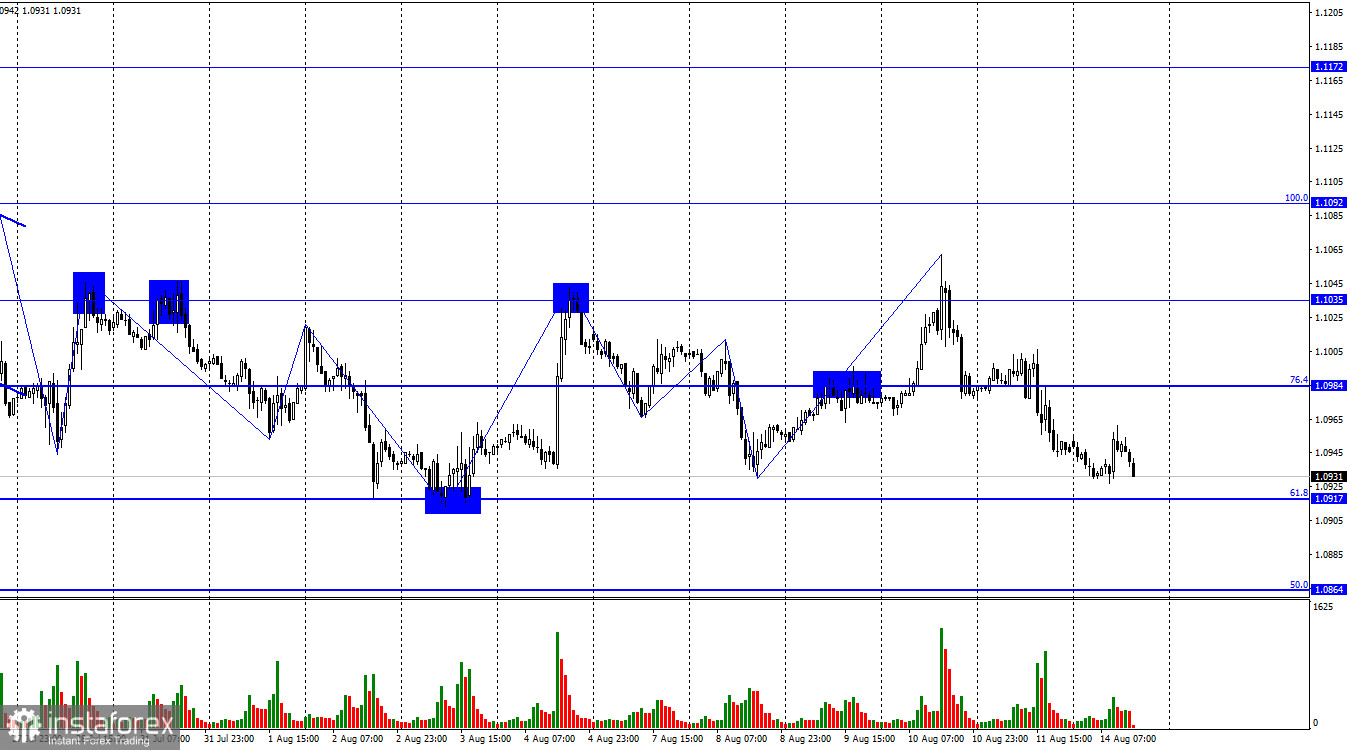

The EUR/USD pair continued its decline on Friday and Monday and has now settled below the corrective level of 61.8% (1.0917). Thus, the decline in quotes may continue toward the next Fibonacci level of 50.0% (1.0864). A rebound from this level would favor the European currency and a slight rise towards 1.0917. Closing below this level will increase the likelihood of a continued fall toward the next Fibonacci level of 38.2% (1.0810).

After several weeks of chaos, the waves finally determined who dominated the market. Remember that the pair constantly changed its direction in the last two weeks, and the waves alternately suggested growth and decline. However, the latest downward wave overrides all the waves of the past two weeks. The bearish trend will persist for some time unless there are any unpleasant surprises.

As for the news background, it was relatively weak on Friday and absent on Monday. Thus, the clear conclusion is that the bulls tried to attack with full force in the past two weeks, but without news support, they failed. The producer price index released in the US on Friday slightly bolstered dollar bulls, but on Monday, the dollar strengthened on its own. The pair's quotes will continue to decline.

