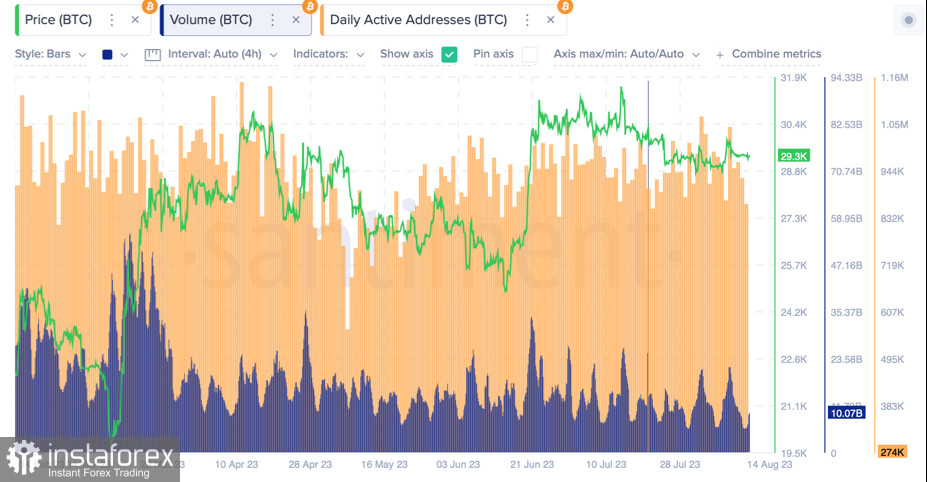

For the last two and a half weeks, Bitcoin's trading indicators have been updating various lows. Trading activity on cryptocurrency exchanges has reached its highest level since the end of 2020, Bitcoin's volatility level has hit an all-time high, and the price continues to move within the range of $28.5k–$30.2k. Despite this, globally, Bitcoin is following an upward trend and is undergoing a correction, which always lasts longer than impulsive growth.

On the daily chart, we observe an absolute balance between bulls and bears; the fear and greed index is also in a neutral position. At the same time, volatility caused by significant economic events does not have a profound impact on the BTC price. Despite this, the asset shows certain prerequisites for the resumption of upward movement.

Fundamental Factors

The past week has been rich in positive events for the crypto industry. The most crucial cause for optimism was the launch of a stablecoin by the PayPal payment system, PYUSD. BofA analysts believe that the product's launch will not lead to radical changes in the approach to regulating stablecoins, as the systemic risk remains.

It is also noted that the Federal Reserve will not prohibit the use of PayPal's stablecoin, but banks will need to obtain permission and recommendations from the authorities before accepting PYUSD payments. The same requirements apply to the creation of a broad stablecoin infrastructure for their customers.

Another significant news was the high likelihood of approval for one or several spot ETFs on BTC. As reported by Maxiport, the approval of investment fund applications will lead to the next Bitcoin bull rally. Rumors suggest that the first information about the SEC's consent to launch the ETF will emerge this week.

BTC/USD Analysis

Meanwhile, trading volumes and market volatility for BTC are at an all-time low. The asset's price is moving in the range of $28.5k–$30k, and as of August 14, there are no clear signs of a trend change. Over the past seven days, the asset has retested the upper boundary of the fluctuation channel twice, indicating a resumption of the downward movement to the lower boundary around $28.5k.

It can also be assumed that a "flag" pattern is forming on the 1D chart, indicating the continuation of the upward trend and the end of the correction. However, due to the lack of investor interest, the length of the "flag" itself becomes disproportionate to the "flagpole," indicating a low probability of this pattern playing out. Technical metrics confirm the absence of trading impulses in both directions.

Considering the disproportion of the "flag" pattern, we can see a resemblance to the "double top" pattern on the 4H chart, which, in this context, indicates an unsuccessful retest of the upper boundary of the fluctuation corridor. This means that, in the short term, Bitcoin will start moving towards the lower boundary of the fluctuation channel at $28.5k. The nearest support zone for Bitcoin remains at the $29k level, but if it is decisively broken, the correction potential could reach the $28k–$28.5k range.

A bullish scenario for BTC will only become relevant if BTC/USD securely settles above the $30.2k–$30.5k level. Until then, bears continue to dominate the Bitcoin market, and the price will keep decreasing. Considering the support line of the global trend, the BTC price may correct down to the $28k level. However, this decline will occur slowly due to the lack of necessary volumes.

Conclusion

Bitcoin continues to move within a downward correction with minimal trading volumes. No significant events are expected to boost volatility in the coming days, meaning there's a high probability the asset will continue to move sideways with a gradual decline towards the $28k–$28.5k area. No major price changes for BTC are anticipated at the beginning of the trading week.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română