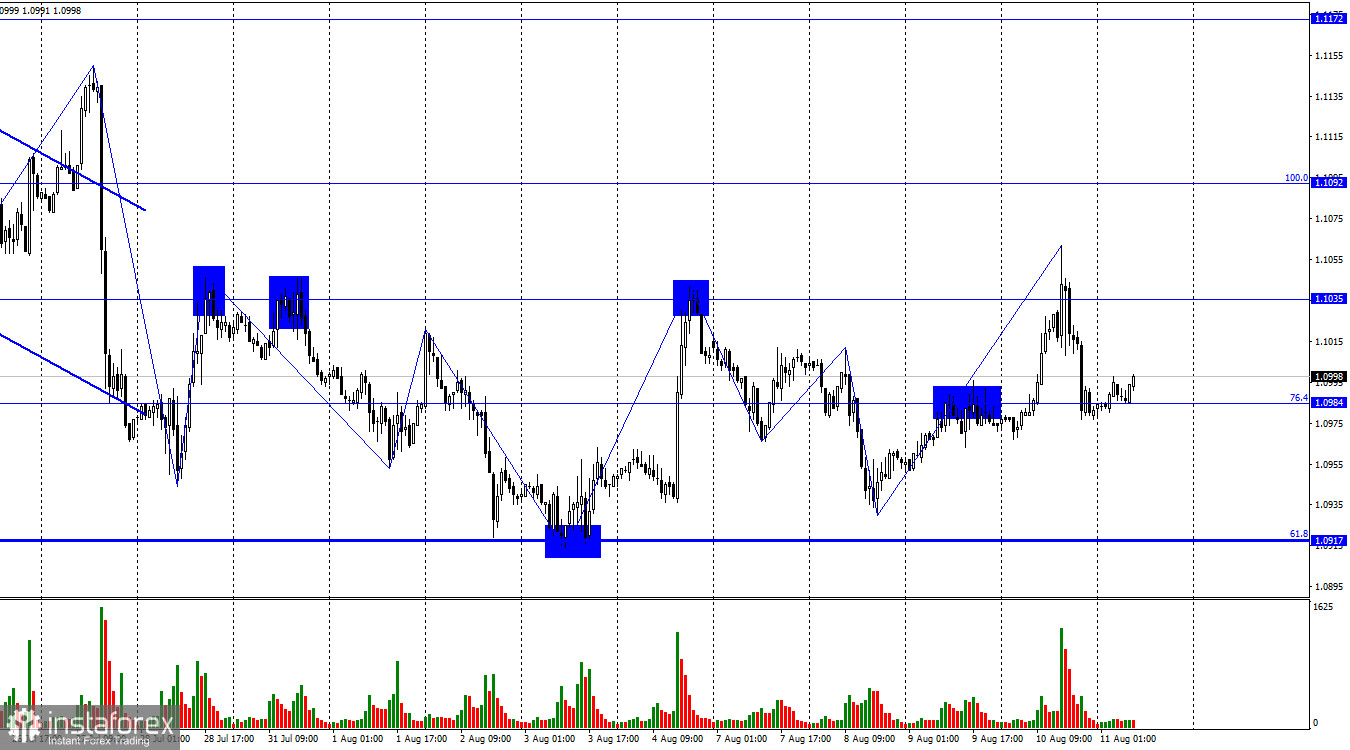

On Thursday, the EUR/USD pair rose to the 1.1035 level, which has become a magnet for the price in recent months. A pullback from this level again favored the US dollar, returning to the Fibonacci level of 76.4% (1.0984). This morning, a rebound from this level worked in favor of the European currency, resuming its rise towards the same 1.1035 level. Consolidating the pair's rate below the 1.0984 level will allow traders to anticipate a drop toward the corrective level of 61.8% (1.0917).

The wave situation continues to become more complex. Yesterday and the day before, the pair formed a powerful upward wave, which surpassed the peaks of the previous two rising waves. One could have concluded the start of a bullish trend, but the 1.1035 level was not breached, and for the past two weeks, the pair has been in a sideways motion. Today, the news backdrop will be fairly weak, so I do not expect a rise above the 1.1035 level. We will likely see a new drop within the horizontal segment.

