Tips for Bitcoin trading

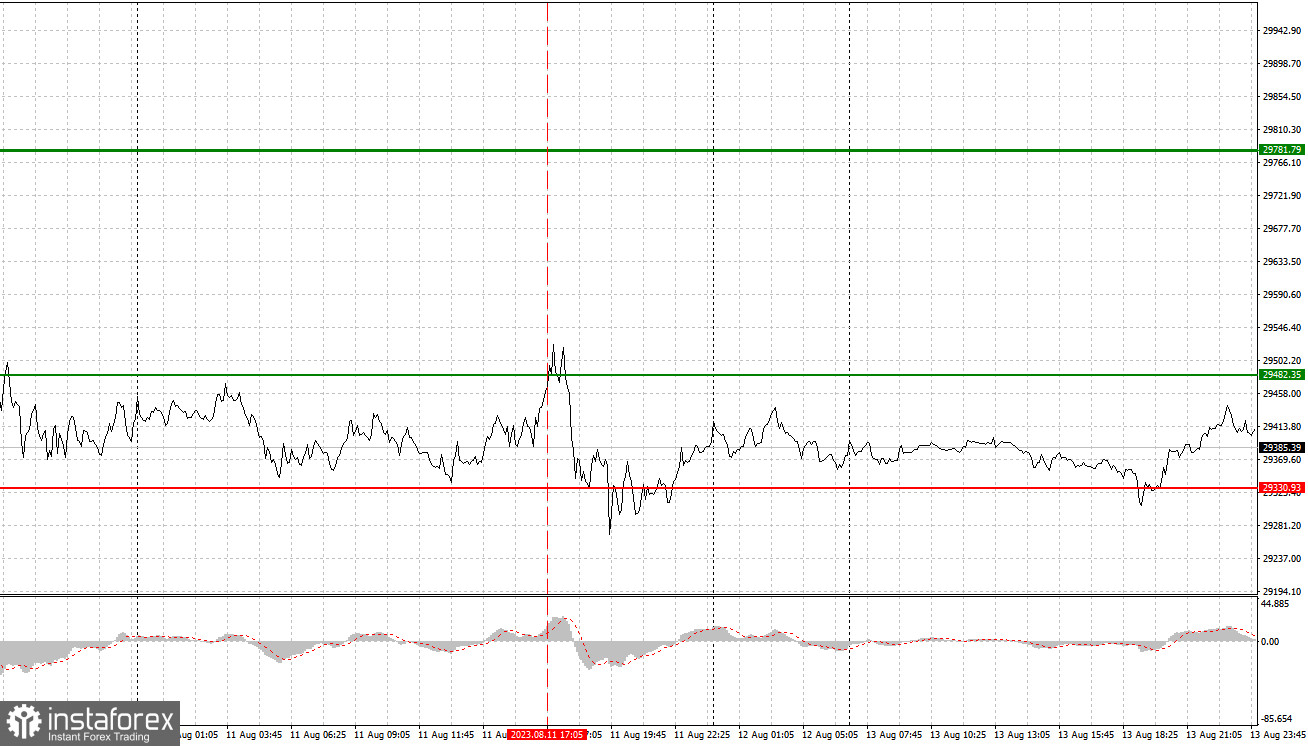

On Friday, the price test at $29,482 coincided with MACD already being relatively high in the overbought zone, limiting Bitcoin's upward potential. Due to this, I refrained from buying BTC. The absence of significant news and Bitcoin's sluggish activity after an unsuccessful attempt to break $30,000 last week create considerable uncertainty about the future trajectory of the BTC quotes. Today, little can alter Bitcoin's direction, so trading will predominantly occur within a sideways channel. Despite this, I plan to base my trading on scenario 1, but I intend to place bets on a downward movement.

Buy signal:

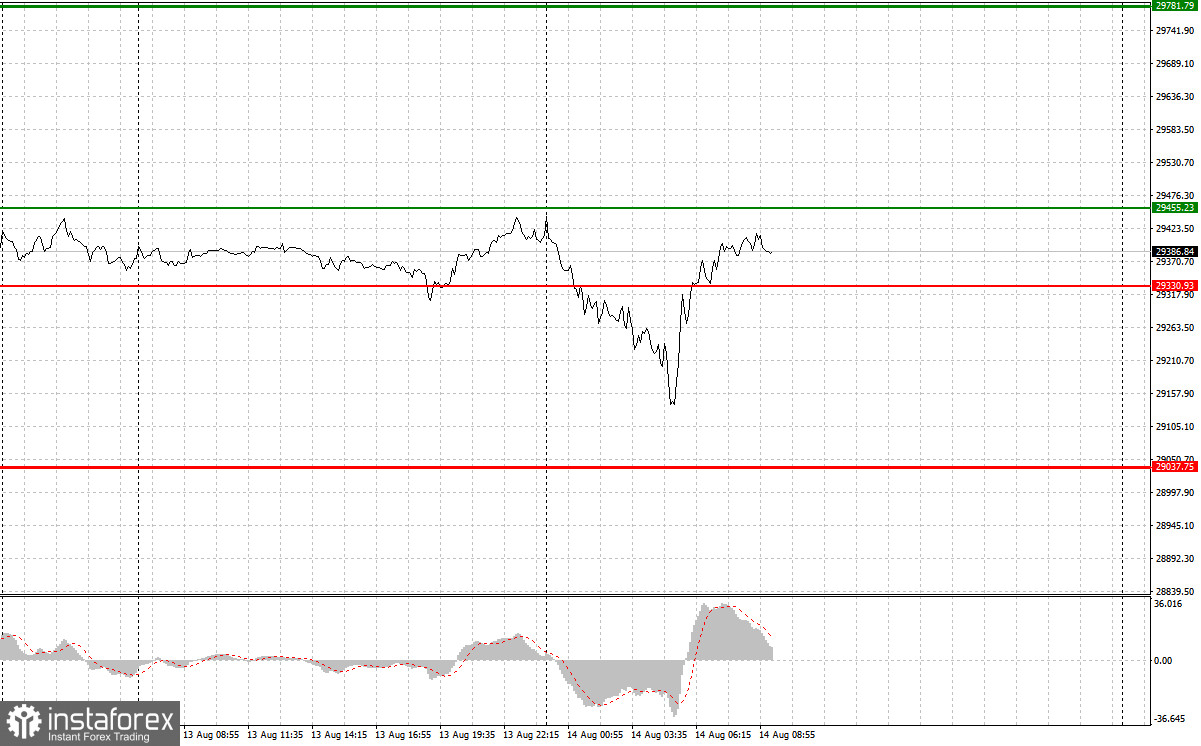

Scenario 1: Buying Bitcoin today is possible when the entry point around $29,455 (green line on the chart) is reached, aiming for an increase to $29,780 (thicker green line on the chart). At around $29,780, it is better to close long positions and open short ones. Anticipating a strong Bitcoin surge today is unlikely, but a gradual upward movement to around $30,000 may occur. Important! Before purchasing BTC, make sure that the MACD indicator is above zero.

Scenario 2: Purchasing Bitcoin today is also viable if the price tests $29,330 twice. This will limit the downward potential of the trading instrument and lead to a market reversal upwards. Expect a rise toward the opposing levels of $29,455 and $29,780.

Sell signal:

Scenario 1: Selling Bitcoin today is only viable after the level of $29,330 (red line on the chart) is retested, resulting in a rapid decline of the trading instrument. The sellers' key target will be the level of $29,037, where it is recommended to close short positions and open long ones. Pressure on Bitcoin will increase in the absence of buyer activity around the daily peak area. Important! Before selling, make sure that the MACD indicator is below zero.

Scenario 2: Selling Bitcoin today is also possible if the price tests $29,455 twice. This will limit the upward potential of the trading instrument and lead to a market reversal downwards. We can expect a decline toward the opposing levels of $29,330 and $29,037.

What's on the chart:

Thin green line – entry price for purchasing the trading instrument.

Thick green line – presumed price level for setting a take profit order or locking in profits manually, as further growth above this level is unlikely.

Thin red line – entry price for selling the trading instrument.

Thick red line – presumed price level for setting a take profit order or locking in profits manually, as further decrease below this level is improbable.

MACD Indicator. When entering the market, it is crucial to consider overbought and oversold zones.

Important: Novice cryptocurrency traders must exercise extreme caution in making market entry decisions. Prior to major fundamental reports, it's best to stay out of the market to avoid abrupt price fluctuations. If you choose to trade during news releases, always set stop orders to minimize losses. Without setting stop orders, you can rapidly deplete your entire deposit, especially if you don't employ proper money management and trade with substantial volumes.

Remember that successful trading requires a clear trading plan, similar to the one I've outlined above. Spontaneously making trading decisions based on the current market situation is inherently a losing strategy for intraday traders.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română