Overview of macroeconomic reports

The main items on today's agenda are the US economic reports. There is nothing lined up in the EU and the UK. However, even the US reports might be enough to generate some good movements in the second half of the day. Unfortunately, everything will depend on the values of these reports. For instance, the data on unemployment claims is expected to provide minimal changes. Usually, deviations from forecasts are very slight, resulting in a weak market reaction.

On the other hand, the US inflation report is a different story. According to forecasts, it will increase to 3.3% on an annual basis by the end of July, and the core inflation will remain unchanged at 4.8%. If these forecasts are realized, this could push the US dollar to rise further, as it will increase the chances of another interest rate hike by the Federal Reserve in 2023. This might even happen at the next meeting in September, especially if the August inflation report also proves unsatisfactory.

Overview of fundamental events

Among the fundamental events on Thursday, we can highlight the speeches of the Fed officials Patrick Harker and Raphael Bostic. However, they will take place late in the evening, so they won't have any impact on the movements of both pairs during the day. In any case, we rarely receive important information from ordinary members of the monetary committee.

Bottom line

On Thursday, the market will undoubtedly focus on the US inflation report. The movements of both pairs in the second half of the day and the Fed's decision on the September rate hike will depend on it. All other events are of secondary importance.

Main rules of the trading system:

- The strength of the signal is calculated by the time it took to form the signal (bounce/drop or overcoming the level). The less time it took, the stronger the signal.

- If two or more trades were opened near a certain level due to false signals, all subsequent signals from this level should be ignored.

- In a flat market, any currency pair can generate a lot of false signals or not generate them at all. But in any case, as soon as the first signs of a flat market are detected, it is better to stop trading.

- Trades are opened in the time interval between the beginning of the European session and the middle of the American one when all trades must be closed manually.

- On the 30-minute timeframe, you can trade based on MACD signals only on the condition of good volatility and provided that a trend is confirmed by the trend line or a trend channel.

- If two levels are located too close to each other (from 5 to 15 points), they should be considered as an area of support or resistance.

