Long-term perspective.

The GBP/USD currency pair lost approximately 100 points this week. The total decline of the British pound over the last few weeks was about 400 points. Although it seems substantial, it's hard to call this a 'correction' on the 24-hour TF. We observed only weak and insignificant pullbacks within the upward trend for 11 months. Thus, even a consolidation below the critical line does not guarantee that a downward trend will begin this time.

We have repeatedly said that the pound is growing illogically, if not groundlessly. Considering the entire macroeconomic and fundamental background, there are still many questions. The US economy still looks much more stable and confident than the British one, and inflation in the US has almost decreased to the target level. The Fed rate continues to rise, just like the Bank of England rate, and remains higher. Therefore, explaining the strong trend of nearly 3,000 points is difficult. The last few months, when it has been obvious to everyone that the cycle of rate hikes in the UK is about to end, have raised many questions.

Since the market often reacts to significant fundamental events in advance (as with the Fed rate hike), the British currency practically has no factors for growth. This week, the Bank of England meeting didn't give traders any new information. The rate will continue to rise (which was clear even before the meeting), inflation remains high, wages are growing too quickly, and the economy isn't growing at all. That's all we could understand from the latest speech by Andrew Bailey.

Thus, we continue to advocate for a drop in the British pound. Still, we remind you that the market may hold a different opinion, so technical analysis should be remembered.

COT Analysis.

According to the latest report on the British pound, the "Non-commercial" group closed 13.3 thousand buy contracts and 3.8 thousand sell contracts. As a result, the net position of non-commercial traders decreased by almost 10 thousand contracts over the week, but overall, it continues to grow. The net position indicator has been steadily growing for the last ten months, along with the British pound. We are approaching the point where the net position has grown too much to expect further growth for the pair. A protracted decline of the pound should begin. COT reports suggest a slight strengthening of the British currency, but it is becoming more difficult to believe in it daily. On what basis the market can continue to buy is very difficult to say. However, there are few technical sell signals yet.

The British currency has grown a total of 2800 points from its absolute lows reached last year, which is a lot, and without a strong downward correction, further growth would be illogical. However, there has been no logic in the pair's movements for a long time. The fundamental background perceives the market one-sidedly: many data points favoring the dollar are ignored. The "Non-commercial" group currently has 92.1 thousand buy contracts open and 42.6 thousand sell contracts. We still are skeptical about the long-term growth of the British currency, but the market continues to buy, and the pair continues to grow.

Analysis of fundamental events.

There were few important macroeconomic events in the UK this week, and the only fundamental event - the Bank of England meeting - did not surprise with its results. As a result - a rather sparse market reaction. Among other reports (especially from the US), one could highlight the ISM indices of business activity in the services and manufacturing sectors, the ADP report, and the unemployment level, but only the ADP report was reacted to. All other reports either had no resonant significance or were ignored. Non-farms on Friday were only 13 thousand below forecast, but at the same time, the previous month's value was revised downward. However, at the same time, the unemployment rate decreased in the US. Thus, the dollar fell somewhat illogically on Friday, but the market had the right to sell it.

Trading plan for the week of August 7-11:

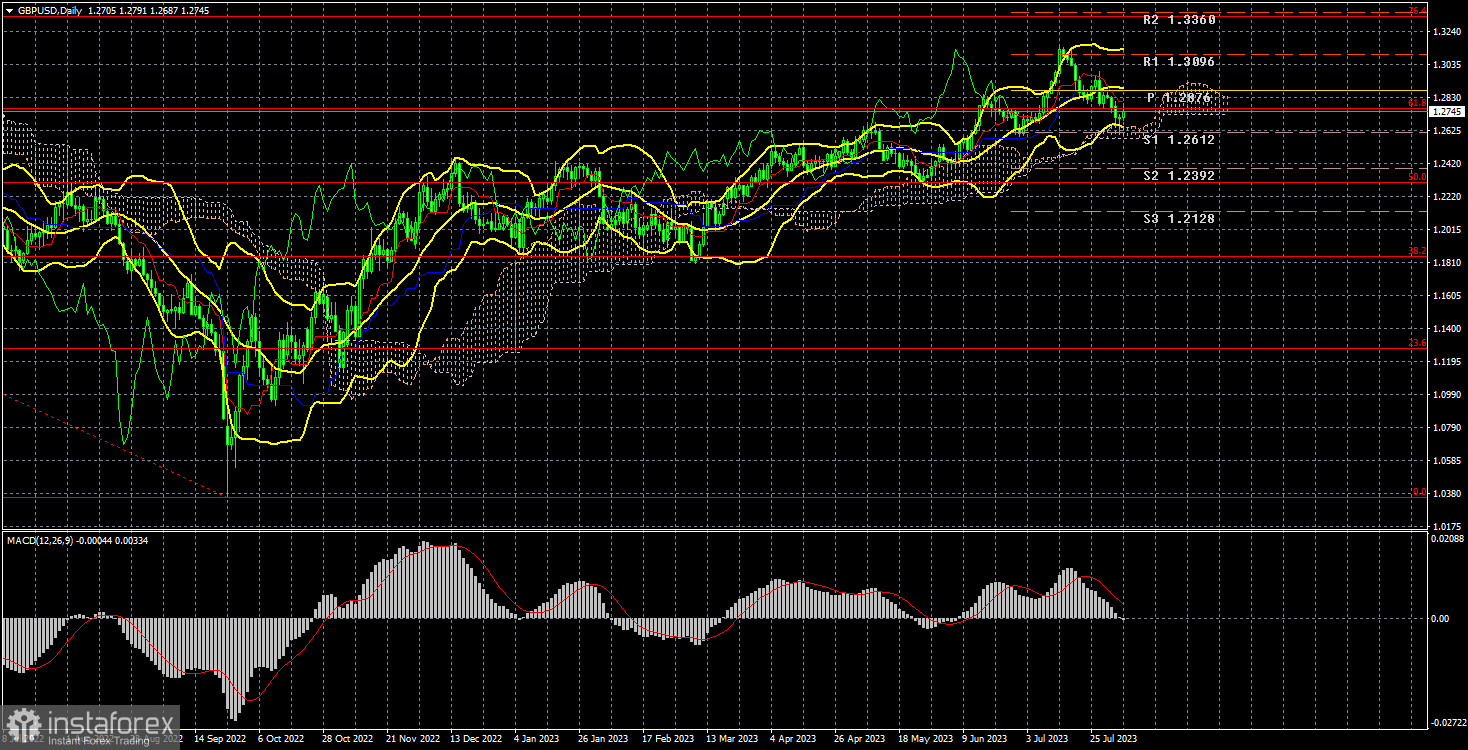

- The pound/dollar pair is trying to form a new correction. Each new attempt to correct looks simply pitiful. The price is above all lines of the Ichimoku indicator (except for the critical one). A price consolidation above the Kijun-sen line will indicate a possible resumption of the upward trend. The growth may be messy, weak, inertial, or illogical. The target is the Fibonacci level of 76.4%, which is 1.3330.

- As for sales, there currently need to be technical reasons for them. Consolidation below the Kijun-sen line has occurred, but the Senkou Span B line is nearby. Selling on such a strong upward trend is dangerous and foolish, but buying without understanding why the pound is growing and when its "fairy tale" will end is also a dubious pleasure. The situation needs to be more standard and frankly stalemate. It is best to trade the pair intraday or on minor TFs.

Explanations of the illustrations:

Support and resistance price levels, Fibonacci levels - these are levels that serve as targets when opening purchases or sales. Take Profit levels can be placed around them.

Ichimoku indicators (standard settings), Bollinger Bands (standard settings), MACD (5, 34, 5).

Indicator 1 on COT charts - the size of the net position of each category of traders.

Indicator 2 on COT charts - the size of the net position for the "Non-commercial" group.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română