The GBP/USD currency pair corrected upwards on Friday but still couldn't settle above the moving average line. As a result, the downward trend for the pound remains intact, and next week, we can expect the continuation of the fall in quotes. It's worth noting that the pound has been rising for a long time (almost a year) and is often much stronger than the euro. Therefore, the correction in the British currency should be more pronounced and noticeable. Thus, regardless of any fundamental and macroeconomic background, we continue to expect a decline in quotes.

On Friday, the US labor market statistics provided the same support to the pair. The Nonfarm Payrolls report was weaker than forecast, and its previous value was revised downwards. After such figures, the market was no longer interested in unemployment or salary reports, so there's no point in considering them. The market again interpreted the conflicting statistics against the dollar, which we've become accustomed to. Nevertheless, there is no reason to expect the onset of a global downward trend. Although the Bank of England has not signaled any pause soon, the market has had ample time to process all possible interest rate hikes.

It's also worth noting that the foreign exchange market is the largest, with many major players capable of directly influencing movement. Suppose one of the major players entered the market on Friday, buying euros for their purposes (for business, for example). Then the demand for the euro increased, the euro rose, and the American statistics had nothing to do with it. Hence, such illogical movements have always been present and will continue to be in Forex.

The US inflation rise may lead to a new surge in the dollar.

Next week in the UK, the most significant events are scheduled for Friday. On this day, GDP reports will be released on a monthly, quarterly, and annual basis, as well as an industrial production report. These reports don't always create a stir and even less frequently trigger a strong market response. Thus, it's essential to recognize them, but the UK's GDP has been hovering around the zero mark for four consecutive quarters. It's doubtful that anything will change in the second quarter of 2023. If nothing changes, the reaction is likely to be negligible.

Industrial production has been falling more often than it's been rising over the past two years, which is likely to continue. Regardless of the outcome of both reports, we don't believe they will bolster the British pound. Macroeconomic data has not supported the pound for quite some time, yet it continues to grow steadily.

In the States, there will be, at a minimum, an inflation report which could support the dollar. It would be alright if the Consumer Price Index increases, as even inflation undergoes corrections. However, the likelihood of at least one more monetary policy tightening by the Federal Reserve in 2023 will increase. The moment to begin easing the monetary policy might be pushed back, and all this can support the US currency, which should continue to strengthen even without such data.

Also, during the week, standard reports on unemployment benefit claims will be released, and several Federal Reserve's Monetary Committee representatives will speak. The only genuinely significant event will be American inflation, which has a real chance of triggering a new drop in the currency pair.

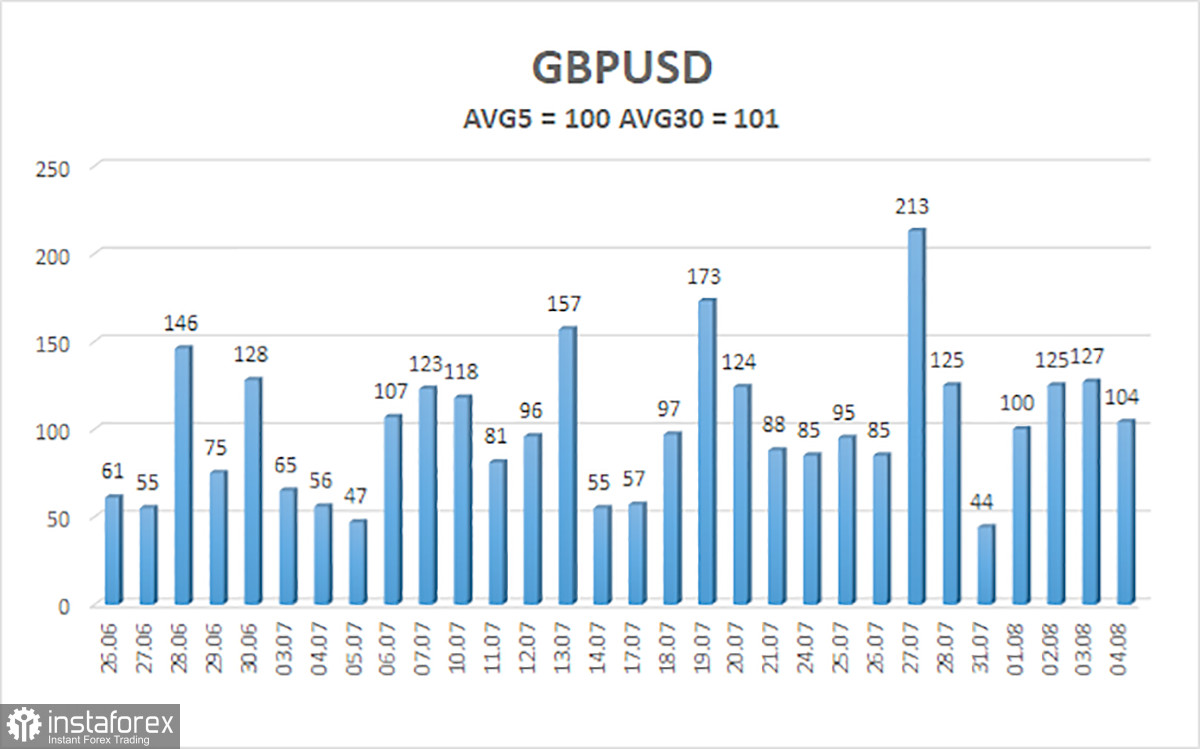

The average volatility of the GBP/USD pair over the last five trading days is 100 points. For the pound/dollar pair, this value is "average." Therefore, on Monday, August 7th, we expect movement within the range delimited by levels 1.2623 and 1.2833. A reversal of the Heiken Ashi indicator back downwards would signal a resumption of the downward movement.

Nearest support levels:

S1 – 1.2695

S2 – 1.2634

S3 – 1.2573

Nearest resistance levels:

R1 – 1.2756

R2 – 1.2817

R3 – 1.2878

Trading recommendations:

In the 4-hour timeframe, the GBP/USD pair remains below the moving average. Short positions targeting 1.2695 and 1.2645 remain relevant, which should be opened in the case of a Heiken Ashi indicator reversal downwards or a price rebound from the moving average. Long positions can be considered if the price consolidates above the moving average with targets at 1.2845 and 1.2878.

Explanations for the illustrations:

Linear regression channels - help identify the current trend. If both are directed in the same direction, the trend is strong.

Moving average line (settings 20.0, smoothed) - determines the short-term trend and the direction in which trading should be conducted.

Murray levels - target levels for movements and corrections.

Volatility levels (red lines) - the probable price channel in which the pair will spend the next day, based on current volatility indicators.

CCI Indicator - its entry into the oversold area (below -250) or the overbought area (above +250) indicates that a trend reversal in the opposite direction is approaching.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română