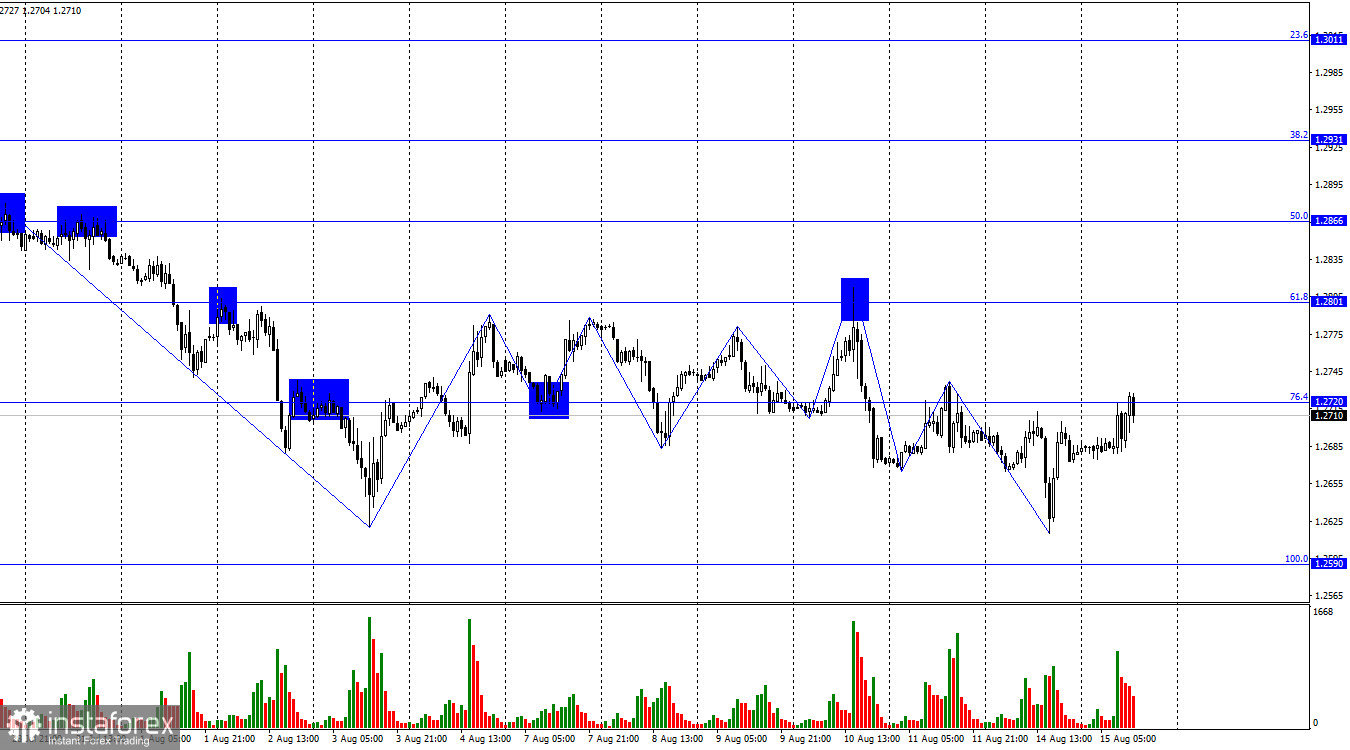

Upon examining a 1-hour chart of the GBP/USD pair, we can see a notable shift. On Tuesday, the pair made a pivotal turn favoring the British pound, retreating to the 76.4% Fibonacci retracement level at 1.2720. Should there be a bounce off this level, we might witness the US dollar regaining ground, leading the pair towards a potential fall to the Fibonacci level of 100.0% at 1.2590. Conversely, if the price stabilizes above 1.2720, traders might gear up for an ascent to the next 61.8% Fibonacci level at 1.2801.

Diving deeper into the wave pattern following two weeks of the sideways movement, the indicators are suggesting a prevailing bearish sentiment. The most recent descending waves have broken past prior lows, while the upward waves have failed to top preceding highs. This paints a picture of a dominant bearish trend, forecasting a further depreciation of the sterling. An imminent rebound from the 1.2720 mark could conclude the formation of the latest ascending wave. In this case, the level of 1.2590 will be a minimum target for the following bearish wave.

