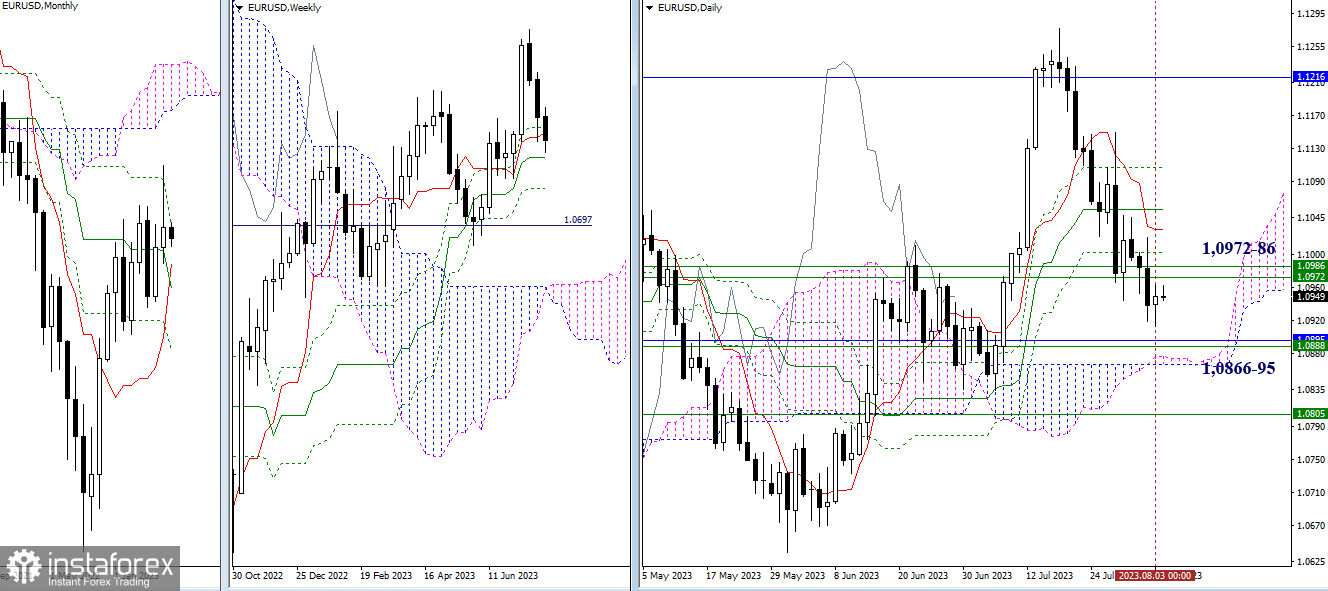

EUR/USD

Higher timeframes

Bearish players are gradually working out the downward trend. Currently, the pair is situated between clusters of levels. Thus, bullish players face the weekly resistances (1.0972 - 1.0986) and the daily Ichimoku cross (1.1003 - 1.1031 - 1.1055 - 1.1107). On the path of developing bearish sentiments lie 1.0866 - 1.0888 - 1.0895 and the support at 1.0805 (the final level of the weekly Ichimoku cross).

