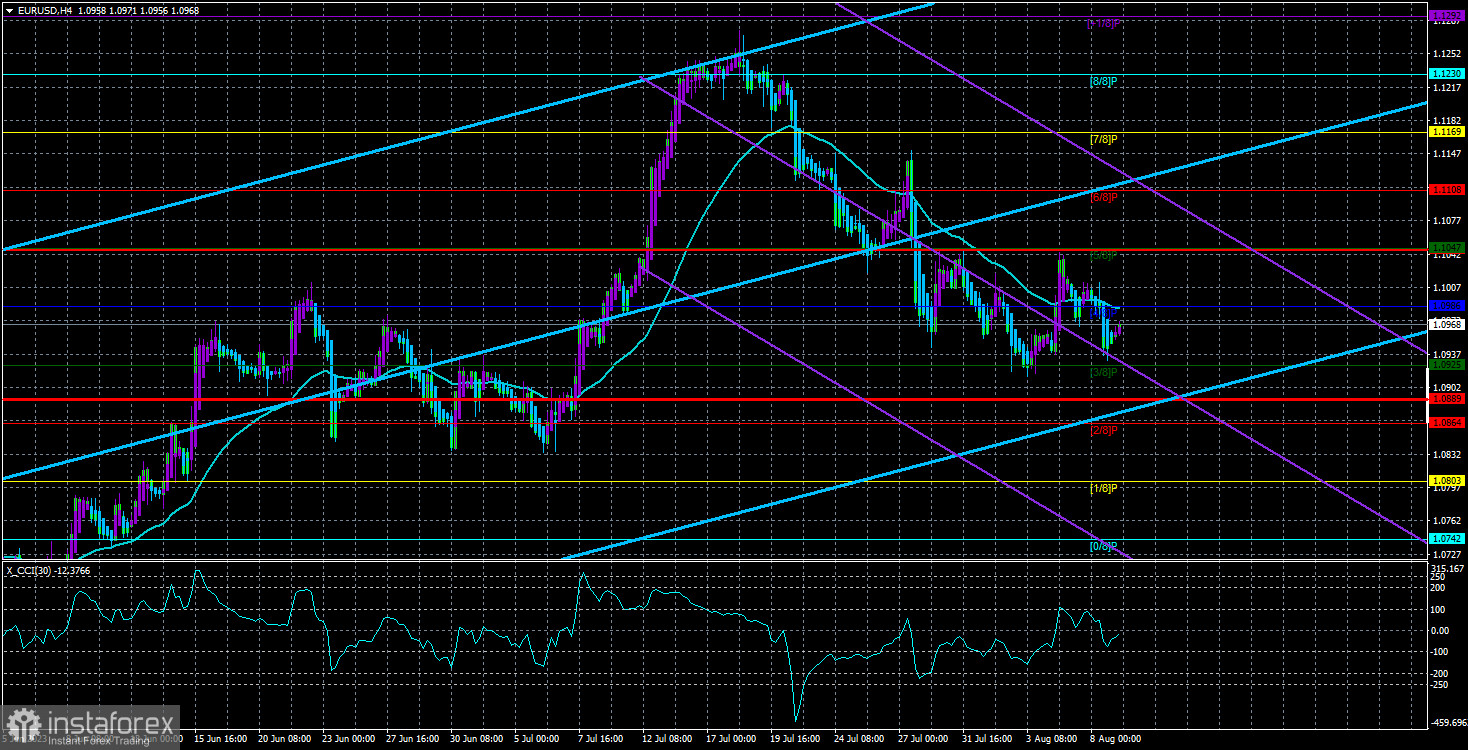

On Tuesday, the EUR/USD pair returned below the moving average although it is still too early to say that the pair has resumed the downtrend. This week is uneventful in terms of significant fundamental and macroeconomic events, suggesting slow market movements and flat trading. In the medium term, the euro's descent should continue but this doesn't mean that it will fall every day. The market might pause for days or even weeks. For now, even the CCI indicator is holding around the zero level, signaling a balance in the market dynamics.

In the first two days of the week, trading activity was somewhat subdued. However, there were some remarks from Federal Reserve officials. Notably, Michelle Bowman indicated that interest rates could see another hike by year-end. This, of course, depends on July and August's inflation levels. Our analysis pegs the probability of another tightening measure at 60-70%. The recent labor market, unemployment, and GDP reports provide the Fed with ample room to potentially raise the key rate once or even twice this year. If inflation for July and August does not dip below 3%, we could see the Fed's rate reaching 5.75% by September.

Will this rate increase substantially bolster the US dollar? Despite the Federal Reserve tightening its monetary policy over the past 11 months, the dollar has consistently been on the decline. There is an opinion that the market might have overvalued the European currency, and part of its upward trajectory was merely due to inertia. Therefore, the primary factor for the euro's potential decline is explained more by its overall overbought status than an additional tightening cycle in the US.