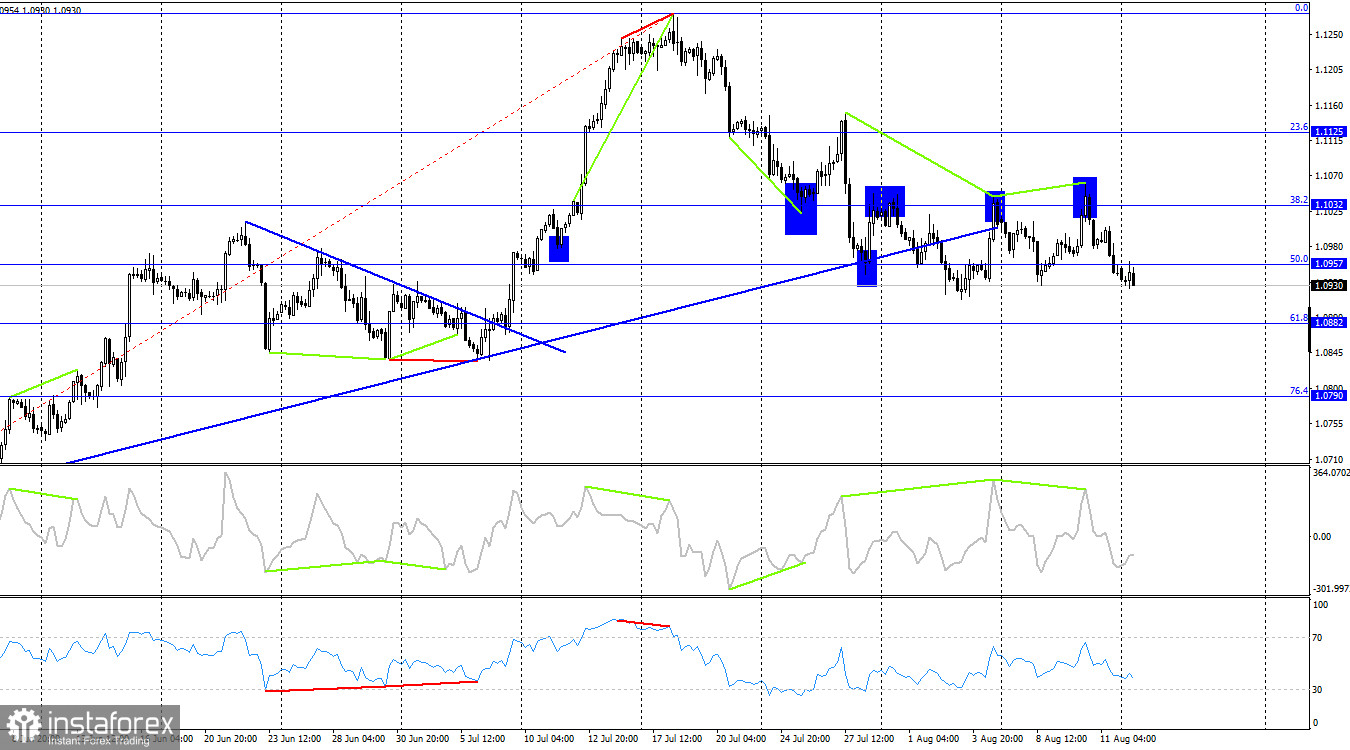

On the 4-hour chart, the pair has settled below the ascending trend line and rebounded twice from the Fibonacci level of 38.2% (1.1032). Thus, I expected the European currency to fall to the corrective level of 61.8% (1.0882), which has now occurred. A rebound from this level will favor the EU currency and a slight rise toward the level of 1.0957. At the same time, consolidation below it will increase the chances of a continued decline toward the next corrective level of 76.4% (1.0790).

