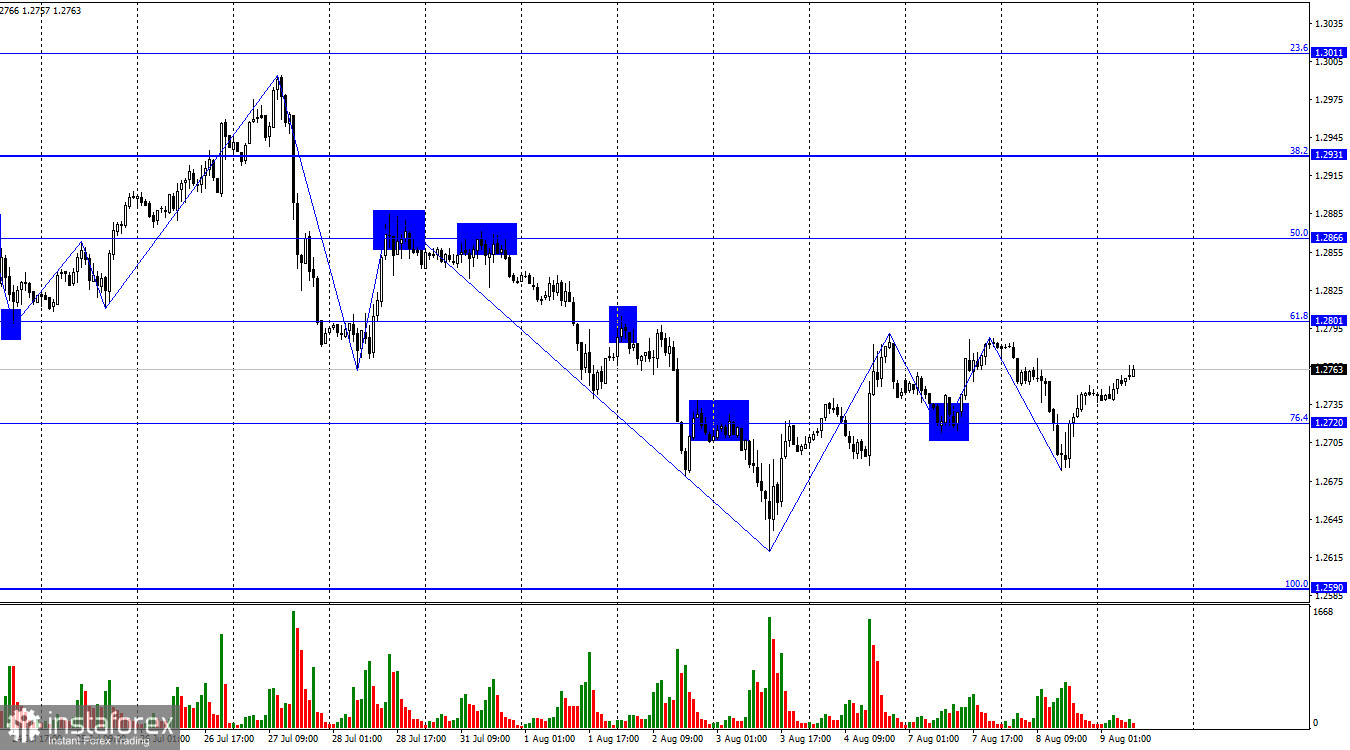

On the hourly chart, the GBP/USD pair made another turn in favor of the US currency on Tuesday, falling below the corrective level of 76.4% (1.2720). However, the decline was short-lived, and currently, the pair is trending toward the Fibonacci level of 61.8% (1.2801). A rebound from this level will again favor the US dollar, leading to a new decline towards 1.2720 or slightly below.

