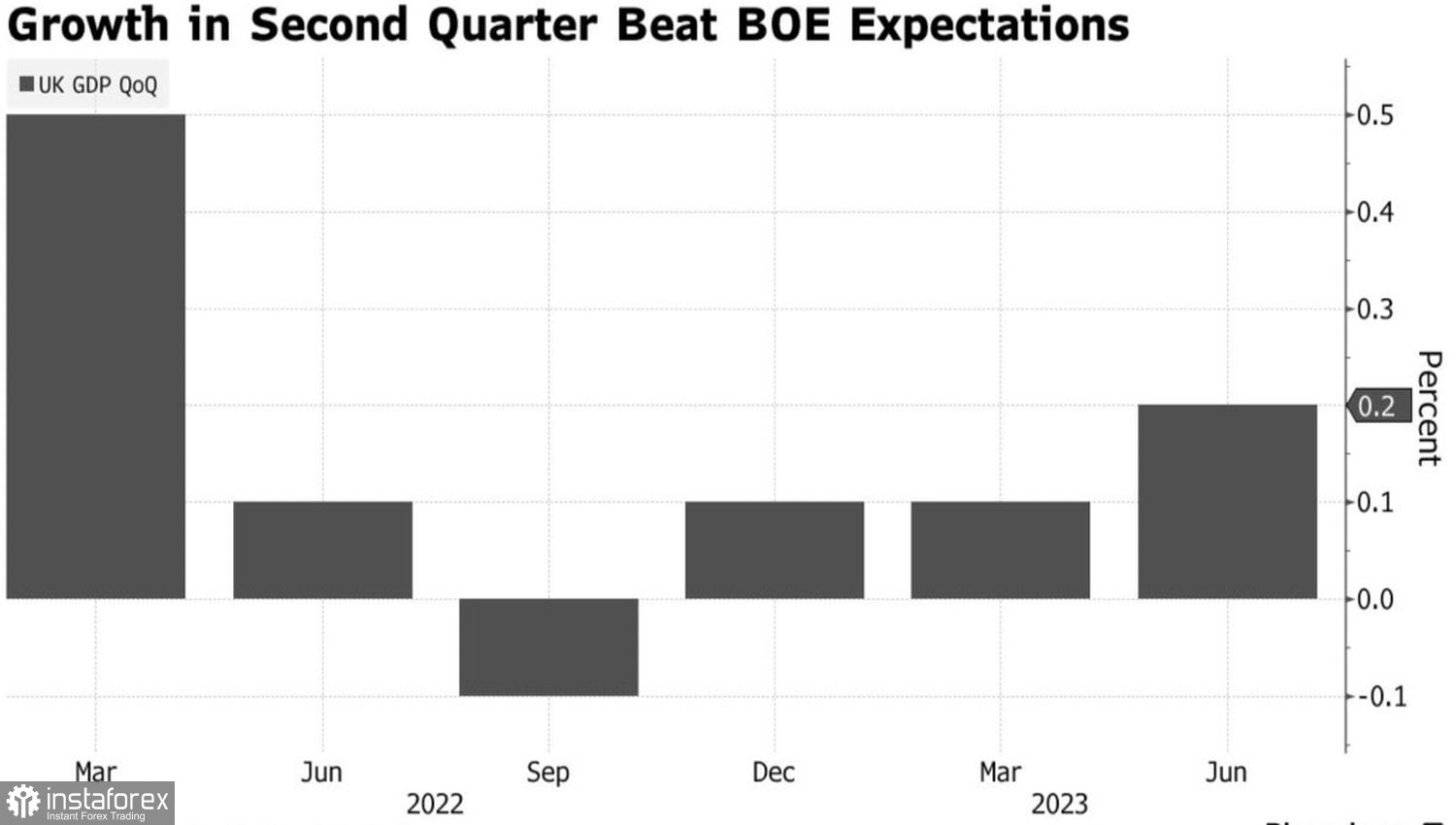

Encouraging news from the UK economy allowed the pound to sing its swan song. The GDP increased by 0.2% in the second quarter and by 0.5% year-on-year in June. Both figures were higher than Bloomberg experts' expectations, and the manufacturing sector showed its best dynamics since 2019. Consumers have been the most active in over a year, business investments increased by 3.4%, yet this didn't help the GBP/USD bulls seize the initiative.

UK GDP Dynamics

According to Capital Economics, the main reason for the success of the Gross Domestic Product in June was the increased number of working days, while the Bank of England's monetary policy tightening hasn't yet fully impacted the economy. The company predicts a mild recession at the end of 2023, most likely starting in the third quarter. Bloomberg expects a downturn by the end of the current year.