Three key economic reports from the UK have emerged as potential market movers today. Two of these have fallen short of market expectations, with the June unemployment figures rising unexpectedly to 4.2%, and unemployment claims swelling by 29K. A silver lining in the cloud, however, was the wage growth report. An unanticipated sharp rise in June could hint at an inflationary surge in July or August. Historically, such indications have prompted traders to bolster their pound sterling positions. It is also worth noting that the July inflation report is due for release tomorrow.

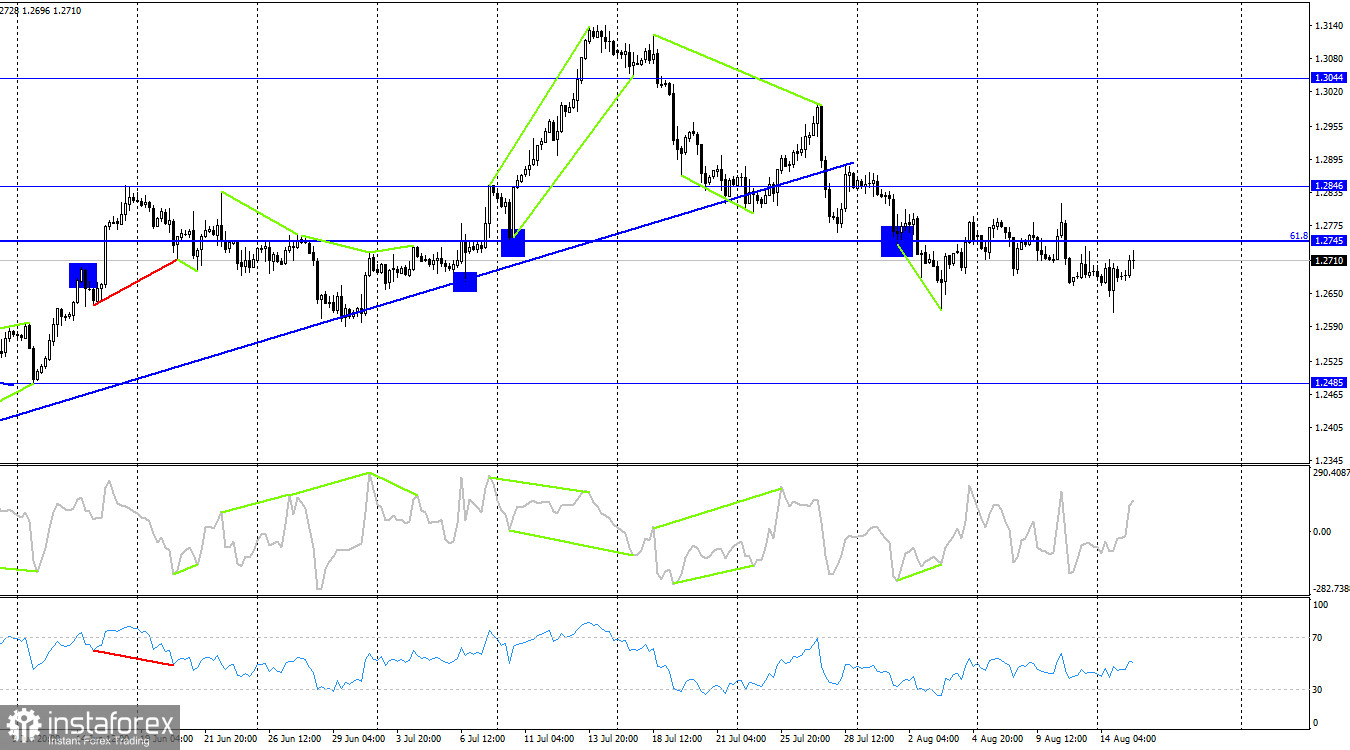

Switching to the 4-hour chart, a bullish divergence of the CCI indicator resulted in the pair pivoting in favor of the pound. Despite this, over the past two weeks, the pair has failed to approach the 1.2846 resistance. The hourly chart further emphasized this stagnation, showcasing a flat movement throughout. No new divergences are currently in sight across our reviewed indicators. Given the present conditions, a strong bullish rally in the pound seems unlikely.