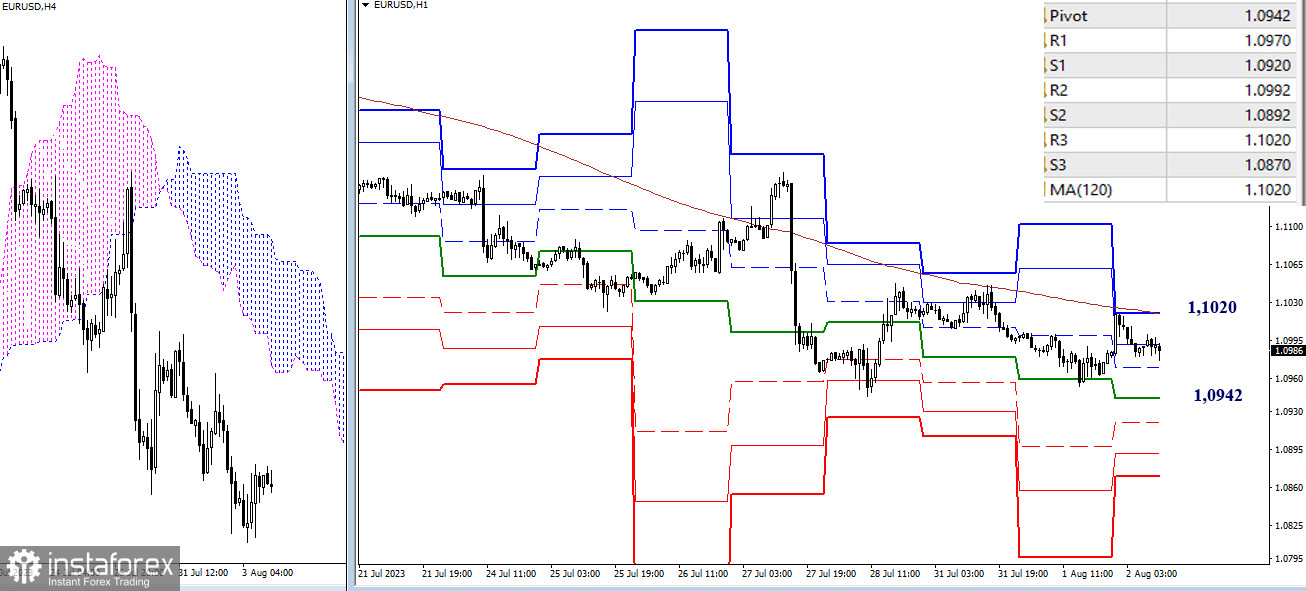

H4 - H1

On the lower timeframes, thanks to a corrective rise, the pair approached the zone of attraction and influence of the weekly long-term trend (1.1020). A break of this level, a reliable consolidation above, and a reversal of the moving average will allow changing the current balance of power in favor of strengthening the bullish presence in the market. The next targets for upward movement today will be the resistances of higher timeframes. If bulls fail, bearish activity may resume within the day, and the classic pivot points (1.0970 - 1.0942 - 1.0920 - 1.0892 - 1.0870) may come into play.

