Futures on US stock indexes kicked off with gains, and European stock indices followed suit. This all happened after investors found some relief from the Italian government's announcement that the new additional tax on banks would be limited. S&P500 futures rose by 0.3%, while NASDAQ added 0.4%. UniCredit SpA and Intesa Sanpaolo SpA, central players in Tuesday's events when the new tax was revealed, displayed strong growth, pushing Stoxx Europe 600 higher by 1%.

Today's improved sentiment might face a test tomorrow as the US Consumer Price Index for July is set to be published. The inflation report will hold weight, significantly impacting the Fed's decisions and the ongoing stock market rally, which remains uncertain. It is anticipated that consumer prices have risen by 3.3% in July compared to the previous year, a bit higher than the previous month but still the slowest pace in two years.

Meanwhile, the yield on 10-year Treasury bonds rose ahead of another auction by the Fed scheduled for later today. The US government is expected to sell $38 billion worth of new 10-year bonds, $3 billion more than issued in May.

Analysts note that the bond auction will indicate investors' concern about the growing US budget deficit after Fitch Ratings downgraded the US's credit rating. The sale of $42 billion worth of three-year bonds on Tuesday showed lower yields than expected, signaling stronger demand than anticipated.

Investors also positively received the recent statements from Fed representatives. Philadelphia Federal Reserve President Patrick Harker revealed a dovish stance, suggesting that the central bank might be nearing the end of the current rate hike cycle. Harker, who participated in this year's Federal Open Market Committee vote, highlighted progress in combating inflation and praised the strength of the US economy.

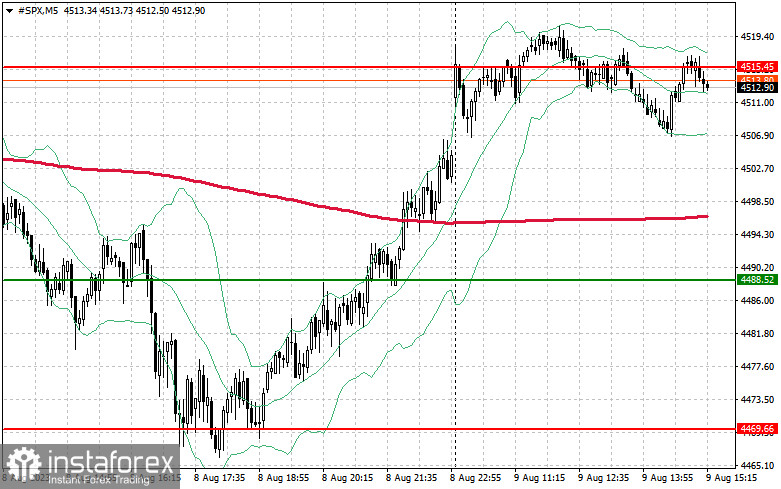

Regarding the S&P 500 index, demand for the trading instrument has returned, though trading remains within a sideways channel. Bulls have a chance to continue the uptrend, but they need to settle above $4,515. This level could trigger a surge to $4,539. Bulls also should maintain control above $4,557, reinforcing the bullish market. In case of downward movement due to reduced risk appetite, bulls should protect $4,488. A breakthrough would swiftly push the trading instrument back to $4,469 and $4,447.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română