Last week, gold tended to decline. After inflation data was published—these are consumer price indices and producer prices in the U.S., showing that inflationary pressure persists—prices dropped by 1% over the week.

Gold prices lack a clear direction, as market participants have differing views regarding interest rates. Some believe the Federal Reserve has ended its tightening cycle, while others think otherwise.

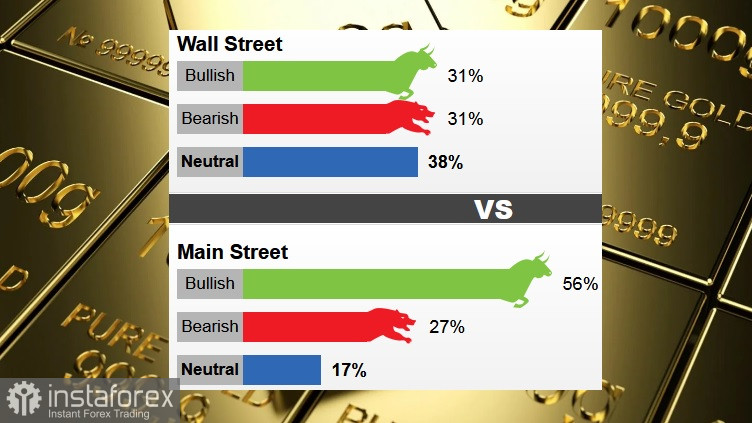

Wall Street analysts and investors are also divided in their opinions. The latest survey shows retail investors expect confident price growth during the current week. Market analysts, however, remain cautious, waiting for a clear direction from economic indicators and technical trends.

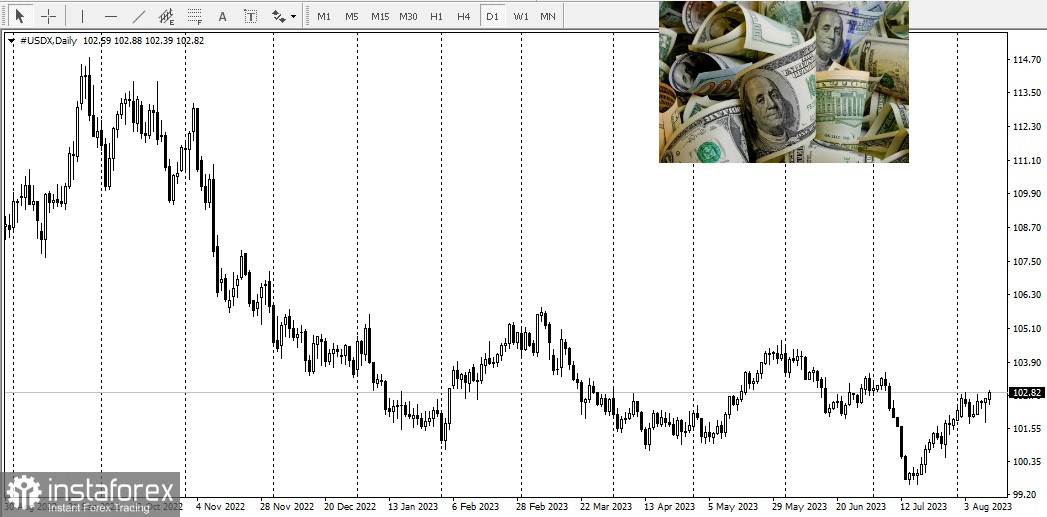

Colin Cieszynski, chief market strategist at SIA Wealth Management, says gold will continue its recent downward trend as the yield on the 10-year U.S. treasury continues to rise, providing a tailwind for the U.S. dollar.

Last week, 13 Wall Street analysts participated in a gold survey. Bullish and bearish stances received four votes each, or 31%. Five analysts, or 38%, remained neutral.

In online polls, 573 votes were cast. Of these, 320 respondents, or 56%, anticipate a rise in the precious metal's prices for the current week. Another 155, or 27%, expect a decline, while 98 voters, or 17%, remained neutral.

According to the latest retail investor survey, gold will trade around $1974 per ounce this week. They are very optimistic about such a direction.

Ole Hansen, head of commodity strategy at Saxo Bank, believes there's no urgency to enter the gold market and no trigger for higher prices in the near term.

Edward Moya, senior market analyst at OANDA, said the precious metal will move sideways during the week. Meanwhile, Managing Director at Bannockburn Global Forex Marc Chandler thinks gold has bottomed out and will start to rise this week.

The most significant news for precious metals this week will be U.S. retail sales for July. These data will be released on Tuesday, followed by the publication of the minutes from the last Federal Reserve meeting on Wednesday, which will provide markets with an insight into consumer behavior and how the Federal Reserve views the economy.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română