Yesterday's high trading activity was expected. The inflation report has always been crucial for traders, and in the last two years, it has become even more so. The US Consumer Price Index (CPI) rose to 3.2% in July, with traders expecting 3.3%. The core index dropped to 4.7% year on year. Following this data, the rise of the US currency was expected, given that the FOMC has increased justification for further monetary tightening. On Thursday, the unemployment benefits report was slightly worse than expected, but it couldn't overshadow the inflation report, so the dollar grew steadily and confidently.

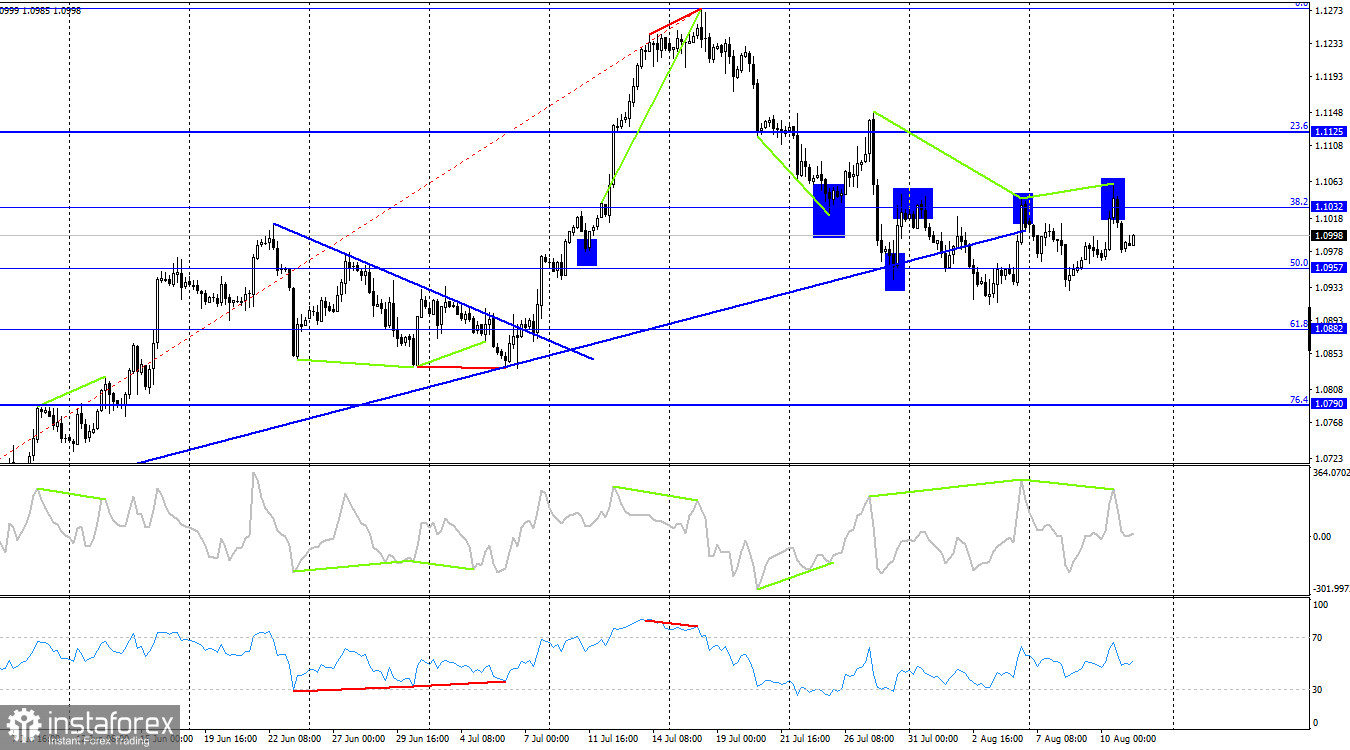

On the 4-hour chart, the pair secured a position below the rising trendline and two rebounds from the Fibonacci level of 38.2% (1.1032). Thus, I expect the European currency to fall toward the corrective level of 61.8% (1.0882). After consolidating below the trendline, the likelihood of the pair's fall has significantly increased in the long term. Additionally, a "bearish" divergence in the CCI indicator formed yesterday, which increases the likelihood of a decline.

