For the second time in a row, non-farm employment in the United States falls short of Bloomberg experts' forecasts. And for the second time in a row, the markets succumb to emotions. Neither the June nor the July reports can be unequivocally considered weak. They do not indicate a cooling of the labor market, which is necessary for the Federal Reserve to tackle inflation. However, investors prefer to play the idea of the end of the monetary restriction cycle and buy EUR/USD. Last month, this strategy worked well as the surprise of the American inflation favored the "bulls." But what about this time?

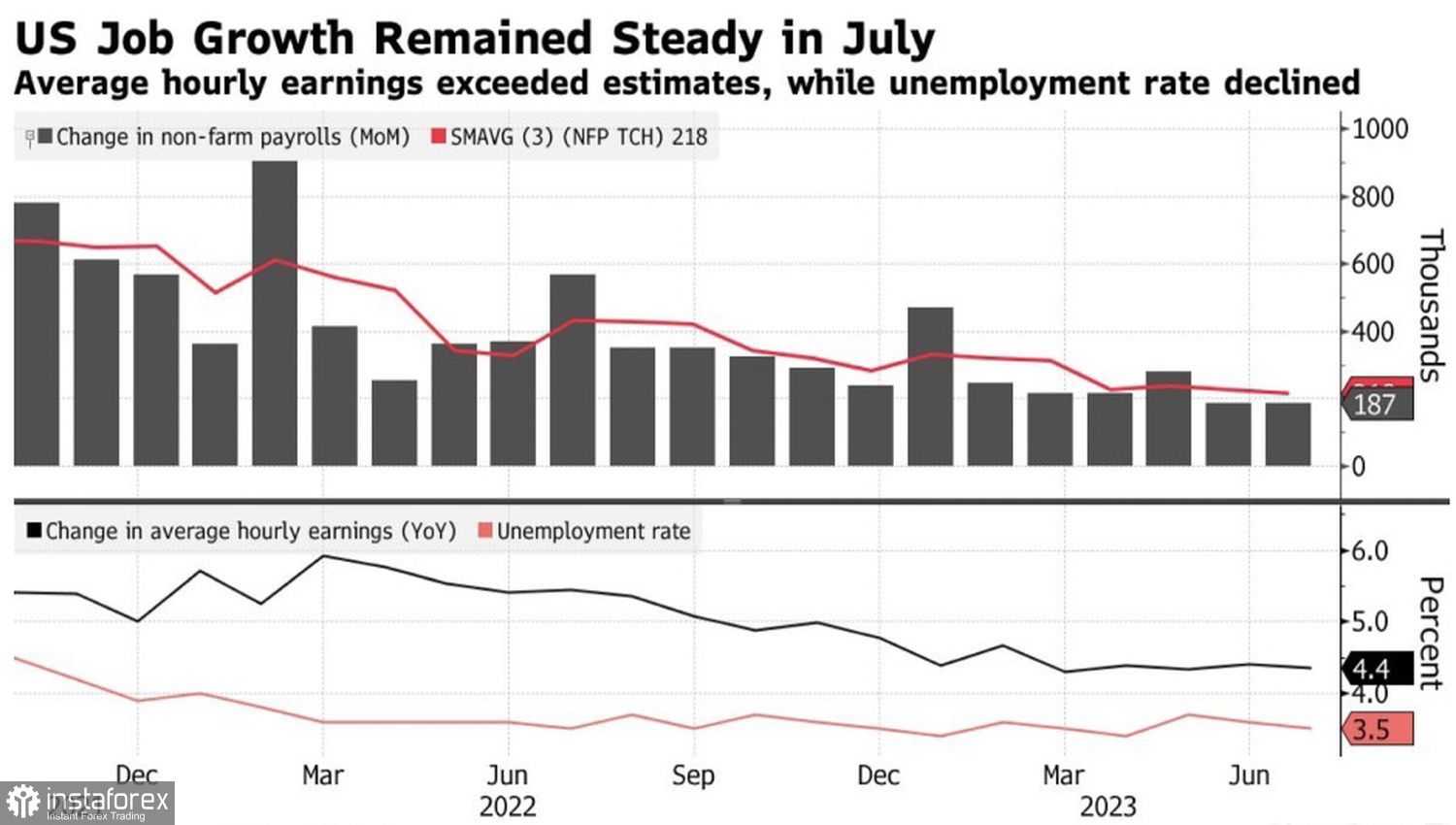

In July, the unemployment rate dropped to a fifty-year low of 3.5%, raising doubts about the FOMC's predictions of the indicator surging above 4% by the end of 2023. Wage growth rates increased by 0.4% MoM and remained at 4.4% YoY, surpassing Bloomberg experts' expectations. Such news should have overshadowed the slowest employment growth since 2020, at 187,000, and its downward revision to 185,000 in June. But they didn't. EUR/USD soared, and it felt like someone is manipulating the market. It lures buyers into a trap, and this could end very badly for them.

Dynamics of American employment, unemployment, and wages

It should be noted that the euro managed to find its bottom during the European Forex session, even before the employment report in the U.S. was released. The "bulls" on EUR/USD were helped by an unexpectedly fast growth in German manufacturing orders, reaching a three-year high. Positive dynamics of this indicator suggest that Germany's economic downturn may soon end. This is joyfully perceived by the fans of the main currency pair.