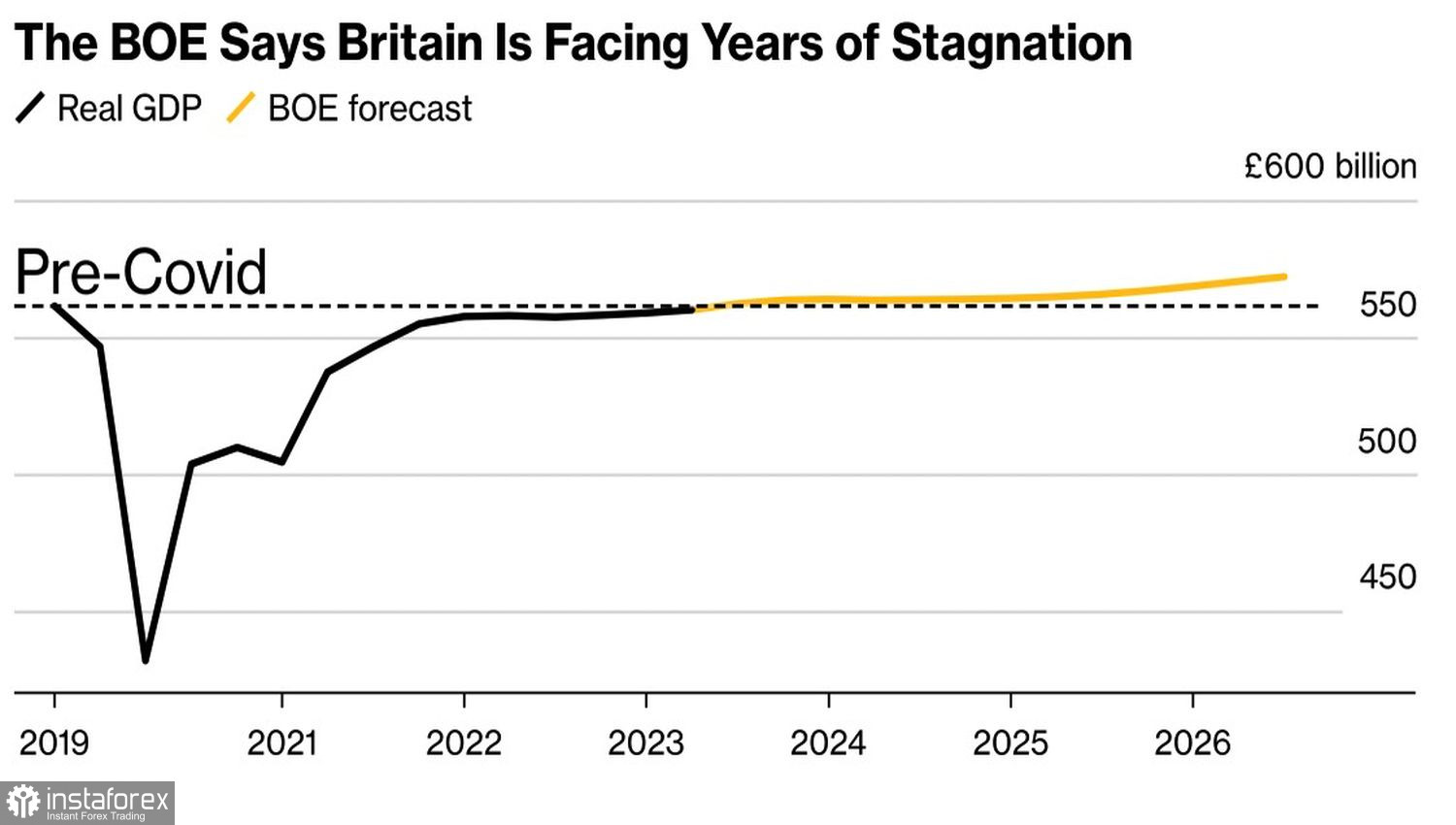

These assessments largely coincide with the views of Bank of England Governor Andrew Bailey and his colleagues on the prolonged stagnation in the UK. It's worth noting that its economy hasn't recovered from the pandemic, unlike other G7 countries. The GDP is still 0.2% lower than in 2019.

