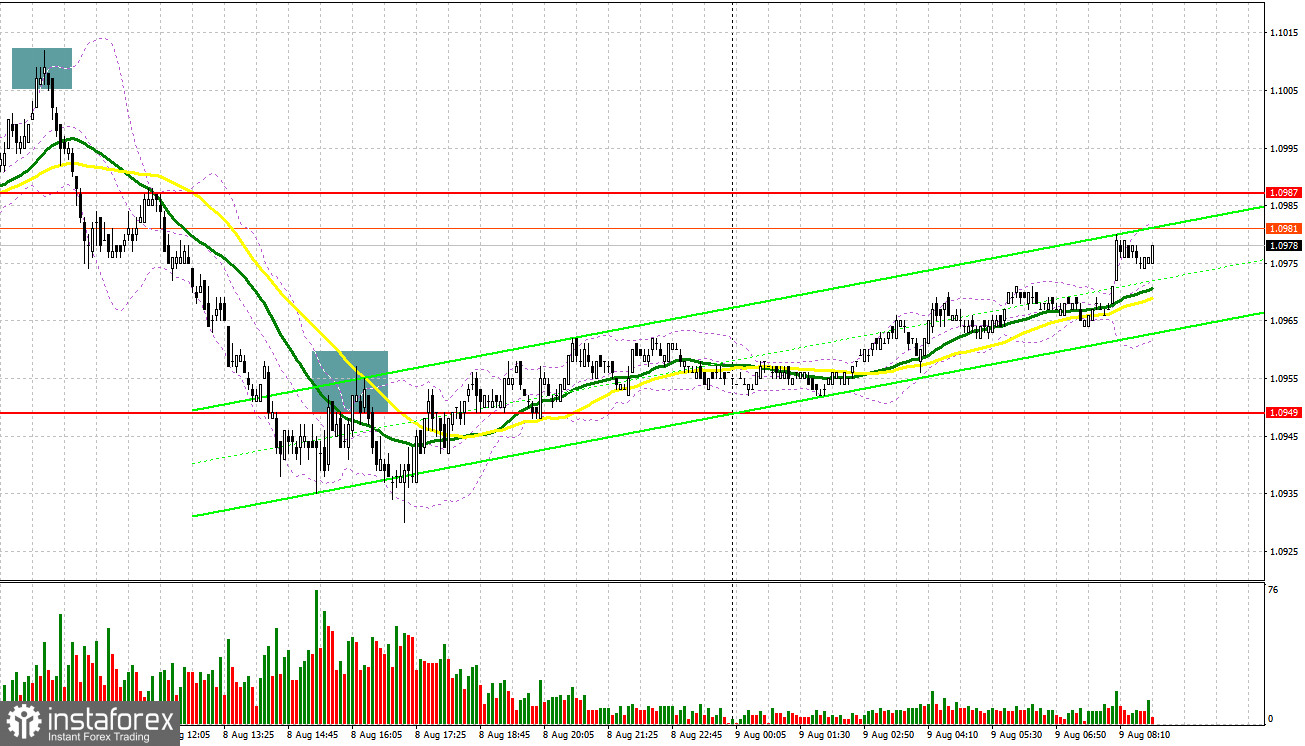

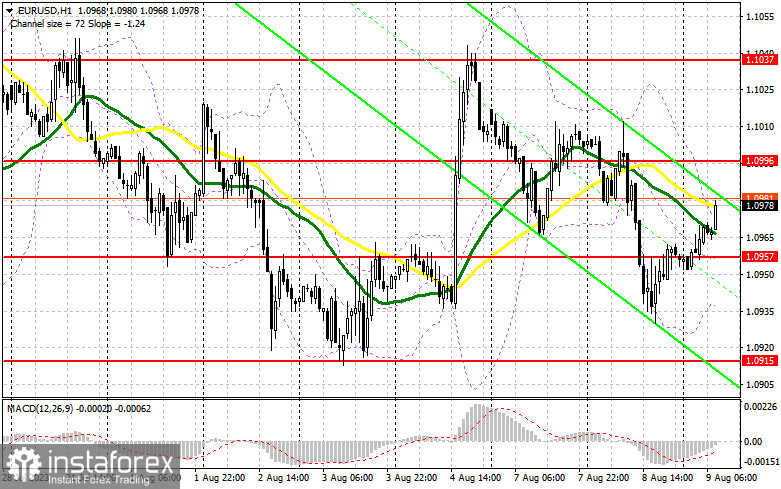

Yesterday, the instrument formed several market entry signals. Let's look at the 5-minute chart and figure out what actually happened. In my morning forecast, I turned your attention to the level of 1.1004 and recommended making decisions with this level in focus. Growth and a false breakout at 1.1004 generated a sell signal. As a result, the pair fell by more than 40 pips. In the afternoon, a breakout and test of 1.0949 produced another sell signal, which resulted in a move of 20 pips.

For long positions on EUR/USD:

Yesterday's German inflation report matched economists' forecasts, while the speech of the Federal Reserve officials had a positive impact on risk assets. As a result, the US dollar weakened. Today, unfortunately, there are no eurozone data, so the first half of the day promises to be quite boring.

