Long-term perspective.

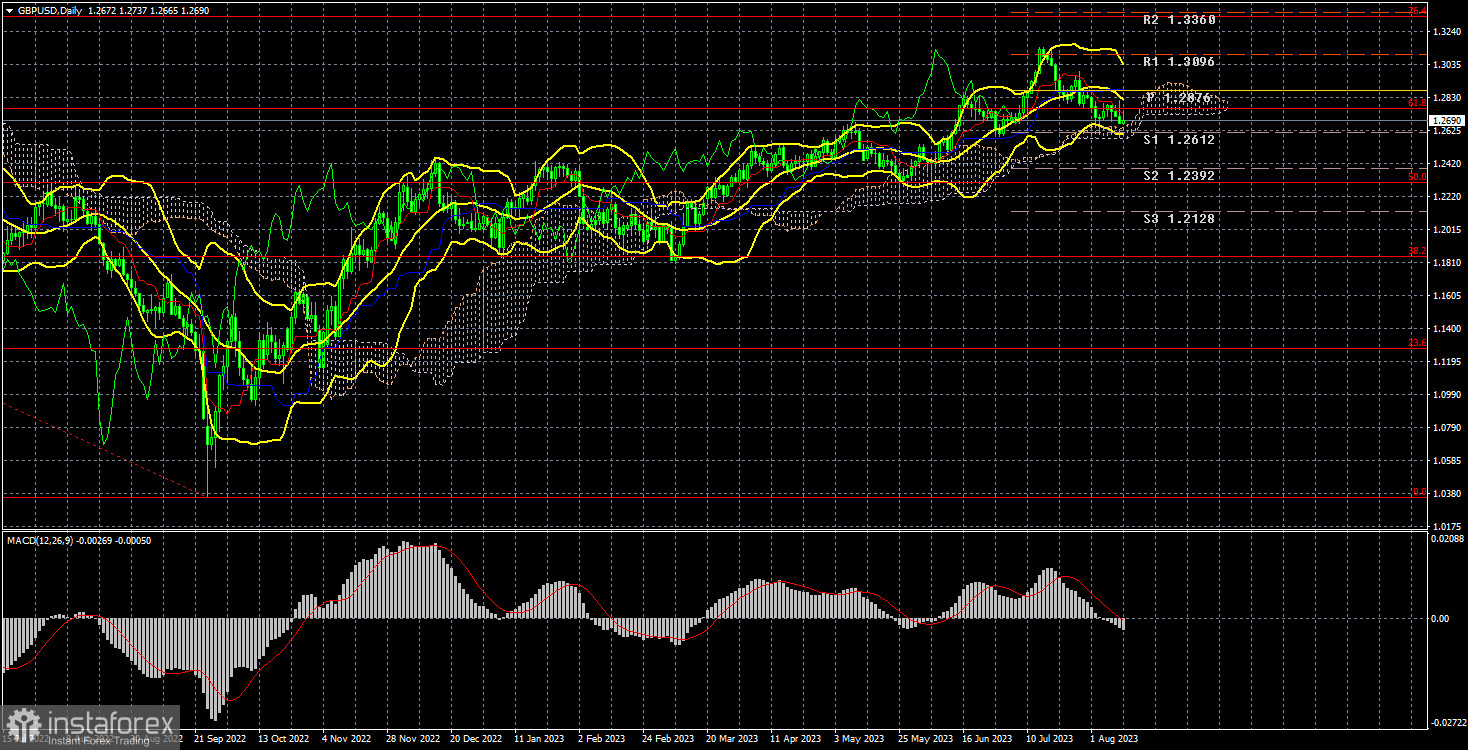

The GBP/USD currency pair lost about 60 points this week. It's a minor change, but the pair traded throughout the week with minimal volatility and a slight downward movement. The price remains below the critical Kijun-sen line and is moving towards the Senkou Span B line, which is strong support. The recent movement of the British pound appears to be a simple retracement. We've seen many such retractions in recent months, and each time they ended with the resumption of a similar global upward trend.

We've repeatedly said there is no basis for further pound growth. Even assuming that the Bank of England continues to raise the key rate to 6% or 6.5%, these regulatory decisions are already priced into the current rates. Recall that the pound has been growing for almost a year and has risen by almost 3,000 points during this time. And throughout this time, the Federal Reserve (Fed) has also been raising rates, which have been consistently higher than the Bank of England's (BOE) rate. Therefore, the pound should continue to fall regardless of any fundamental backdrop.

Of course, we're dealing with the forex market, where movements are only sometimes logical or justified. The inertial upward trend can also continue indefinitely. The pound might rise because there is a demand for it. And demand can arise for various reasons. Some major players might need a lot of pounds for their company's operations and buy them with dollars. This creates a bias towards the pound. This leads to the pound's growth.