On the 24-hour timeframe, the pair remains below the critical line and shows no signs of extended downward momentum. The immediate target, the Senkou Span B line, remains in place. The future trajectory of the pair depends on whether it crosses this line or not. So far, the pair has failed to break through the 50.0% Fibonacci level. The more this situation persists, the less likely the decline is. Essentially, on the daily timeframe, we have only observed a minor correction, much like the numerous ones over the past 11 months. Every time, the outcome was a renewed bullish rally. Although the euro is set to fall further, its decline isn't self-evident.

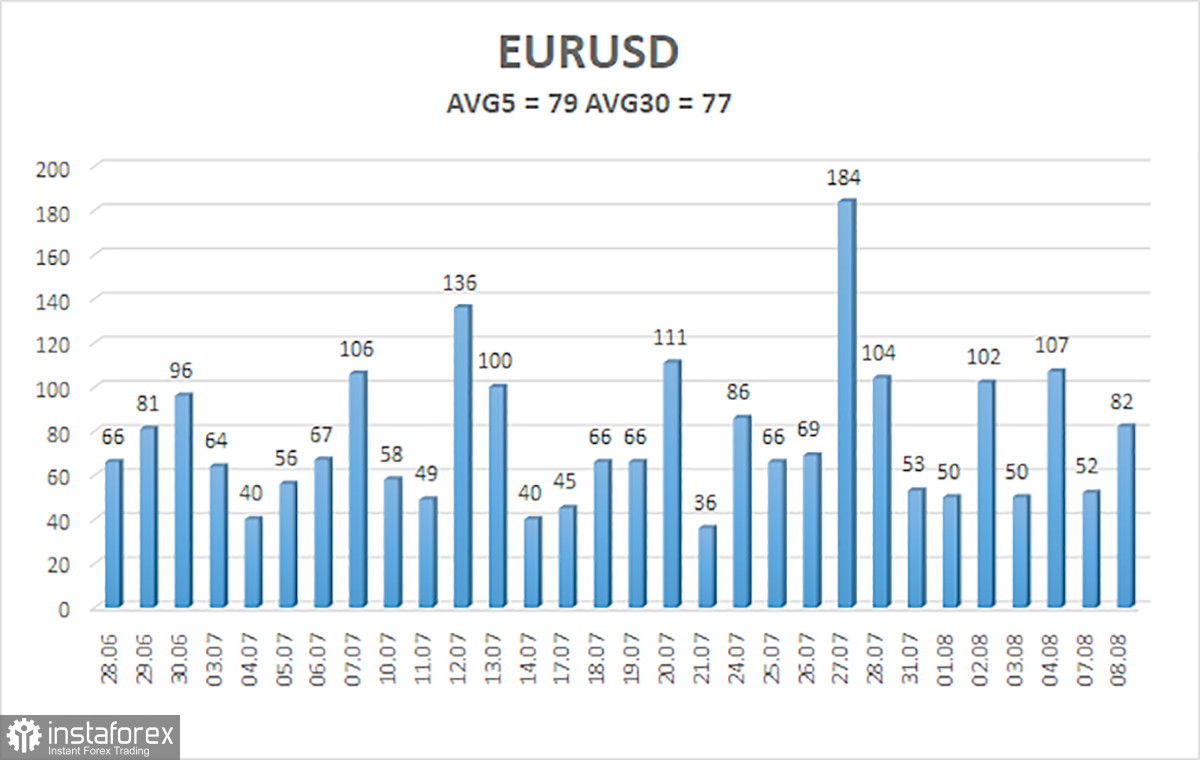

As of August 9, the average volatility of the EUR/USD pair over the last five trading days stands at 79 points, qualifying as medium. Consequently, the pair is expected to trade between 1.0889 and 1.1047 on Wednesday. A reversal of the Heiken Ashi indicator could signal a possible resumption of the downward trend.

Nearest support levels:

S1 – 1.0925

S2 – 1.0864

S3 – 1.0803

Nearest resistance levels:

R1 – 1.0986

R2 – 1.1047

R3 – 1.1169

Trading tips:

EUR/USD started an upward correction even though it is still trading below the moving average. At the moment, new long positions can be opened with the targets at 1.1047 and 1.1108 if the price settles above the moving average. We can consider short positions in case of a downward reversal in the Heiken Ashi indicator with the targets at 1.0925 and 1.0889.

On the chart:

Linear regression channels help determine the current trend. If both of them are pointed in the same direction, it means that the existing trend is strong.

The Moving Average (with a 20-day period, smoothed) shows a short-term trend and the direction to trade in.

Murray levels are target levels for price movements and corrections.

Volatility levels (red lines) represent a probable price channel within which the pair will spend the next day based on current volatility indicators.

The CCI indicator entering the oversold (below -250) or the overbought (above +250) area indicates that a trend reversal is approaching.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română