Stock trading ended mixed on Monday. It seems that the market continues to focus on important US economic data due out this week, as it could be crucial not only for the local financial market but for global markets as a whole.

After a series of statements made by Fed members about the need to continue raising rates and the decision by Fitch Ratings to downgrade the US credit rating, a sort of equilibrium emerged in the markets. Investors likely shortened their activity in currency markets, clearly reflected by the dynamics of the ICE dollar index, which recently showed an attempt to rise above 102.00 points. Currently, it lies at 102.01 points. Market players probably understood that inflation may surge again and economic growth may decline if the Fed raises rates further, especially amid subsequent negatives for financial markets.

Although the US stock market rose, it will likely consolidate until the publication of consumer inflation data this Thursday. Forecasts say there will be a noticeable increase in the index, by 0.3% y/y.

Many expect another rate hike of 0.25% at the September meeting, but this scenario will happen only if inflation rises. In that case, dollar demand will surge, while the local declines in stock markets will continue and could evolve into a full-scale correction. Yields on government bonds may again aim for new highs.

Forecasts for today:

GBP/USD

The pair trades downward in the short-term and may consolidate below 1.2800. If US inflation increases, the decline will continue to 1.2600. Meanwhile, a rise above 1.2800 due to other inflation news could lead to an increase in price to 1.2990.

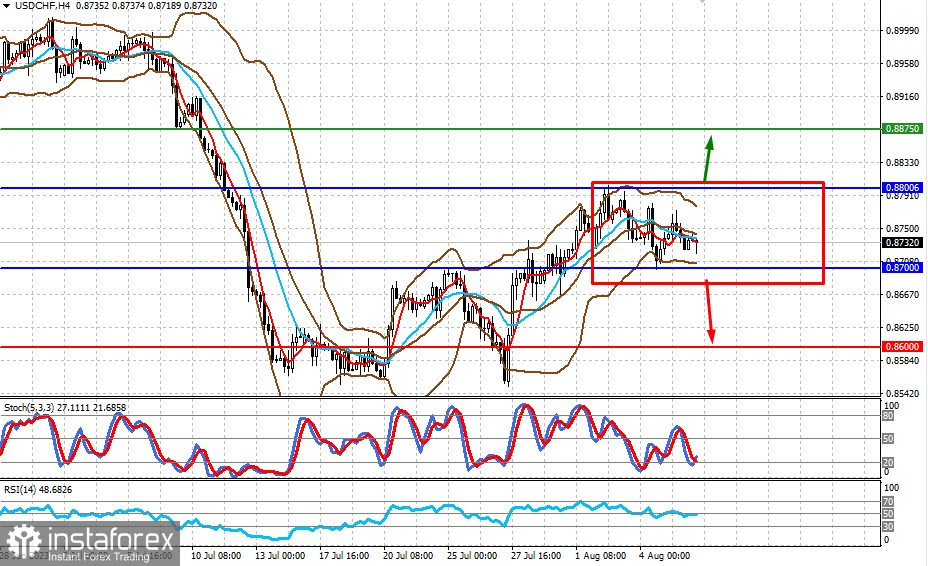

USD/CHF

The pair trades within the range of 0.8700-0.8800, and may remain in this area until the release of the consumer inflation data in the US. If the report shows the anticipated increase, the pair will rise to 0.8875. But if the data falls short of 3.0% y/y, the pair may break out of the range and drop to 0.8600.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română