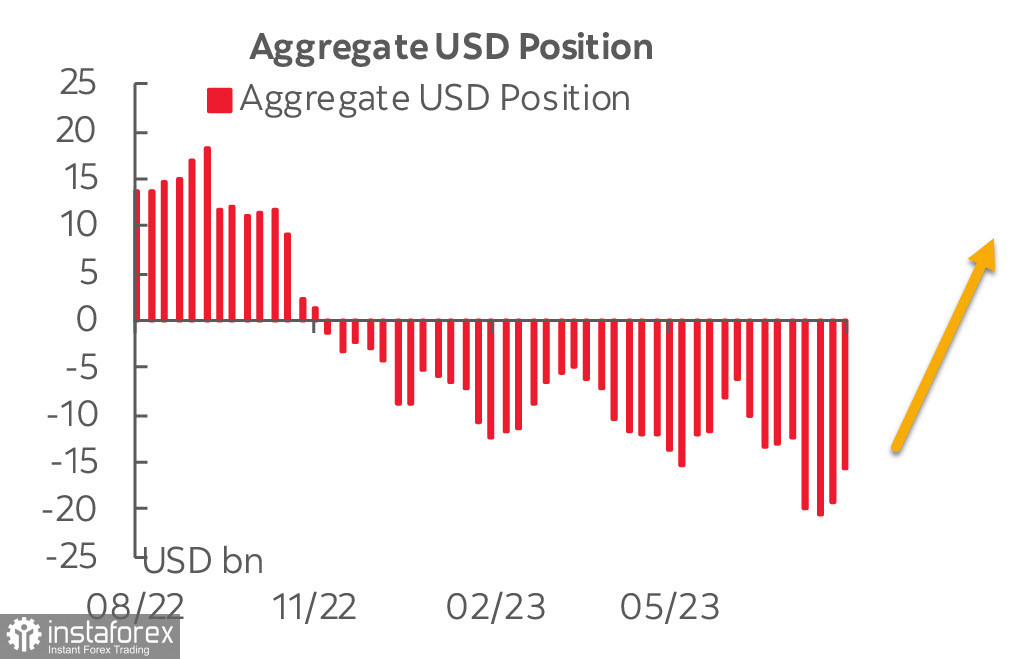

The bearish market sentiment on the US dollar has been fading as speculators cut their short positions on the US dollar by 3.4 billion last week. Hence, the overall short positions on USD against major currencies contracted to -15,782 billion. Even though the bearish sentiment on USD prevails, market participants are poised to increase long positions on USD.

The greenback strengthened against most G10 currencies, with the exception of the Australian dollar and the Swiss franc. Another factor behind the growing demand for the US dollar is the decrease in long position in gold by 4.5 billion to -27.5 billion.

The consumer price index in the US rose in June by 3.2% versus the forecast 3.3%, the core CPI came out in line with the forecasts: 0.2% m/m and 4.7% y/y. These figures are in favor of the forecast that the Fed will not raise interest rates at the next meeting in September, but may raise it again a little later this year.

The dollar fell after the CPI data, but quickly overcame this short-lived weakness and began to strengthen across the board. On Friday, producer price data came in higher than expected, with the core PPI at its highest level since November last year. As a result, investors had to upgrade inflation expectations again. Indeed, rising producer prices increase the risks of a re-acceleration of inflation.

We expect the US dollar to continue its slow growth this week, which is based primarily on growing expectations of a slowdown in global economic growth.