I will act after a decline and false breakout near the new support level at 1.0957, formed at the end of yesterday. Afterwards, it will be possible to get a buy signal based on an upward movement, and the pair will likely update the resistance level at 1.0996. A breakout and a downward retest of this range amid the absence of eurozone data will boost demand for the euro. It may continue the uptrend and update the high at 1.1037. A more distant target will be the 1.1072, where I will take profits.

If EUR/USD declines and bulls fail to defend 1.0957, which is unlikely in the absence of macro data, bulls may eventually lose optimism in the face of the Fed's aggressive policy, and the buyers will run into problems again. In this case, only a false breakout of the support level of 1.0915 will provide new entry points into long positions. You could buy EUR/USD at a bounce from the 1.0871 low, keeping in mind an upward intraday correction of 30-35 pips.

For short positions on EUR/USD:

Today, sellers still have a chance of maintaining a bear market as long as they protect 1.0996 and quickly regain control over the level of 1.0957, which was formed at the end of Tuesday. In case of a rise in EUR/USD, I plan to open short positions only after a false breakout of 1.0966. In this case, the pair can fall to the area of 1.0957, just above which are the bullish moving averages. Only after a breakout and consolidation below this level as well as an upward retest, there might be a sell signal. Afterwards, the pair may fall to a weekly low of 1.0915. A more distant target will be the 1.0871 level where I recommend locking in profits.

If EUR/USD rises during the European session and bears fail to protect 1.0996, which is possible, the bulls will remain active. In this case, I would advise you to postpone short positions until a false breakout of the resistance level of 1.1037. You could sell EUR/USD at a bounce from the 1.1072 high, keeping in mind a downward intraday correction of 30-35 pips.

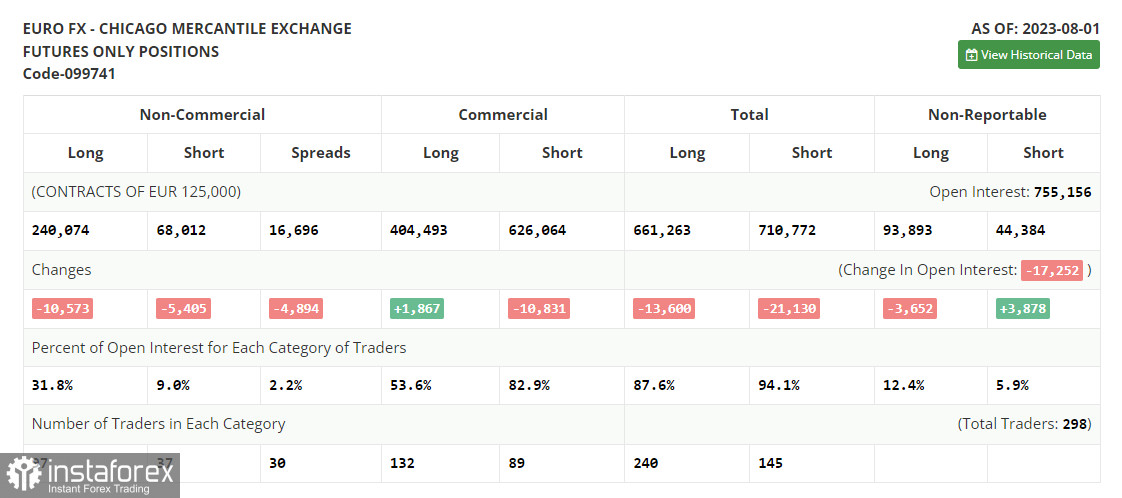

COT report:

According to the COT report (Commitment of Traders) for August 1, there was a decline in both long and short positions. This happened after the meetings of the Federal Reserve and the European Central Bank, and now traders are focused on new data that will allow them to better understand the central banks' plans. The US inflation report will be released on Thursday, which will provide further clarification. A further decrease in price pressure will likely enable the Fed to take a pause in September, while an increase will fuel more discussions about the need to further tighten monetary policy, favoring the dollar. However, even with the downward correction, in the medium term, it is better to go long on the decline. The COT report showed that long non-commercial positions decreased by 10,573 to 240,074, while short non-commercial positions fell by 5,405 to 68,012. As a result, the spread between long and short positions decreased by 4,894, which is rather favorable for the euro sellers. The closing price dropped to 1.0999 against 1.1075 a week earlier.

Indicator signals:

Moving averages:

Trading is taking place around the 30-day and 50-day moving averages, indicating a sideways market trend.

Note: The author considers the period and prices of the moving averages on the hourly chart (H1), which differs from the general definition of classical daily moving averages on the daily chart (D1).

Bollinger Bands

If EUR/USD declines, the indicator's lower border at 1.0940 will serve as support.

Description of indicators:

• A moving average of a 50-day period determines the current trend by smoothing volatility and noise; marked in yellow on the chart;

• A moving average of a 30-day period determines the current trend by smoothing volatility and noise; marked in green on the chart;

• MACD Indicator (Moving Average Convergence/Divergence) Fast EMA with a 12-day period; Slow EMA with a 26-day period. SMA with a 9-day period;

• Bollinger Bands: 20-day period;

• Non-commercial traders are speculators such as individual traders, hedge funds, and large institutions who use the futures market for speculative purposes and meet certain requirements;

• Long non-commercial positions represent the total number of long positions opened by non-commercial traders;

• Short non-commercial positions represent the total number of short positions opened by non-commercial traders;

• The non-commercial net position is the difference between short and long positions of non-commercial traders.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română