However, no matter what the data is, decisions are made by people. The statement of ECB Chief Economist Philip Lane that due to a sharp decline in energy prices, inflation should decrease rapidly by the end of 2023 should be taken as "dovish" rhetoric. It hints at the impracticality of further raising the deposit rate. European Central Bank Executive Board member Fabio Panetta shares the same view. According to him, there is no need to further raise borrowing costs since the deferred effects of the ECB's monetary policy tightening are only starting to take effect now.

Dynamics of German manufacturing orders

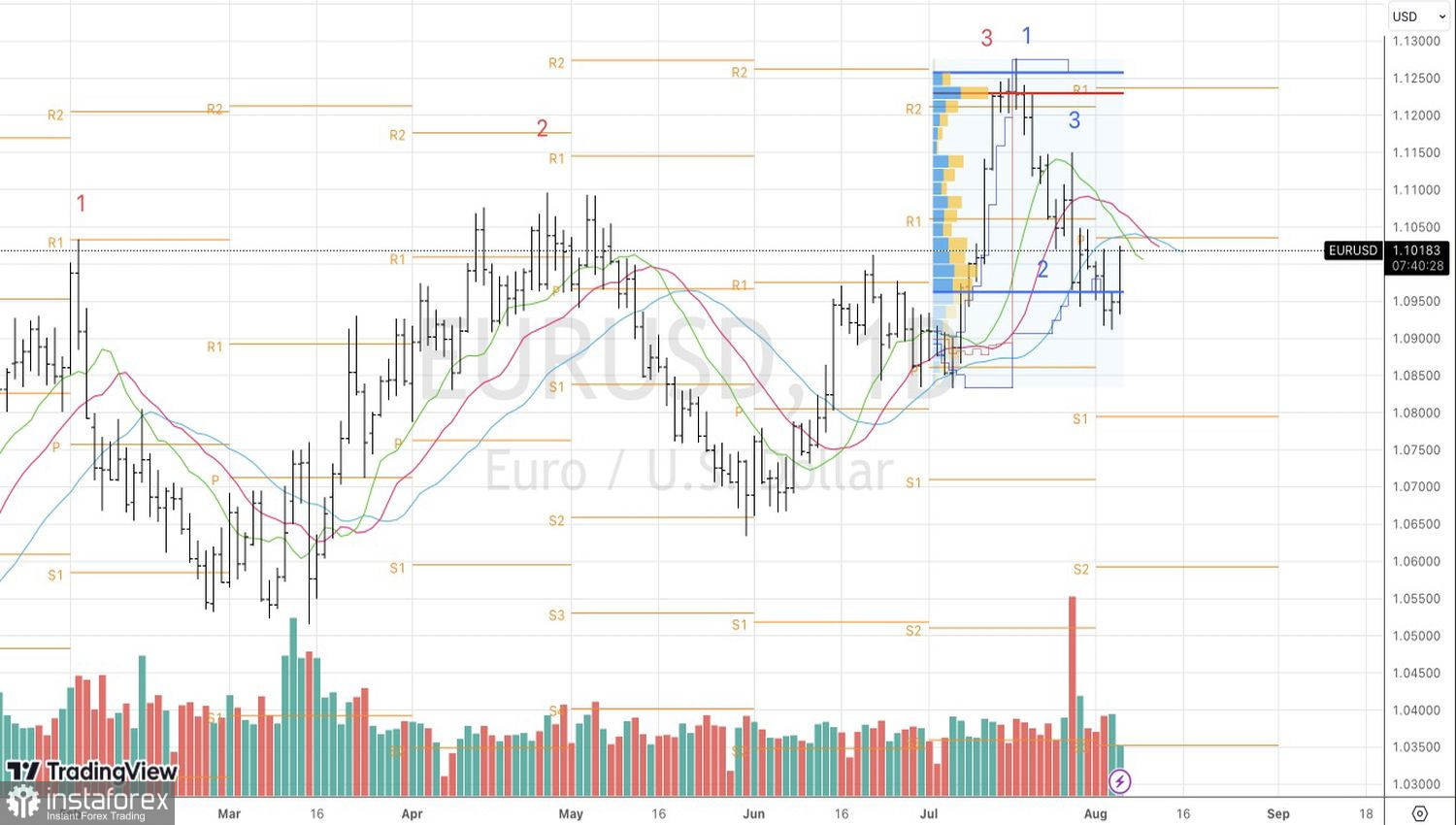

In my opinion, the June report on American employment does not provide grounds to assume that the Federal Reserve will start cutting the federal funds rate before March 2024. The reaction of EUR/USD seems too emotional, and investors will revise their views in the near future. This creates premises for selling the currency pair on the rise.

Technically, on the EUR/USD daily chart, there is an attempt by the "bulls" to counterattack. Nevertheless, the quotes are still below moving averages, and the situation is being controlled by the "bears." The inability of the pair to overcome the convergence zone of 1.1015–1.1025 or a rebound from pivot levels at 1.1035 and 1.106 are reasons for selling.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română