EUR/USD

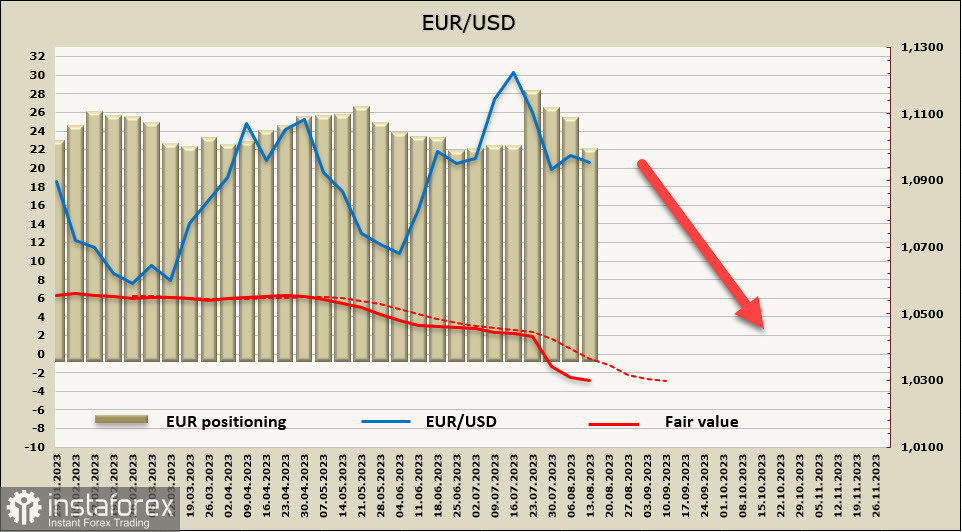

The economic calendar for the Eurozone has been almost empty in recent days. So, the lack of fundamental news could affect the forecasts for the euro. The only significant event is the minutes from the ECB meeting held on July 27, which, however, also did not contain any information that could shed light on further ECB's policy moves.

The bank notes that the economic outlook for the eurozone has deteriorated, the labor market is stable, and the support measures that were urgently implemented during the onset of the economic crisis must be quickly and consistently phased out to avoid additional inflationary pressure.

With core inflation climbing to 5.5% in June, it is clearly premature to expect the ECB to complete the cycle of aggressive rate hikes. These expectations will keep the euro from falling too low, even if it sells off.

The net long position in the euro decreased during the reporting week by 3.107 billion to 20.517 billion. This trend has been recorded for the third week in a row after the peak in July. EUR/USD closed again below the long-term average and there are no signs of an upward reversal so far.

We assume that the upward correction is over as the euro is half a step away from retesting the support of 1.0910/20. There are good chances that the downward movement will be more pronounced this time. The nearest target is the technical level 1.0875 and then 1.0830. The bearish momentum may develop to the support zone 1.0780/0810.

GBP/USD

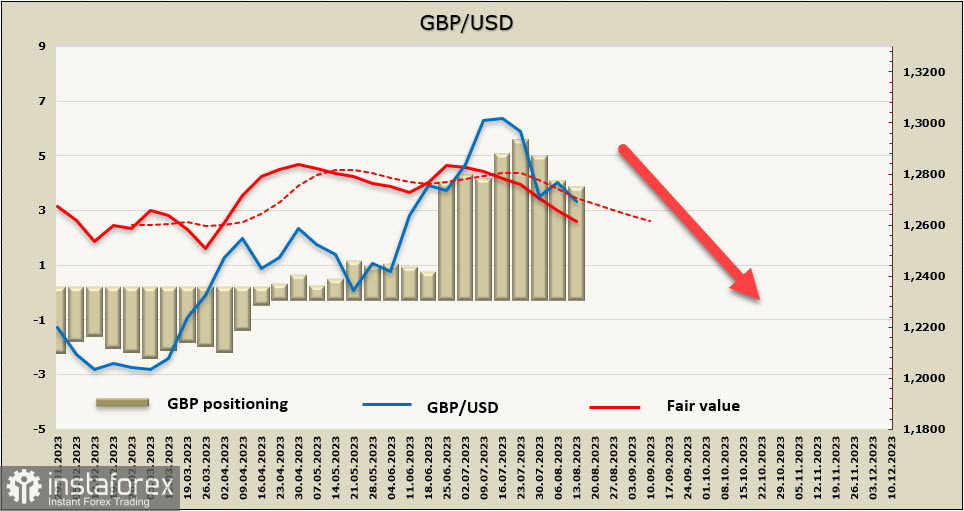

UK GDP grew by 0.2% in Q2 2023 instead of the expected 0%. GDP expanded by 0.5% in June on month, although growth had not been expected. A number of other indicators, published on Friday, also came as a pleasant surprise, thus reviving optimism about the British economy. Industrial production rose in June instead of the expected decline, investment also increased, and the trade balance improved considerably.

The NIESR Institute released a neutral report, noting that GDP growth in June was primarily due to a low figure in May because of additional days-off. Expansion in manufacturing and construction in June was a positive surprise, creating conditions for economic growth.

NIESR predicts 0.3% GDP growth in the 3rd quarter and believes that the UK will avoid a recession this year.

The net long position in GBP decreased during the reporting week by 212 million to -3.75 billion, the closing price is steadily declining.

The pound sterling, as expected in the previous review, resumed its decline. However, as the movement does not look quite convincing, GBP/USD has not reached a low of 1.2619 yet. We expect GBP to extend its weakness with the nearest downward target at 1.2619. The main target is 1.2450/70 and then 1.2240. The likelihood of moving towards the lowest target will increase in case the local low of 1.2619 is successfully updated.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română