***

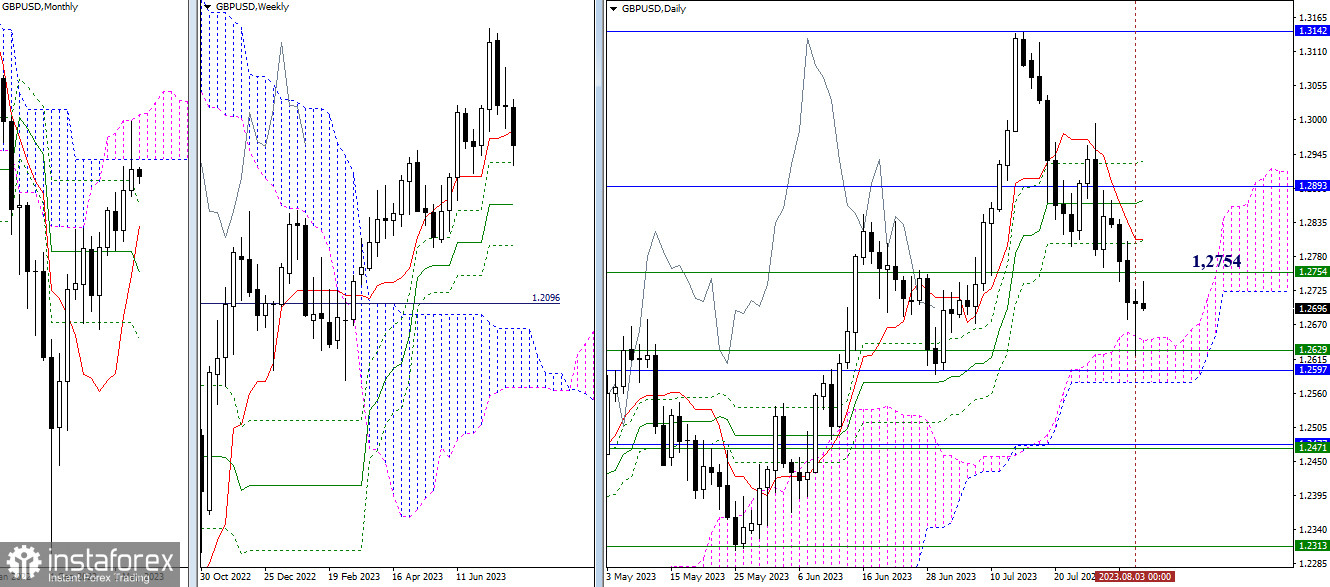

GBP/USD

Higher timeframes

The pound continued its decline, and yesterday it tested a sufficiently wide support zone formed by the daily cloud (1.2651 - 1.2577) and levels from higher timeframes (1.2597 - 1.2629). A break below is unlikely to be easy, but if it materializes, it will open the way to the level of 1.2471, where the weekly medium-term trend and the monthly short-term trend are currently converging. The nearest resistance in the current situation is the weekly short-term trend (1.2754) and the levels of the daily cross (1.2807 - 1.2870 - 1.2934), strengthened by the monthly resistance (1.2893).

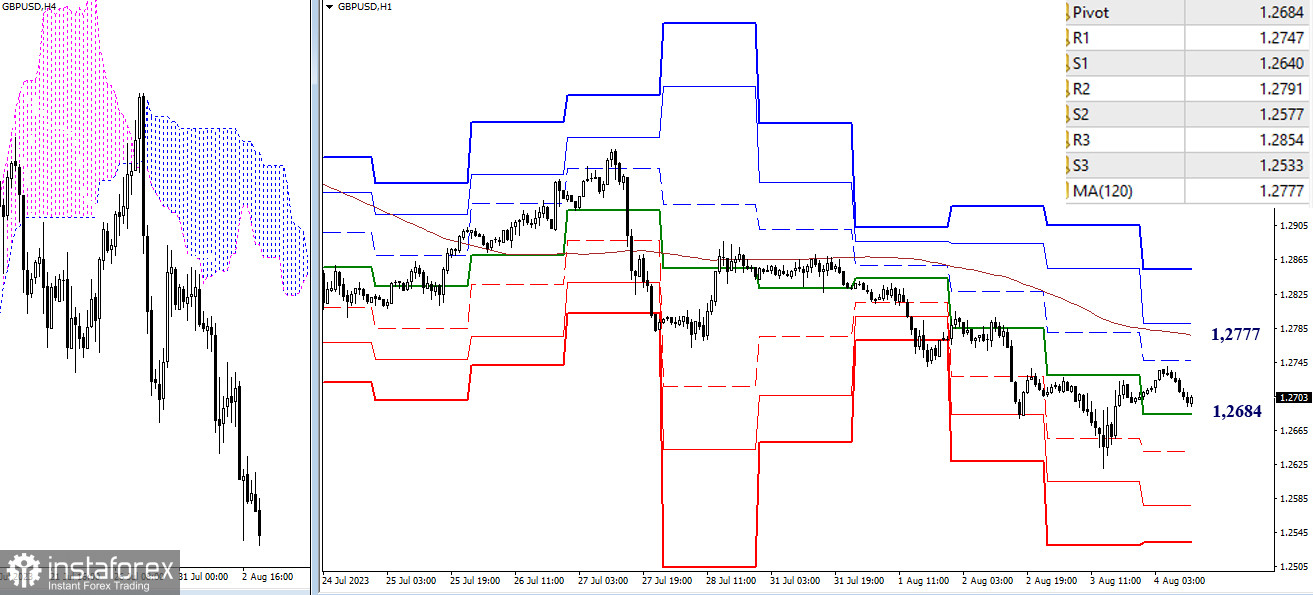

H4 - H1

On the lower timeframes, the downward trend is developing. Nevertheless, as of writing, the pair is in a correction zone and is trading above the central pivot point of the day (1.2684). Classic pivot points (1.2640 - 1.2577 - 1.2533) may serve as intraday supports today. In case of a rebound from the central pivot point (1.2684), the pair may rise to the resistance of classic pivot points at 1.2747 and up to the key level of 1.2803 (the weekly long-term trend). The result of this testing will determine the further balance of power and prospects.

***

The technical analysis of the situation uses:

Higher timeframes - Ichimoku Kinko Hyo (9.26.52) + Fibo Kijun levels

Lower timeframes - H1 - Pivot Points (classic) + Moving Average 120 (weekly long-term trend)

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română