EUR/USD

Yesterday was relatively calm in anticipation of today's US CPI data for July and the ongoing placement of $38 billion worth of 10-year government bonds. The bonds were placed at 3.999%, compared to the previous auction's 3.857%, due to high demand. The inflation forecast suggests a decrease in the core CPI from 4.8% YoY to 4.7% YoY and an increase in the overall CPI from 3.0% YoY to 3.3% YoY. The weekly report from the Labor Department on unemployment benefit claims gains increased significance after Friday's mixed employment indicators – the forecast is 230,000 claims against the previous 227,000.

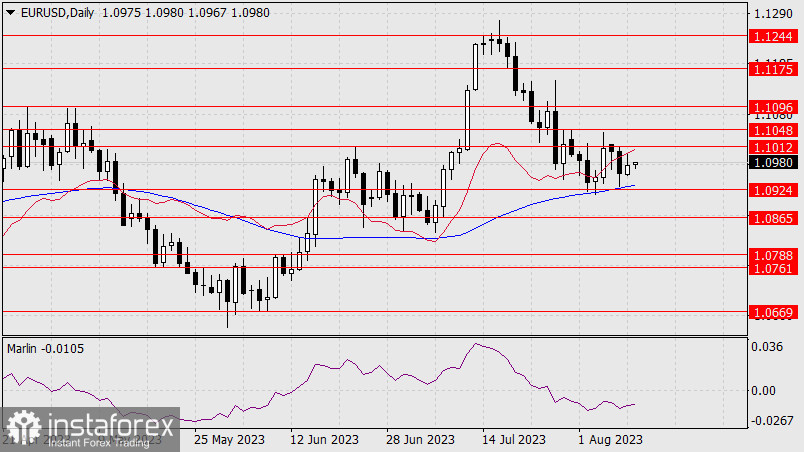

On the daily chart, the balance indicator line stopped the euro from rising further. The Marlin oscillator is horizontal. In case today's data meets forecasts or it turns out to be better, the euro could continue to rise to 1.1012 and even to 1.1048 and 1.1096 (the peak of April 26th).

On the four-hour chart, the price has crossed the MACD line and is now descending along it, preparing for an upward move. The Marlin oscillator is moving along the zero line, also not trying to outpace events.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română