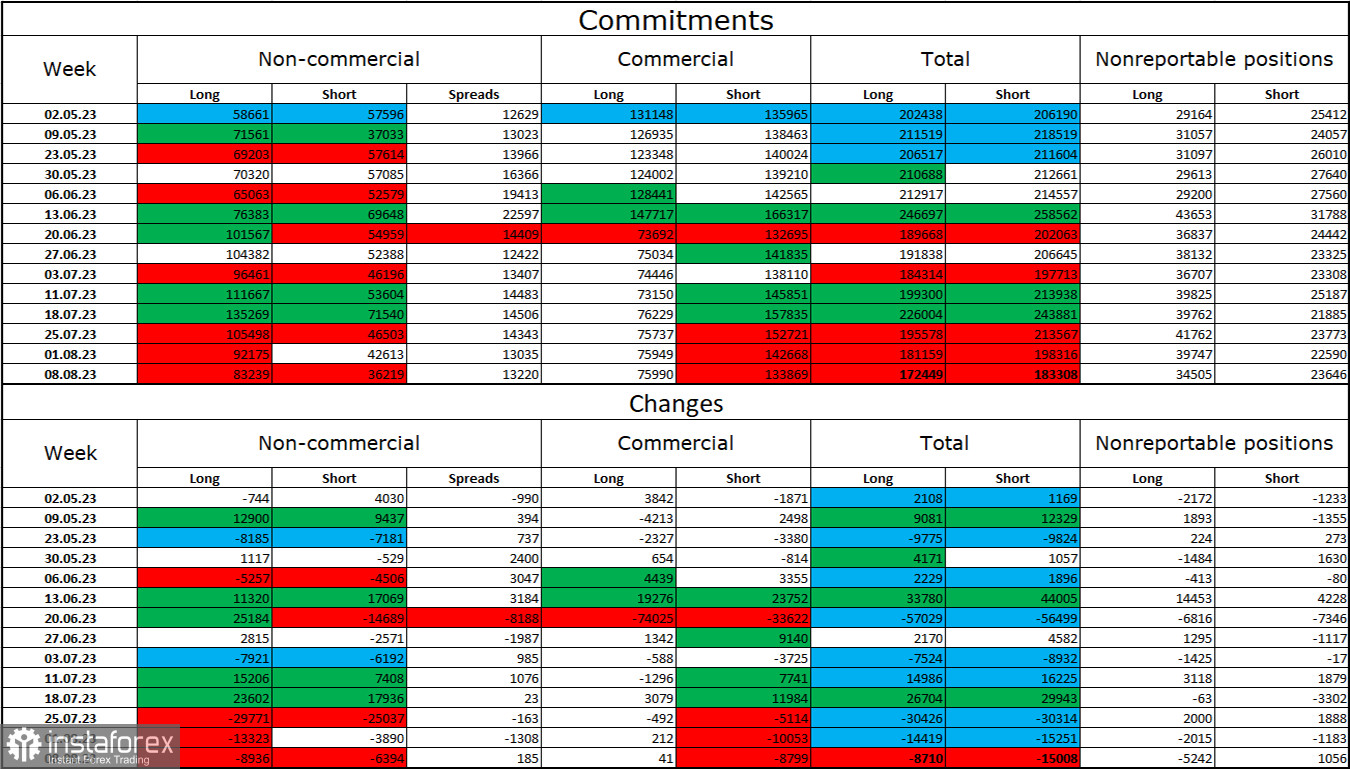

Commitments of Traders report:

The sentiment of the non-commercial group of traders reveals a declining bullish stance over the past reporting week. There has been a significant reduction in the number of Long contracts held by speculative traders, with a decrease of 8,936 contracts, whereas Short positions dropped by 6,394. Overall, while the sentiment of large market players remains predominantly bullish, the disparity between Long and Short contracts has widened considerably, with long positions standing at 83,000 compared to short positions at 36,000. From my perspective, the British pound had promising growth prospects several weeks back. However, many factors have since shifted, tilting the scales in favor of the US dollar. Betting on a strong rally for the sterling is becoming more and more complicated. Over the last few weeks, it has been evident that bullish traders have been trimming their positions, with a reduction of nearly 50,000 in their ranks. Although bearish positions are also seeing a decline, the gap between bulls and bears only seems to be widening.

Economic calendar for US and UK:

UK – Average Earnings with Bonus 06-00 UTC).

UK – Claimant Count Change (06-00 UTC).

UK – Unemployment Rate (06-00 UTC).

US – Retail Sales (12-30 UTC).

On Tuesday, the economic calendar has four important reports, three of which have already been published. In the remaining half of the day, the influence of the informational background on the market sentiment will be very weak.

GBP/USD forecast and trading tips:

I recommended selling the pound after a rebound from 1.2801 on H1, aiming at 1.2720 and 1.2690. Both targets have been hit. I also advised you to sell the pair on a rebound from 1.2720 with the target at 1.2590. Today it will be possible to open such a trade. You can go long only after a close below the 1.2720 level. But be careful with this move as the pound's growth may be weak.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română