave. Its internal wave structure does not look clear or impulsive. Therefore, we may see a more extended set of descending waves.

Today, there were three reports, but none of them had a significant impact on market sentiment. In the morning, the indices of economic sentiment in Germany and the European Union turned out to be less weak than the market expected, and a couple of hours ago the retail trade report in the US showed stronger growth than market participants expected. Therefore, today both the euro and the US currency could rise. That is what we saw throughout the day. In the morning, the euro was rising, and in the second half of the day, the dollar. However, as I already said, these movements do not yet bring global changes to the wave marking of the pair. It is the wave picture that allows me to talk about a decline to the 8th figure and then lower. As the ECB has recently started to soften its monetary rhetoric, demand for the US currency will decline over time. At least until the Fed starts talking about the possibility of lowering interest rates.

General conclusions

Based on the analysis conducted, I conclude that the construction of the upward wave set is complete. I still consider the targets in the range of 1.0500-1.0600 to be quite realistic, and I advise selling the pair with these targets in mind. The a-b-c structure looks complete and convincing, so it is likely finished. Therefore, I continue to advise selling the pair with targets around the 1.0836 mark and below. I believe that the construction of the downward segment of the trend will continue.

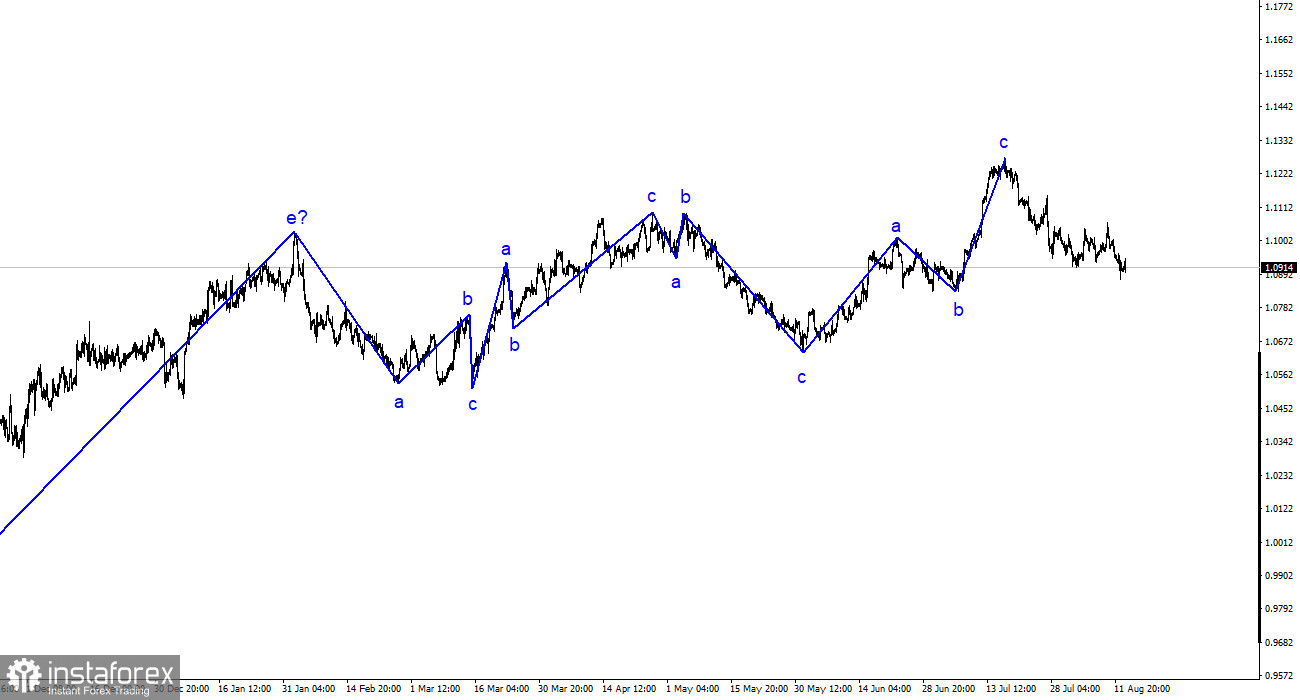

On the larger wave scale, the wave marking of the ascending segment of the trend has taken an extended form but is likely complete. We have seen five waves up, which are most likely the a-b-c-d-e structure. Subsequently, the pair constructed four three-wave structures: two downward and two upward. Now, it has likely entered the stage of building another descending three-wave structure.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română