Long-term perspective.

The EUR/USD currency pair dropped 10 points during the current week. The pair had been falling almost the entire week, but the fall was too weak and uncertain. And the Friday increase, which, in our view, was quite "forced," completely neutralized all the bears' efforts during the week. Therefore, at this moment, the pair continues to move downward, which is already very good, but it is still too early to say that we are at the beginning of a new downward trend.

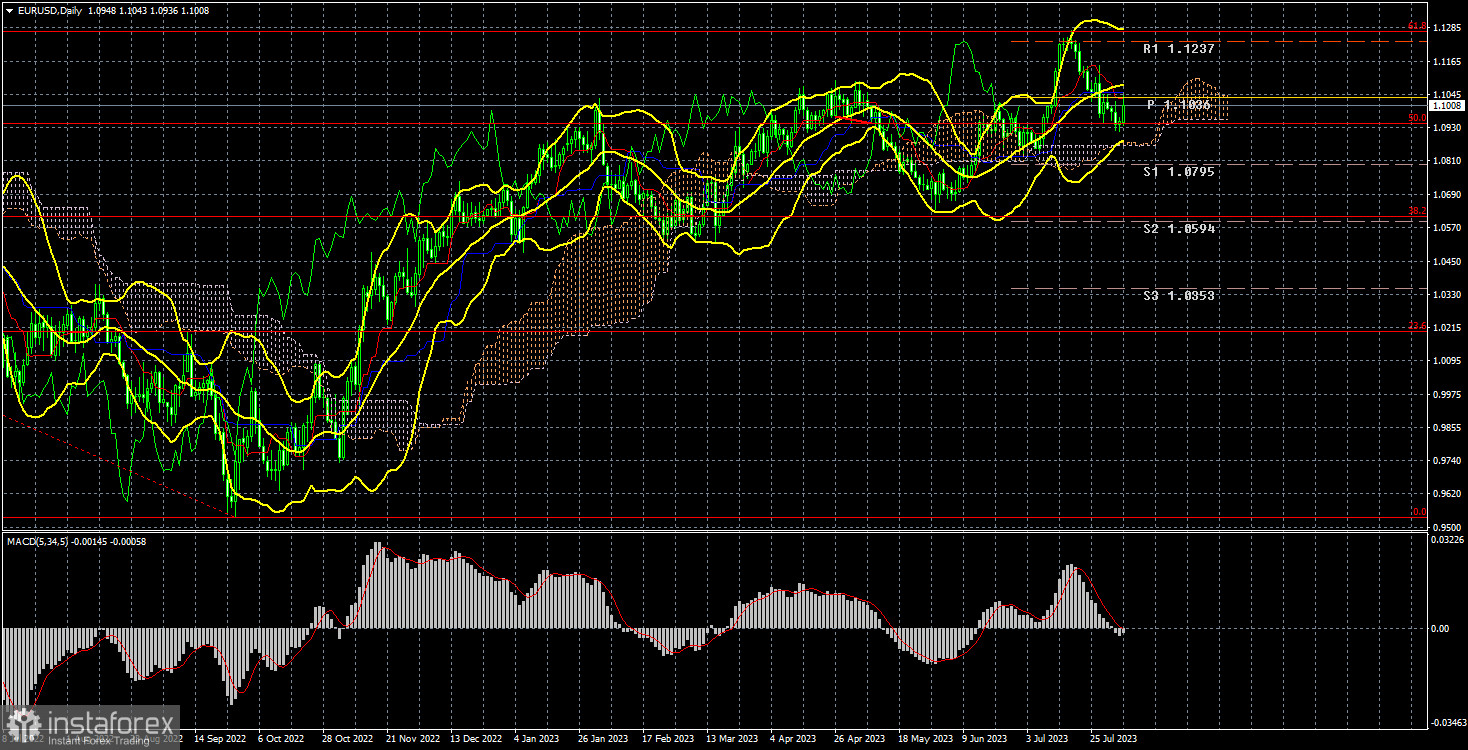

The euro quotes are currently below the critical line but above the Senkou Span B line. Therefore, we expect the euro to continue to fall next week, at least to the lower border of the Ichimoku cloud. Everything will depend on whether the price can overcome this line, which almost merges at this point with the upper line of the cloud. If so, then we can count on the start of a new downward trend.

