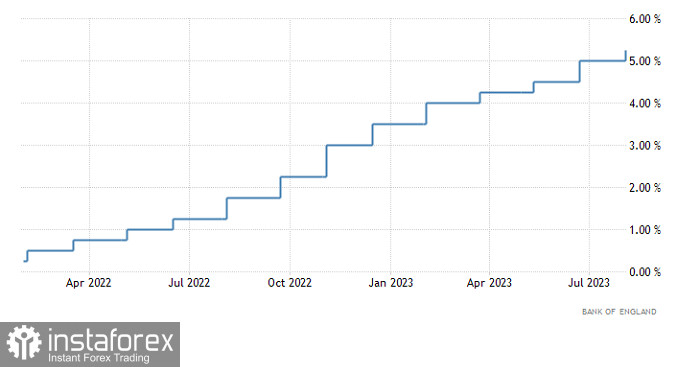

As expected, the Bank of England delivered another interest rate hike, by twenty-five basis points to 5.25%. Moreover, eight out of nine members of the Monetary Policy Committee voted in favor of this, compared to only two and a half months ago. Furthermore, the central bank made it clear that this would not be the last rate hike. They forecasted that inflation would return to the 2% level only in 2025. This indicates that the BoE is preparing the markets for the possibility of further rate hikes, even into the next year.

BoE rate

However, the pound's growth was quite modest. The deterrent is today's labor report, which is the main agenda. If the unemployment rate is expected to remain unchanged, 190,000 new non-farm jobs are expected to be created. This level of job creation is not enough to maintain labor market stability and sets the stage for a deterioration in employment. If these forecasts are confirmed, the pound may gain a bit more strength. However, the problem is that recent employment data has been significantly better than expected, indicating a further strengthening of the labor market. Therefore, there is a high probability that the report may turn out to be somewhat different than anticipated, and possibly in favor of the dollar. This assumption has held back the pound from rising. Thus, if the latest figures prove to be better than expected, the dollar will not only easily recover all its losses from yesterday but will also noticeably strengthen its position.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română