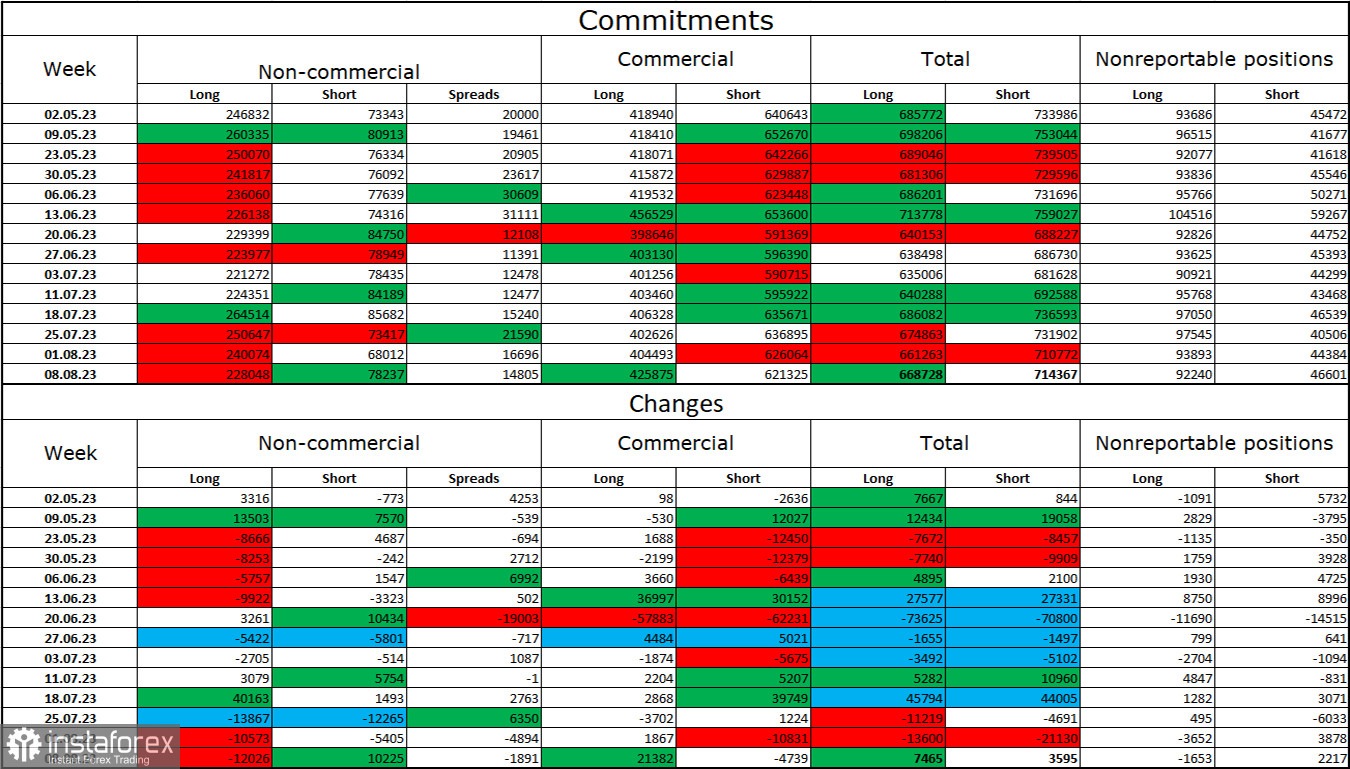

Commitments of Traders (COT) Report:

During the last reporting week, speculators closed 12,026 long contracts and opened 10,225 short contracts. The sentiment among major traders remains "bullish," but it has significantly weakened over the past week. The total number of long contracts speculators hold is now 228,000, while short contracts are 78,000. The "bullish" sentiment persists, but I believe the situation will continue to shift in the opposite direction soon. The high value of open long contracts suggests that buyers may continue to close them soon – there's a strong bias towards the bulls. I believe the current figures indicate the possibility of a continued decline in the euro in the coming weeks. The ECB increasingly signals the imminent end of the QE tightening procedure.

News calendar for the USA and the European Union:

On August 14th, the economic events calendar has no interesting entry. The influence of the news background on traders' sentiment will be absent throughout the day.

Forecast for EUR/USD and advice for traders:

I previously advised selling upon a rebound from the level of 1.1035 on the hourly chart with targets of 1.0984 and 1.0917. Both targets have been reached, and trades can now be left open with targets of 1.0864 and 1.0810. Purchases are possible upon a rebound from the level of 1.0864, with a target of 1.0917, but I find it hard to expect a strong rise from the pair today.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română