Although pound declined sharply on Wednesday, volatility remained significantly lower than the day before, meaning the market could not get away from the current trend, similar to euro, which remained stuck given the completely empty macroeconomic calendar in the eurozone.

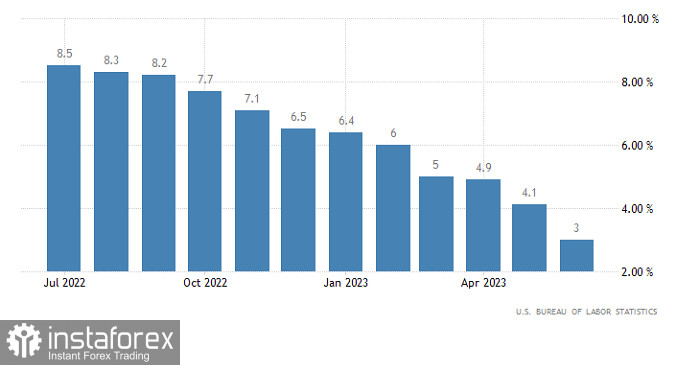

The upcoming US inflation data played a key role in this situation, as no one wanted to take risks, considering the existing forecasts. Analysts said the pace of consumer price growth in the US may accelerate, in which the most modest forecast points to a rise from 3.0% to 3.1%. Some predict growth of up to 3.3%.

In any case, inflation growth will eliminate all questions regarding the further actions of the Federal Reserve. At the very least, the bank will raise the refinancing rate again.

In terms of dollar, it will rise sharply. The extent of the acceleration in consumer price growth will determine how serious the movement will be.

US Inflation

Correction in EUR/USD slowed, halting the movement of the pair. This attracted the attention of speculators. For the correction to continue, the pair needs to stay below 1.0900. Otherwise, there may be an increase toward 1.1050.

GBP/USD experiences a roughly similar price fluctuation. The support level of 1.2700 serves as a variable pivot, so a stable trading below this level could lead to the surge of short positions. Rising above 1.2800, on the other hand, will end the current correction.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română