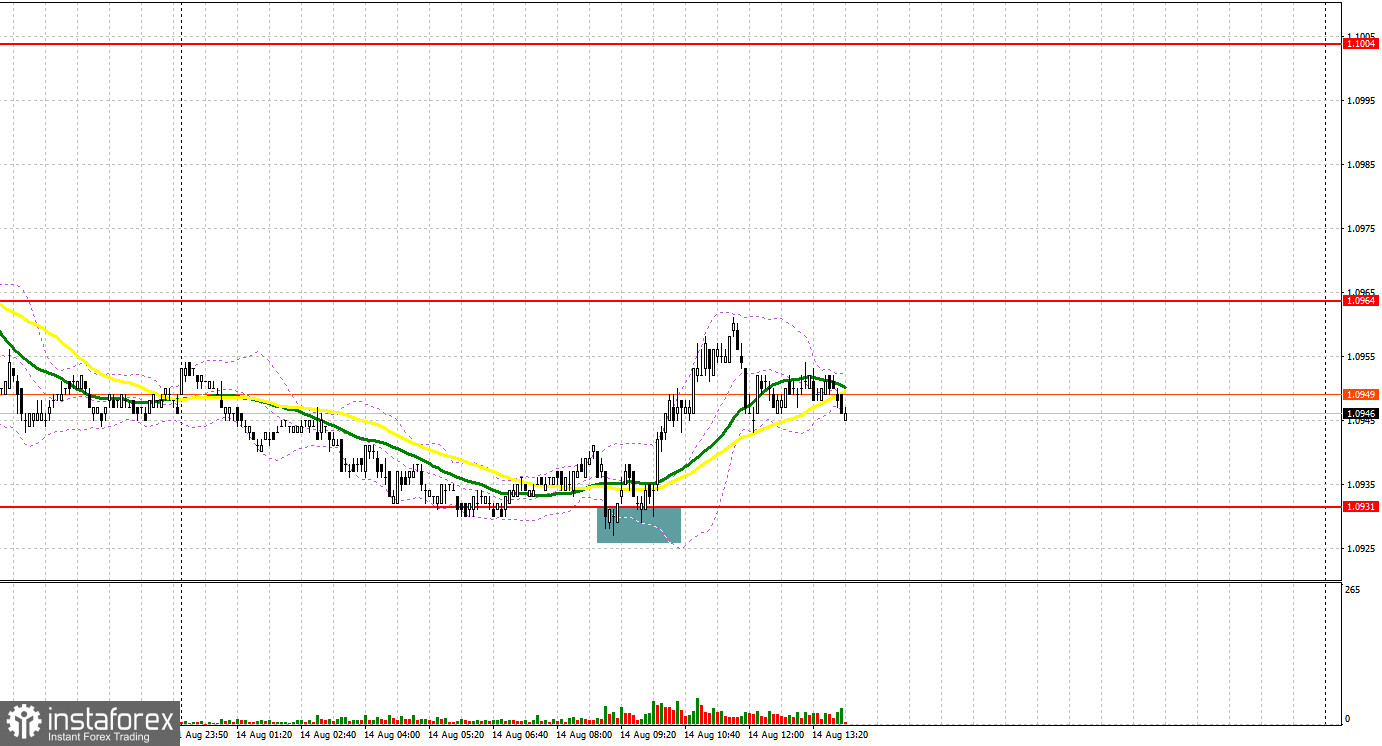

In my morning forecast, I pointed out the 1.0931 level and suggested making decisions about market entry based on it. Let's examine the 5-minute chart to see what transpired there. The decline and the formation of a false breakout provided an excellent buying signal, resulting in a 30-point surge in the euro. The technical picture remained unchanged for the latter part of the day.

For opening long positions on EURUSD, it's necessary to consider the following:

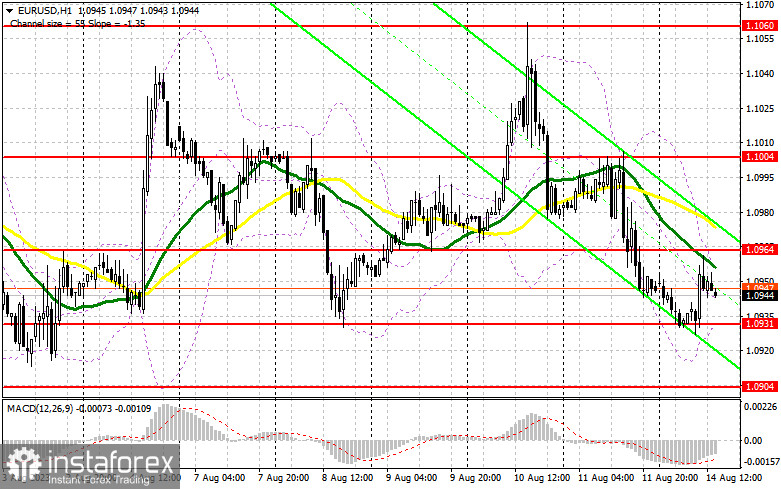

The absence of statistics from the Eurozone favored euro buyers in the first half of the day. However, it's doubtful that the bulls will remain as active during the American session, where no statistics are expected either. For this reason, I'll be more inclined to continue selling in line with Friday's trend, especially if the bulls fail to manifest around the day's high and can't reach up to 1.0964. The optimal scenario for buying under these conditions would be another decline and a formation of a false breakout around the morning support level of 1.0931. This would provide a good buying entry point, analogous to what I analyzed above. The target remains the same resistance at 1.0964, where the moving averages, supporting the bear's side, lie. A breakout and a top-down test of this range would strengthen demand for the euro, offering a chance to continue the upward trend and renew the 1.1004 high formed last Friday. The ultimate target remains in the 1.1060 area, where I'll lock in profits.

If the EUR/USD decline and show inactivity around 1.0931 in the latter part of the day, which is quite possible after several tests of this level during the European session, the pressure on the pair would only increase. In such a case, only a false breakout around the next support level at 1.0904 would signal to buy the euro. I would immediately open long positions on a rebound from the 1.0871 minimum, aiming for an upward correction of 30-35 points within the day.

For opening short positions on EURUSD, it's necessary to consider:

Sellers receded in the first half of the day. But did they? After all, we didn't reach the nearest resistance at 1.0964. I will only act after forming a false breakout at this level, leading to a sell signal and a pair drop to the nearest support of 1.0931. Only after a breakthrough and consolidation below this range, given the absence of fundamental statistics and a backtest from below-up, can a sell signal be obtained, paving the way to a minimum of 1.0904. The ultimate target will be the 1.0871 area, indicating the formation of a bearish trend. I will lock in profits there. If EUR/USD moves upward during the American session and bears are absent at 1.0964, which can't be ruled out, the bulls will try to re-enter the market. In such a scenario, I'll defer short positions until the next resistance of 1.1004. I can also sell there, but only after a failed consolidation. I'll open short positions immediately on a rebound from the maximum of 1.1060, aiming for a downward correction of 30-35 points.

Indicator Signals:

Moving Averages:

Trading is below the 30 and 50-day moving averages, indicating a possible fall in the pair.

Note: The author considers the period and prices of moving averages on the H1 hourly chart and differ from the general definition of classic daily moving averages on the D1 daily chart.

Bollinger Bands:

In case of an increase, the upper boundary of the indicator around 1.0964 will act as resistance.

Description of Indicators:

• Moving average (determines the current trend by smoothing out volatility and noise). Period 50. It is marked in yellow on the chart.

• Moving average (determines the current trend by smoothing out volatility and noise). Period 30. It is marked in green on the chart.

• MACD indicator (Moving Average Convergence/Divergence). Fast EMA period 12. Slow EMA period 26. SMA period 9.

• Bollinger Bands. Period 20.

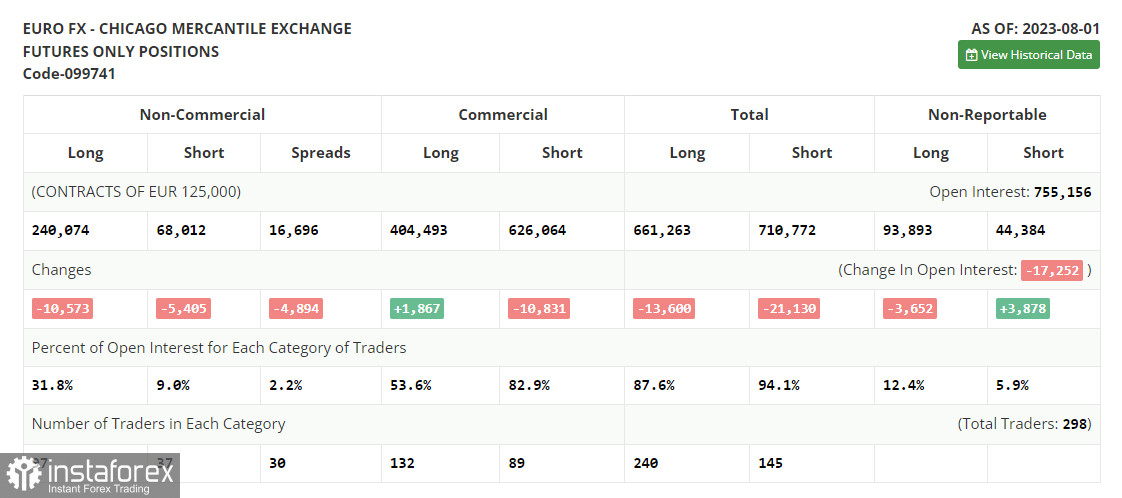

• Non-commercial traders - speculators, such as individual traders, hedge funds, and large institutions that use the futures market for speculative purposes and meet specific requirements.

• Long non-commercial positions represent the total long open position of non-commercial traders.

• Short non-commercial positions represent the total short open position of non-commercial traders.

• The net non-commercial position is the difference between non-commercial traders' short and long positions.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română