Trading tips for Bitcoin trading

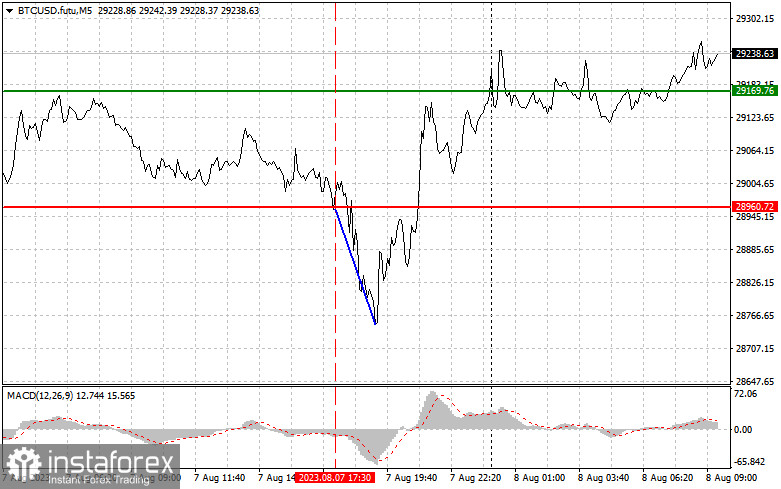

The price test at $28,960 coincided with MACD in the negative zone but not yet reaching its daily lows, confirming the right selling point for Bitcoin. As a result, the drop to $28,766 happened quickly, but a more significant decline did not happen. Sellers keep testing swing lows near $29,000, and if bulls do not counteract, a larger drop to $27,000 might occur. Investors are cautious about risky assets lately, and the US stock market is under pressure, explaining the lack of demand for Bitcoin. Therefore, one should be extremely careful with buying BTC. Notably, it is better to stick to scenario 1.

Buy signal

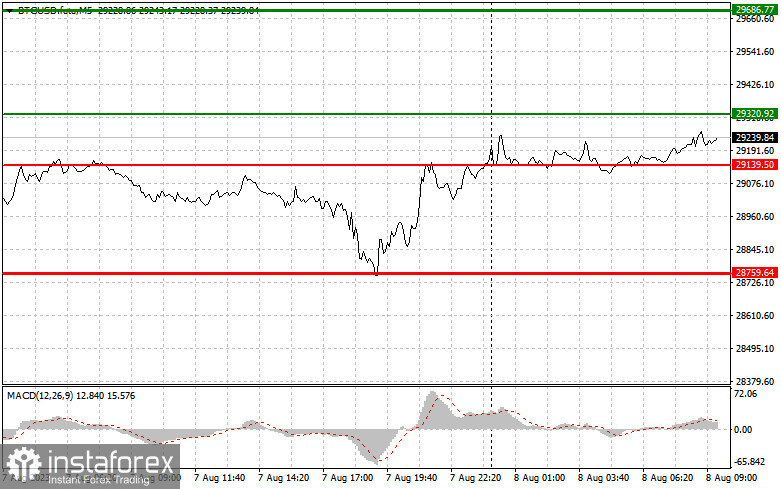

Scenario 1: Buying Bitcoin is possible if the entry point near $29,320 (green line on the chart) is reached, targeting growth to $29,686 (thicker green line on the chart). You can close long positions near $29,686 and open short positions. BTC is unlikely to grow in the near future. Important! Make sure the MACD indicator is above zero before buying.

Scenario 2: Buying Bitcoin today is also possible if there are two consecutive price tests at $29,139. This may limit the downside potential of the trading instrument and lead to an upward market reversal. Expect a rise to the opposite levels at $29,320 and $29,686.

Sell signal

Scenario 1: One can sell Bitcoin only after the level of $29,139 is reached (red line on the chart), leading to a rapid decline in the trading instrument. The sellers' key target will be $28,759, where it is recommended to close short positions and open long positions. Pressure on Bitcoin may increase at any moment. The longer it stays below $29,000, the higher the probability of a drop. Important! Make sure the MACD indicator is below zero before selling.

Scenario 2: Today one can sell BTC if there are two consecutive price tests at $29,320. This will may the upside potential of the trading instrument and lead to a downward market reversal. We may expect a decline to the opposite levels at $29,139 and $28,759.

On the chart:

Thin green line - entry price for buying the trading instrument.

Thick green line - anticipated price to set take profit or lock profits since further growth above this level is unlikely.

Thin red line - entry price for selling the trading instrument.

Thick red line - anticipated price to set take profit or lock profits since further decline below this level is unlikely.

MACD indicator. When entering the market, pay attention to overbought and oversold zones.

Important! Beginner traders in the cryptocurrency market should be extremely cautious when making entry decisions. Before important fundamental reports, it's best to stay out of the market to avoid sharp price fluctuations. If you decide to trade during news releases, always set stop orders to minimize losses. Without stop orders, you can quickly lose your entire deposit, especially if you don't use money management and trade with large volumes.

Remember that successful trading requires a clear trading plan, like the one presented above. Making spontaneous trading decisions based on current market situations is an initially losing strategy for an intraday trader.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română