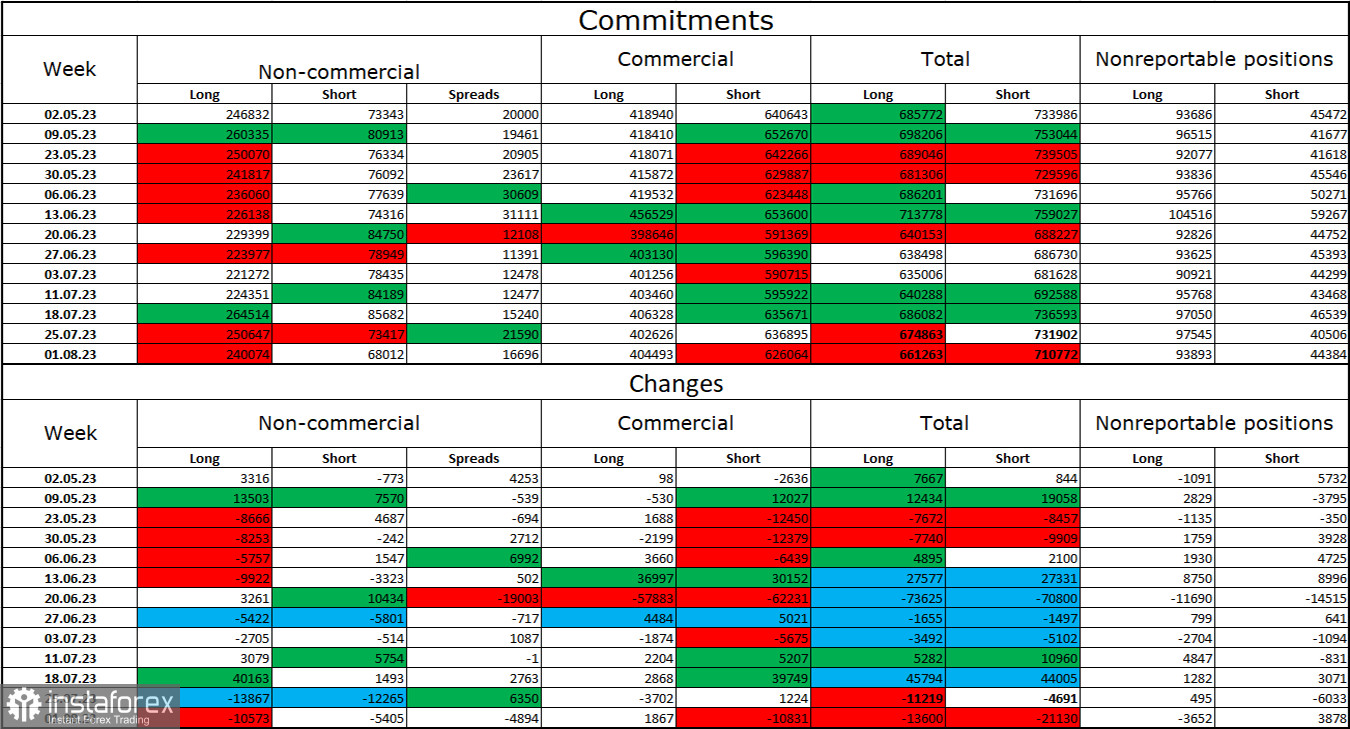

Commitments of Traders (COT) Report:

During the last reported week, speculators closed 10,573 long contracts and 5,405 short contracts. The sentiment among large traders remains bullish and weakened slightly over the past week. The total number of long contracts held by speculators now stands at 240,000, with short contracts at just 68,000. Bullish sentiment persists, but the situation will likely shift in the opposite direction soon. The high number of open long contracts suggests that buyers might start to close them soon – there's too strong a bias towards the bulls currently. I think the current figures permit the continuation of the euro's fall in the upcoming weeks. The ECB increasingly signals the imminent end of the monetary tightening process.

News calendar for the US and the European Union:

USA - Producer Price Index (PPI) (12:30 UTC).

USA - Consumer Sentiment Index from the University of Michigan (14:00 UTC).

On August 11th, the economic events calendar contains two not-so-interesting entries. The influence of the news backdrop on traders' sentiment throughout the day will be weak.

Forecast for EUR/USD and advice to traders:

I advised selling yesterday upon a rebound from the 1.1035 level on the hourly chart, targeting 1.0984 and 1.0917. The first target was reached. New sales are possible upon closing below 1.0984 or with a new rebound from 1.1035. Purchases are feasible upon a rebound from the 1.0984 level, targeting 1.1035, but I find it hard to expect strong growth from the pair today.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română