Bank of England's UK Economic Forecasts

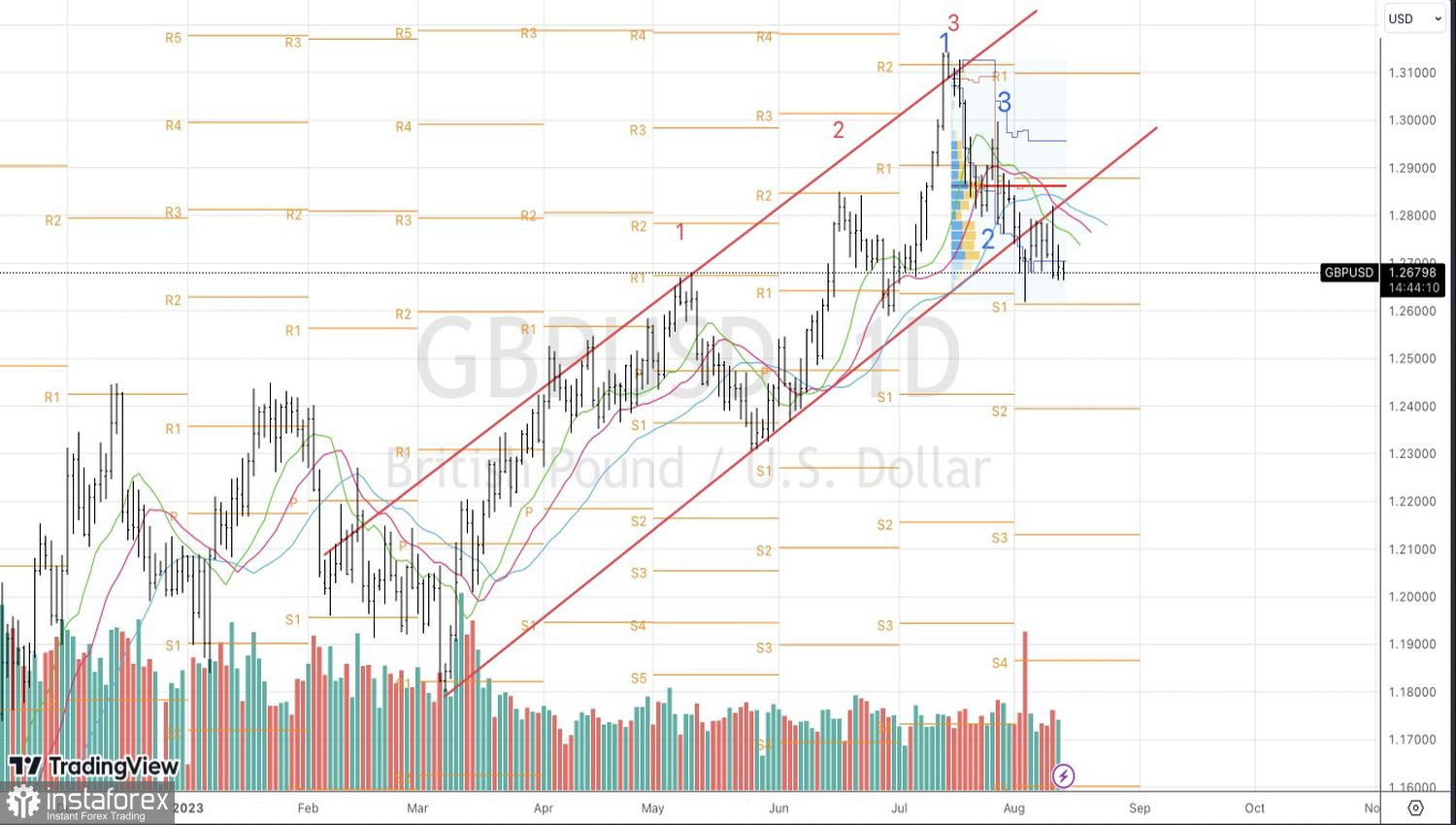

Despite the likelihood of a repo rate hike of 25 bps to 5.5% at the BoE's September meeting following the Q2 GDP data increasing from 80% to 90%, it only provided temporary support to GBP/USD. The pound faces challenges in the week leading to August 18, with labor market, inflation, and retail sales data, which will set everything straight. Moreover, there are always two currencies in any pair, and the U.S. dollar looks very strong.

The rally of the USD against its main competitors is based on the increase in Treasury bond yields. Investors are offloading long-term securities as they are no longer afraid of a recession. If the Federal Reserve achieves a soft landing, it will allow the central bank to maintain the federal funds rate plateau not until March 2024, but until June. Such predictions come from Goldman Sachs and are favorable for GBP/USD bears. Indeed, the widening yield differential between U.S. and UK bonds works in their favor.

The pound isn't aided by expectations of a repo rate increase to 5.75%, as earlier they were even higher. A month ago, the futures market was dreaming of 6.5%, but slowing inflation made it change its mind. A further slowdown in consumer price growth to the Bloomberg experts' forecasted 6.7% in July could trigger a new wave of GBP/USD sell-offs. I wouldn't be surprised if speculators use the sterling rally following UK labor market data to establish short positions. When everyone is buying, there's a perfect opportunity to sell.

Technically, on the GBP/USD daily chart, the pair's correction is gaining momentum. This is evidenced by its position below moving averages and fair value. Use the pound's price rise to form short positions against the U.S. dollar with initial target levels at 1.2615 and 1.2565.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română