The dollar jumped during the US trading session, although it did not have any significant reason to rise as much. So, eventually the dollar will retreat at the same pace. All this looks like plain speculation. Or even some mistake on the part of a major institutional investor. This is quite possible, given that yesterday's economic calendar was empty. Traders were not active, resulting in a so-called thin market. And in such conditions, just one order from a major player can move the market. But considering that the market almost immediately returned to its original position, it's very likely that it was just plain human error. This happens in all fields, and one shouldn't think that the financial sector is some kind of remarkable exception.

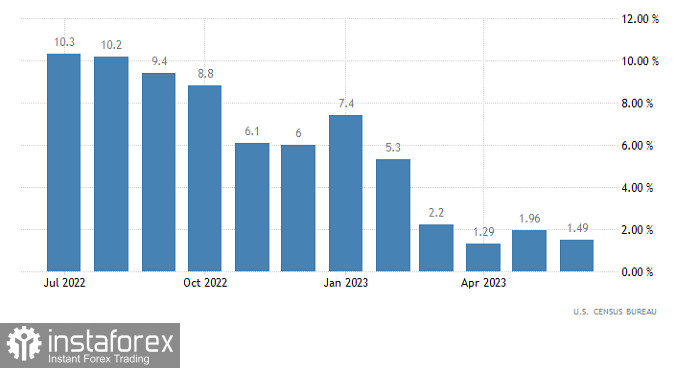

On the bright side, we can look forward to today's economic calendar. And it's not about the British labor market. The UK unemployment rate is expected to remain unchanged and will not affect market sentiment. It's about retail sales in the United States, which is likely to slow down from 1.5% to 1.0%. This will be a reason for a slight rebound in the dollar, which has strengthened quite significantly over the past few days.

US retail sales

The EUR/USD pair fell below the 1.0880 mark, but by the end of the day, the price stayed above the 1.0900 level. Thus, we can't be certain that the corrective cycle will persist.

On the four-hour chart, the RSI indicator is moving in the lower area of 30/50, thus reflecting bearish sentiment among traders.

On the same time frame, the Alligator's MAs are headed downwards, which points to the direction of the corrective phase.

Outlook

In order to increase the volume of short positions, the exchange rate should stay below the 1.0900 mark. In this case, the euro could move towards the 1.0850/1.0800 area. As for the alternative scenario, the price may rebound from the 1.0900 level, similar to August 3rd.

The comprehensive indicator analysis unveiled that in the short-term and intraday periods, indicators are pointing to the corrective phase.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română