This week, only one report from the UK could have influenced the pair's movement. The GDP for the second quarter grew by 0.2% instead of the forecasted 0.0%. This report was released on Friday, but it didn't significantly impact the currency pair's movement. Regarding the US inflation report, we touched on this topic earlier. July's rise in the Consumer Price Index (CPI) suggests a higher probability of the Federal Reserve (Fed) implementing stricter monetary measures come September, bolstering the dollar's position.

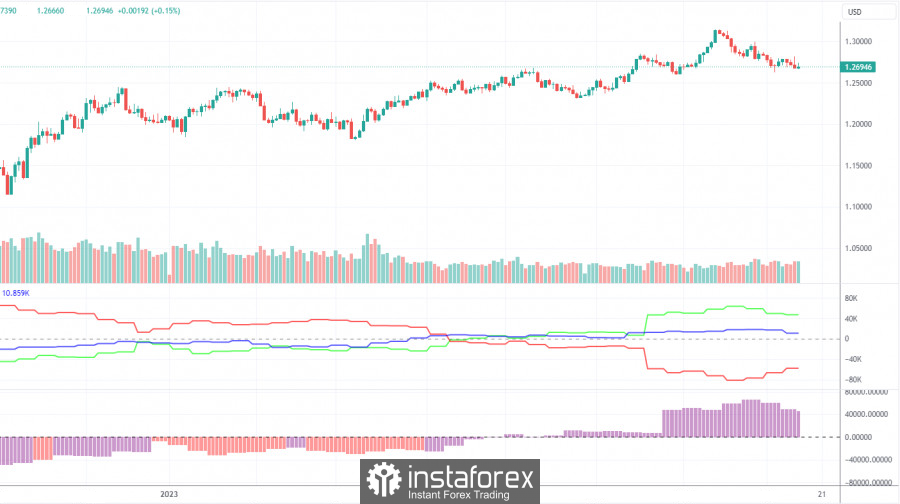

COT Analysis

The latest data on the British pound highlights that the "Non-commercial" sector finalized 8.9 thousand buy contracts while wrapping up 6.3 thousand on the sell side. This has led to a decline in the net position of non-commercial traders, dropping close to 2.6 thousand contracts within the week. Over the past 11 months, we've seen both the net position metric and the British pound on a consistent uptrend. We're nearing a juncture where this escalating net position might be too expansive to anticipate further ascent in the pair's trajectory. We foresee the onset of a sustained decline in the pound's value. Although COT data hints at a potential marginal uptick in the British currency, placing confidence in such an outlook is growing more challenging. The underlying reasons driving continuous market buy-ins still need to be discovered. Yet, a rising trend of sell indicators surfaced on the 4-hour and 24-hour charts.

The British pound has experienced a substantial surge of 2800 points since its nadir last year. Advancing without a notable bearish adjustment would be counterintuitive. Still, the movements of this pair have been deviating from logical patterns for some time now. The market's interpretation of underlying fundamentals seems skewed, often sidelining favorable dollar-centric data. Currently, the "Non-commercial" segment stands with an open position of 83.2 thousand buy contracts versus 36.2 thousand sell contracts. Our outlook on the British currency's long-term growth remains cautious, especially as the market has been redirecting its focus toward selling of late.

Trading plan for the week of August 7-11:

- The GBP/USD pair is trying to form a new correction. Each new attempt at correction has looked rather pitiful, but this time, we'll see a movement below the Ichimoku cloud. Currently, the price is above all lines of the Ichimoku indicator (except for the critical one). Securing the price above the Kijun-sen line will indicate a possible resumption of the upward trend. The growth might be chaotic, weak, inertial, or illogical. The goal is the 76.4% Fibonacci level at 1.3330.

- As for sales, there currently needs to be technical grounds for them. A fixation below the Kijun-sen line has occurred, but the Senkou Span B line is nearby. Selling in such a strong upward trend is risky, but buying without understanding why the pound is growing and when its "fairytale" will end is also dubious. The situation is unconventional and frankly stalemate. It's best to trade the pair intraday or on younger timeframes.

Explanation of the illustrations:

Support and resistance price levels, Fibonacci levels - these are the targets when opening buy or sell positions. Around them, one can place Take Profit levels.

Indicators include Ichimoku (standard settings), Bollinger Bands (standard settings), and MACD (5, 34, 5).

On the COT charts, Indicator 1 represents the net position size of each category of traders.

On the COT charts, Indicator 2 represents the net position size for the "Non-commercial" group.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română