And what about the fundamental background? There are two scenarios. First - the market has finally realized that the ECB is not a "good wizard" and cannot raise the rate forever. At the next meeting, the regulator may pause, which will be a harbinger of the end of the tightening cycle. If the euro has grown in recent months due to the rate factor, then now it loses this support, and a downward trend should begin.

Second - the market continues to ignore the fundamental background. For example, now, if it wishes, it can refer to the US labor market decline (quite weak) and say that the US economy is not having the best of times to buy the dollar, even though the EU economy has been stagnant for a long time. In the first case, the euro must fall without options.

COT analysis.

On Friday, a new COT report for August 1 was released. For the past ten months, COT report data has fully corresponded to what is happening in the market. In the illustration above, it is seen that the net position of large players (the second indicator) began to grow in September 2022, and at about the same time, the European currency began to grow as well. The net position has not increased significantly in the last 5–6 months, but the euro remains very high. Currently, the net position of non-commercial traders remains "bullish" and strong, and the European currency continues to appreciate against the dollar (in the long term).

We have already drawn traders' attention to the fact that the rather high value of the "net position" allows for the completion of an upward trend. This is indicated by the first indicator, on which the red and green lines have moved far apart, often preceding the end of a trend. During the last reporting week, the number of buy contracts in the "Non-commercial" group decreased by 10.5 thousand, and the number of shorts – by 5.4 thousand. Accordingly, the net position decreased by another 5.1 thousand contracts. The number of buy contracts is 172 thousand higher than the number of sell contracts among non-commercial traders, which is a very large gap, with a difference of more than triple. In principle, even without COT reports, it is clear that the European currency should be declining, but the market is still not in a hurry to sell.

Analysis of fundamental events

This week, the key event was the Bank of England meeting, which was only loosely related to the euro and dollar. Second - the Non-Farm Payrolls report, and unemployment in the US caused the dollar to plummet on Friday. In addition to these events, there were many other important reports that either caused a weak market reaction or none. Among them, we can only note the ADP report, which exceeded the forecast by about twice, strengthening the American currency. However, as we warned, the Friday NonFarm report was the opposite, which already caused a fall in the US dollar. At the same time, it was not so disastrous that the dollar would fall so heavily, and the unemployment report was even better than the forecasts. Therefore, a technical rebound upward was logical, and the macroeconomic background did not imply a strong fall in the US currency.

Trading plan for the week of August 7–11:

- In the 24-hour timeframe, the pair worked off the Fibonacci level of 61.8% at 1.1270 and began a downward correction. The price has overcome the critical line, so opening long positions without new buying signals is not recommended. At the same time, the pair worked off the Fibonacci level of 50.0%, from which it also rebounded quite vigorously. Thus, the upward movement could theoretically resume next week. We advocate for a continued decline in the euro, but the market has repeatedly shown that it doesn't particularly want this.

- As for selling the euro/dollar pair, on the 24-hour TF, these can be supported or opened, but the first already significant Fibonacci level of 50.0% stopped the decline. Of course, the decline will not be swift, and the level may be overcome next week. We already see that the euro is ready to lose an average of 100 points per week, which is very little. However, the decline can continue, at least to the Senkou Span B line.

Explanations for the illustrations:

Support and resistance price levels, or Fibonacci levels - are levels that serve as targets when opening purchases or sales. Take-profit levels can be placed around them.

Ichimoku (standard settings), Bollinger Bands (standard settings), and MACD (5, 34, 5) indicators.

Indicator 1 on COT charts - the size of the net position of each category of traders.

Indicator 2 on COT charts - the size of the net position for the "Non-commercial" group.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română