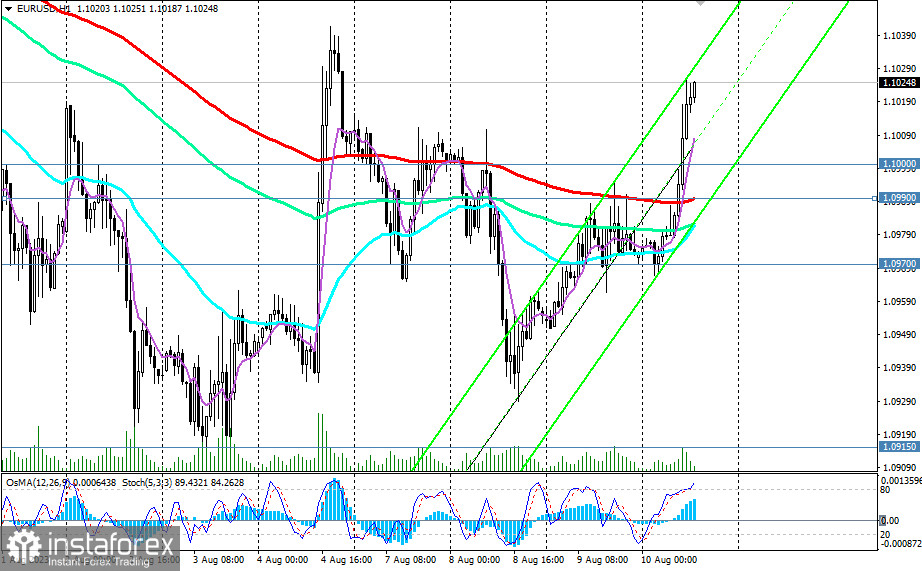

After rebounding from the important support level at 1.0970 (50 EMA on the daily chart and 144 EMA on the weekly chart) and surpassing two significant short-term resistance levels at 1.0990 (200 EMA on the 1-hour chart) and 1.1000 (200 EMA on the 4-hour chart), EUR/USD is currently developing an upward momentum.

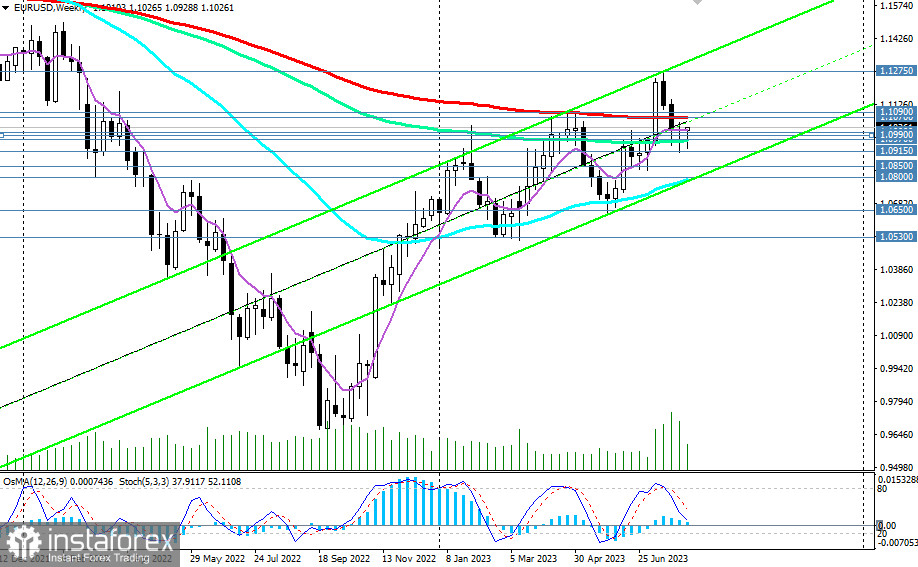

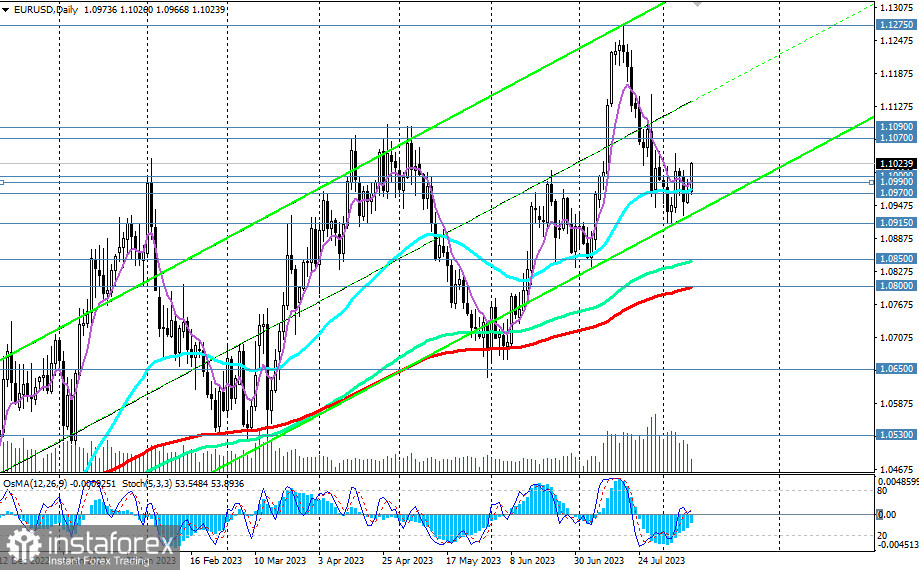

Last month, EUR/USD attempted to break into the long-term bullish market zone located above key resistance levels at 1.1070 (200 EMA on the weekly chart) and 1.1090 (50 EMA on the monthly chart).

However, the dollar's renewed strengthening in mid-July and weak macro statistics coming from the eurozone did not allow the pair to consolidate at the reached levels. As a result, EUR/USD reverted to a decline, re-entering the long-term bearish market zone (below the 1.1070 mark).

We will see whether the pair's buyers have enough determination, and if EUR/USD has the potential to return to the levels previously reached, during this and next week when the most crucial macro data from the U.S., followed by the eurozone, will be released.

In an alternative scenario, if EUR/USD breaks the local support level of 1.0915, it will head towards the key support levels of 1.0850 and 1.0800 (200 EMA on the daily chart). Breaking these, in turn, will indicate a return of EUR/USD to the bearish market zone—both medium and long term.

However, breaking the local support level at 1.0530 will ultimately send EUR/USD back into the global bearish market zone.

The first signal for implementing this scenario could be the breaking of the support levels at 1.1000 and 1.0990, with a confirmed break of the 1.0970 support level.

Support levels:1.1000, 1.0990, 1.0970, 1.0915, 1.0900, 1.0850, 1.0800, 1.0775, 1.0700, 1.0650, 1.0530

Resistance levels: 1.1070, 1.1090, 1.1200, 1.1275, 1.1300, 1.1400, 1.1500, 1.1600, 1.1700

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română