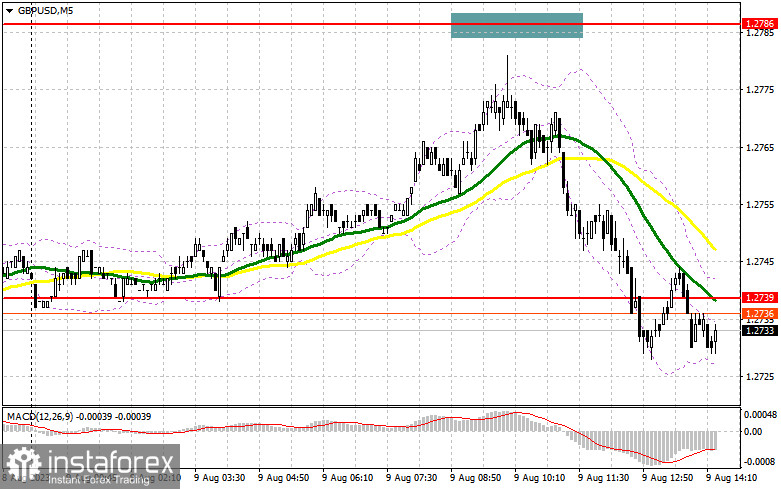

In my morning forecast, I emphasized the 1.2786 level and recommended making decisions based on it. Let's review the 5-minute chart to see what happened. There was an increase, but it didn't reach the false breakout test at 1.2786, after which pressure on the pair resumed. The technical outlook was revisited for the afternoon.

To open long positions on GBP/USD, you need to:

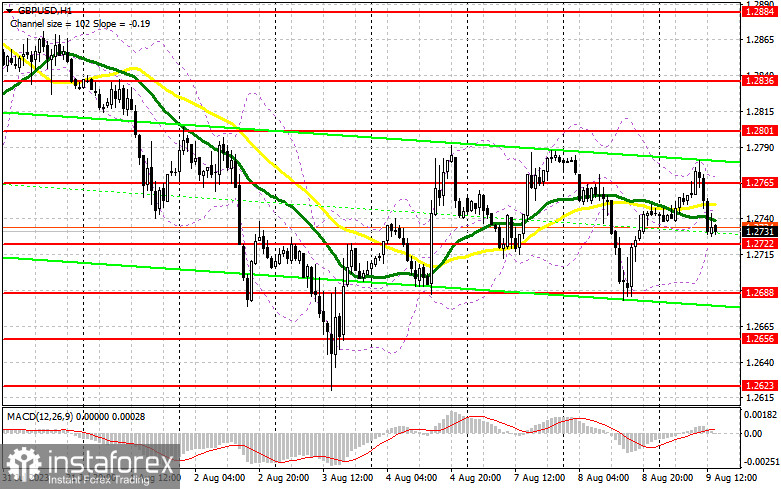

There are no significant data during the American session, so bulls might try to regain control, as they've been doing throughout the week. A false breakout at 1.2722 would be optimal for increasing long positions with a target of updating the 1.2765 resistance set in the first half of the day. Only a breakout and establishment above this range will provide an opportunity to set a bullish market with a renewal of the weekly high at 1.2801. The ultimate target is the 1.2836 resistance, where I recommend taking profits. If the price declines to 1.2722 and there are no buyers in the afternoon, the pressure on the pound will intensify. In such a case, only the defense of the next area at 1.2688 and a false breakout there will signal opening long positions. I plan to buy GBP/USD immediately on a bounce only from the 1.2656 low, aiming for a 30-35 point intraday correction.

To open short positions on GBP/USD, you need to:

Trading is within a channel, so it's too early to speak of any sellers' advantage. Only a failed establishment above 1.2765 will signal a sell with a perspective of a drop to the interim support at 1.2722. A breakout and a bottom-up reverse test of this range will deal a significant blow to the buyers, allowing for a more substantial GBP/USD decline to 1.2688. The ultimate target is low at 1.2656, where I'll be taking profits. If GBP/USD rises and there's no activity at 1.2765 in the afternoon, nothing significant will happen, and trading will remain within a lateral channel. However, the bulls will get a chance to set an upward correction to 1.2801. Only a false breakout at this level will provide an entry point for short positions. If there's no downward movement, I'll short the pound immediately on a rebound from 1.2836, aiming only for a 30-35 point intraday pair correction.

Indicator Signals:

Moving Averages:

Trading occurs around the 30 and 50-day moving averages, indicating a sideways market trend.

Note: The author considers the moving average periods and prices on the H1 hourly chart and differ from the general definition of classic daily moving averages on the D1 daily chart.

Bollinger Bands:

In case of a decline, the lower boundary of the indicator at 1.2722 will act as support.

Indicator Descriptions:

• Moving average (determines the current trend by smoothing volatility and noise). Period 50. It's marked in yellow on the chart.

• Moving average (determines the current trend by smoothing volatility and noise). Period 30. It's marked in green on the chart.

• MACD Indicator (Moving Average Convergence/Divergence) Fast EMA period 12. Slow EMA period 26. SMA period 9.

• Bollinger Bands. Period 20.

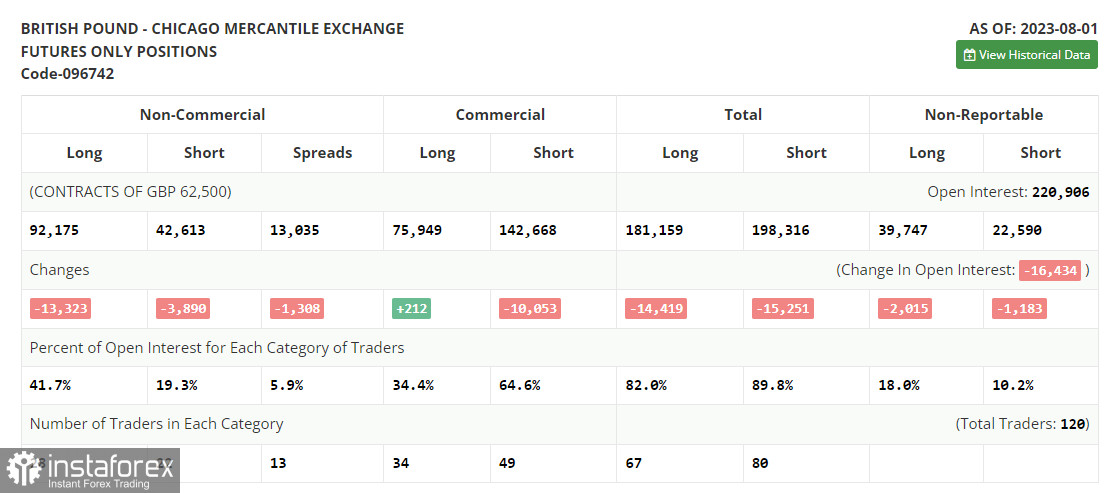

• Non-commercial traders are speculators such as individual traders, hedge funds, and large institutions that use the futures market for speculative purposes and meet certain requirements.

• Non-commercial long positions represent the total open long position of non-commercial traders.

• Non-commercial short positions represent the total open short position of non-commercial traders.

• The total non-commercial net position is the difference between non-commercial traders' short and long positions.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română