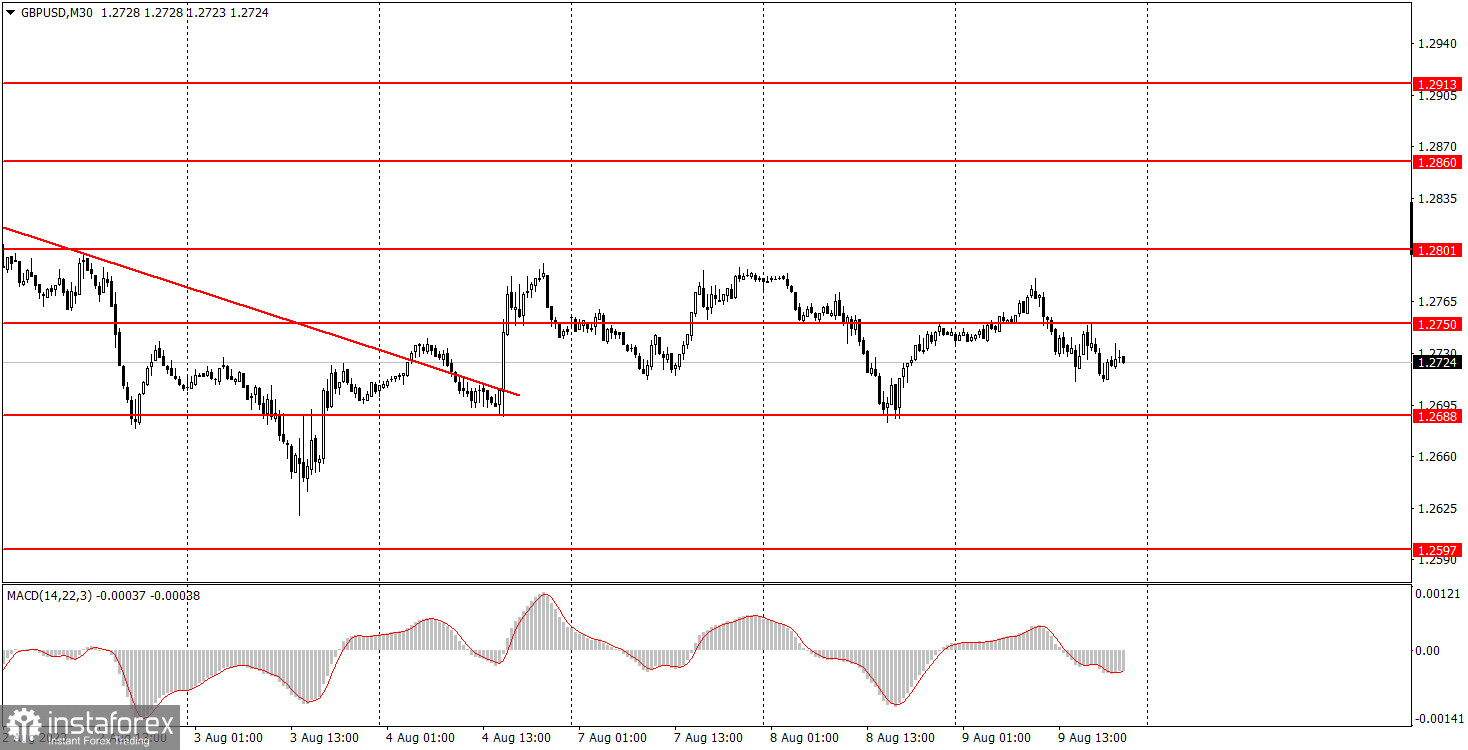

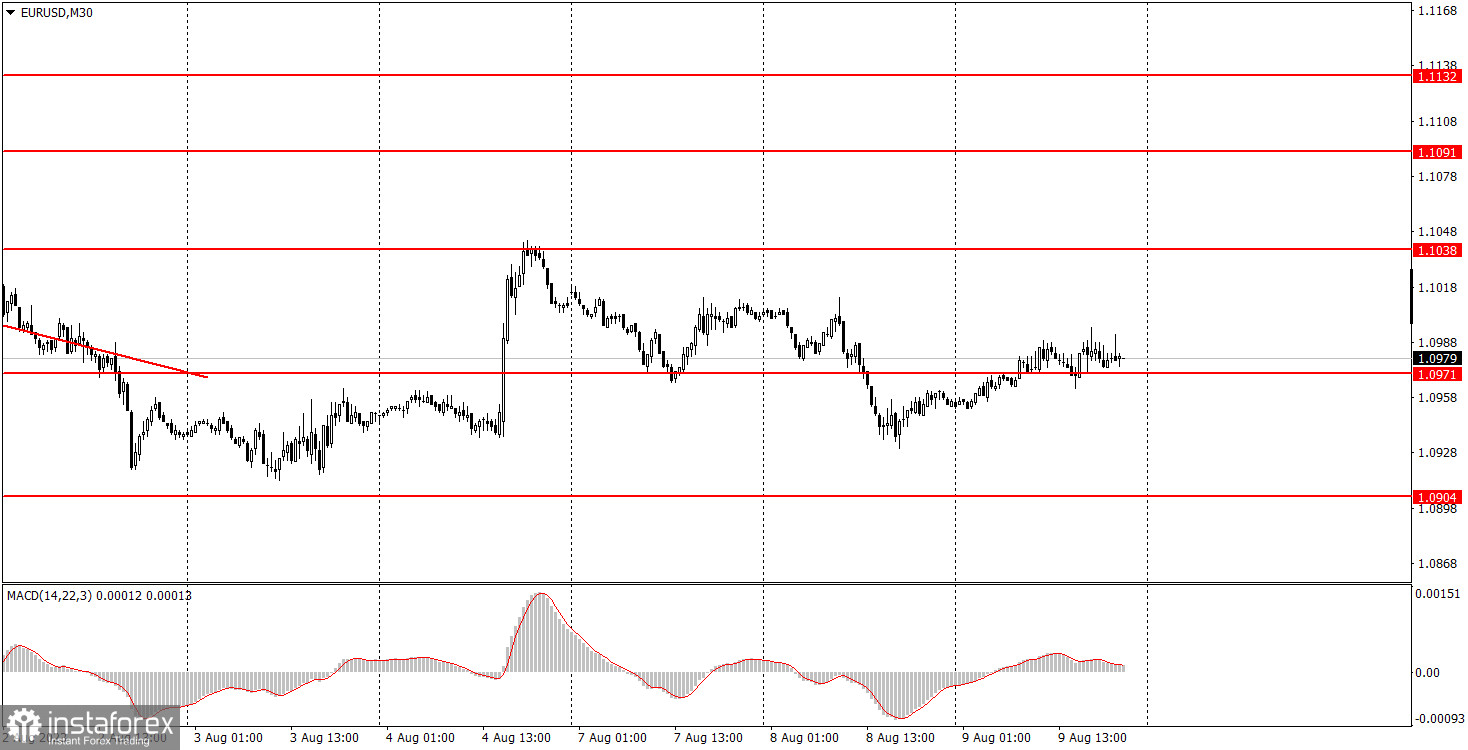

Comments on charts

Support and resistance levels are levels that serve as targets when opening long or short positions. Take Profit orders can be placed around them.

Red lines are channels or trend lines that display the current trend and show which direction is preferable for trading now.

The MACD (14,22,3) indicator, both histogram and signal line, is an auxiliary indicator that can also be used as a source of signals.

Important speeches and reports (always found in the news calendar) can significantly influence the movement of a currency pair. Therefore, during their release, it is recommended to trade with utmost caution or to exit the market to avoid a sharp price reversal against the previous movement.

Beginners trading in the forex market should remember that not every trade can be profitable. Developing a clear strategy and money management is the key to success in trading over a long period of time.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română