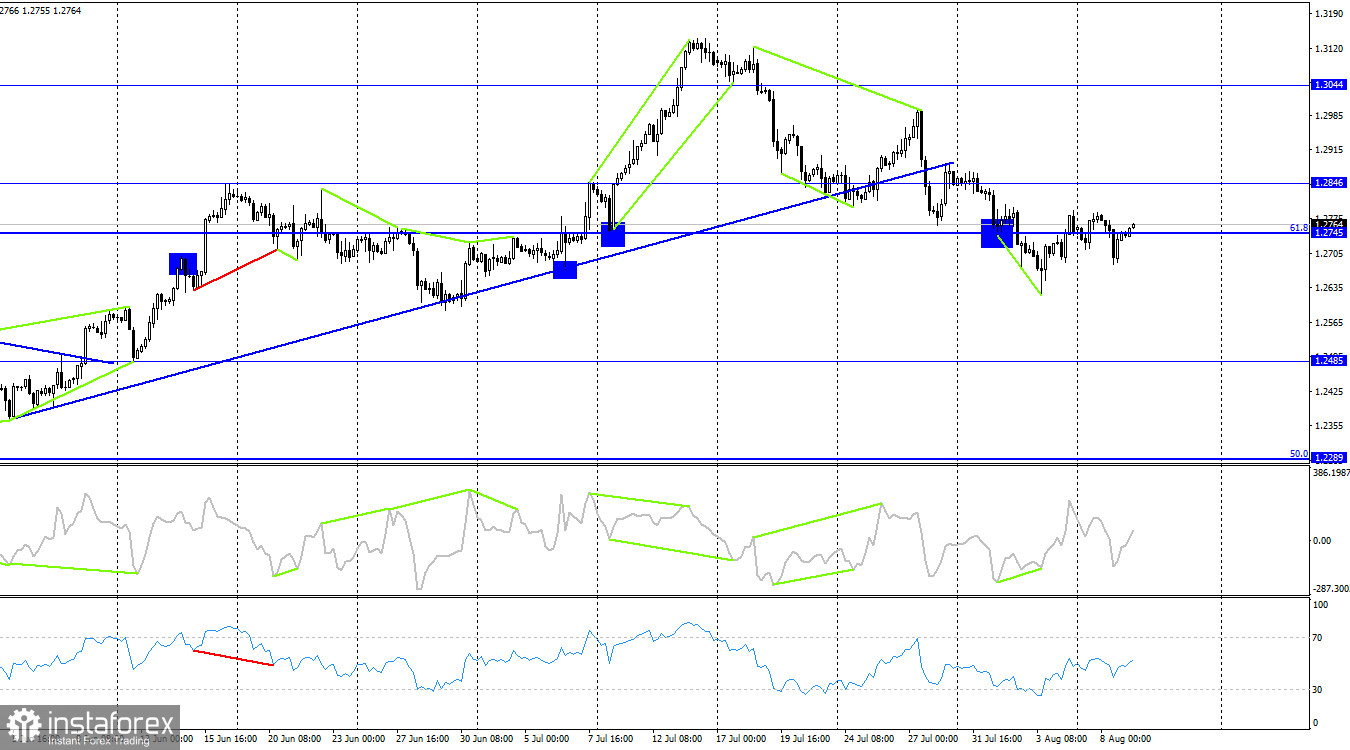

The wave pattern for the pound is also becoming more intriguing. Yesterday, we saw a strong downward wave that broke through the latest low. The most recent upward wave did not surpass the previous peak. Therefore, the current rise of the pound will end in the coming hours, after which a new descending wave will form with targets below the last low. However, breaking the peaks of August 4 and 7 will complicate the current picture. The movement will be considered horizontal for some time, with neither the bears nor the bulls gaining an advantage.

There was no significant news for the pound yesterday or today. The US dollar doesn't have much to boast about, either. Patrick Harker and Michelle Bowman spoke earlier in the week, and their rhetoric was diametrically opposite. Harker suggested it's time for measured decisions without rushing, implying a pause in tightening monetary policy in September. Conversely, Bowman argued for continued tightening since inflation is still not meeting the target level. I don't rule out that the dollar's fluctuation—both up and down—might be due to these differing comments from FOMC members.

The US inflation report, set to be released tomorrow, might assist traders in determining what to expect from the FOMC in September, as rising inflation could indicate that Bowman is right and not Harker. In this scenario, the dollar might exhibit stronger growth than it has attempted in the past few days.

On the 4-hour chart, the pair favored the pound after forming a "bullish" divergence at the CCI indicator. There was also a consolidation above the Fibonacci level of 61.8% (1.2745), suggesting the potential for continued growth towards the 1.2846 level. No emerging divergences are currently observed in any indicator. I don't have strong confidence in a strong pound rise under the present conditions. The wave situation on the hourly chart suggests a drop in the pair today.

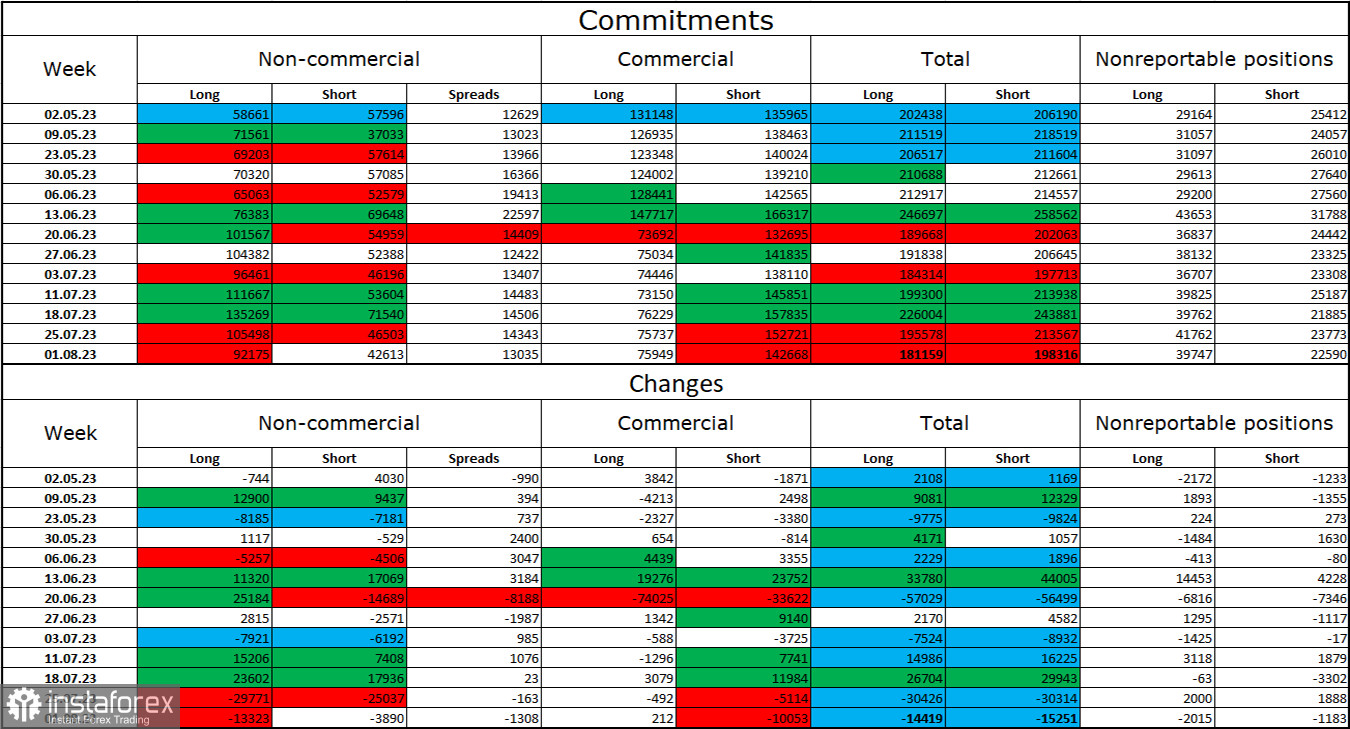

Commitments of Traders (COT) report:

The sentiment among "Non-commercial" traders has become less bullish over the past reporting week. The number of long contracts held by speculators decreased by 13,323 units, while the number of short contracts decreased by 3,890. The overall sentiment of major players remains bullish, and there's a twofold gap between the number of long and short contracts: 92,000 against 42,000. The pound had good prospects for continued growth recently, but many factors have shifted in favor of the US dollar. Betting on a strong rise in the pound is becoming increasingly difficult. The market doesn't always account for all factors supporting the dollar, and the pound has risen lately only on expectations of further rate hikes by the Bank of England.

News Calendar for the US and UK:

On Wednesday, the economic events calendar had no noteworthy entry. The influence of news will be absent for the rest of the day.

GBP/USD Forecast and Advice for Traders:

I recommend new pound sales on a rebound from the 1.2801 level (or 1.2787) on the hourly chart, targeting 1.2720 and 1.2684. The only potential buying signal today would be a close above the 1.2801 level, but be cautious – any growth in the pound might be very brief.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română