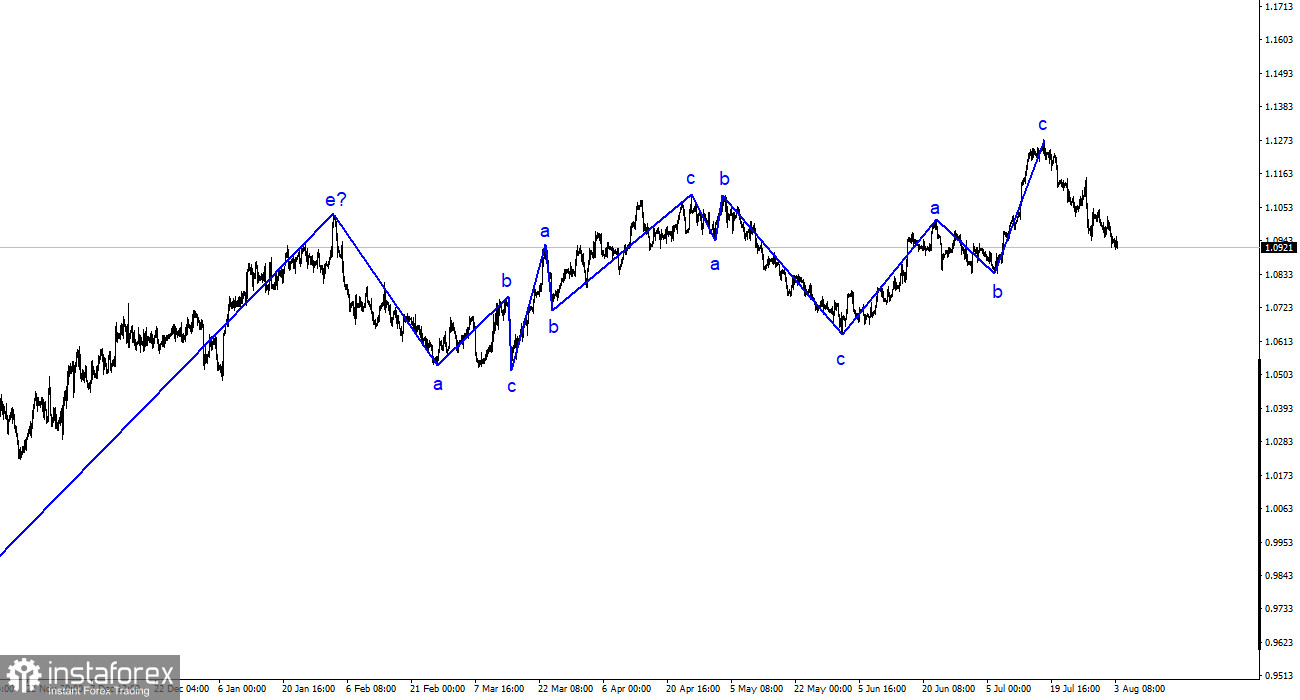

The wave analysis of the 4-hour chart for the euro/dollar pair remains clear. The ascending trend segment, which began forming last year, has taken on a complex structure, and in the past six months, we have only observed alternating three-wave structures. I have recently mentioned multiple times that I expect the pair to be around the 5th figure, where the construction of the last upward three-wave structure started. I stand by this view. Another ascending three-wave structure has been completed, and the market is now starting to build a descending trend segment.

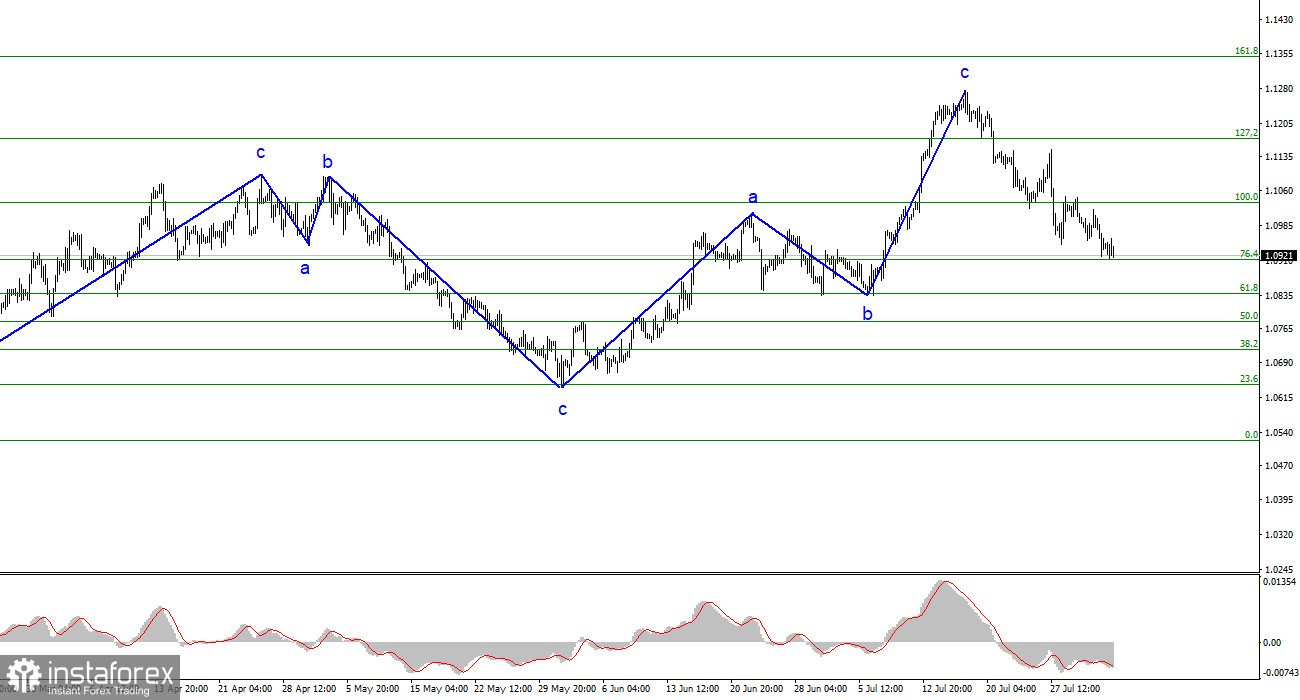

The segment of the trend, starting on May 31, could take a five-wave form with the structure of a-b-c-d-e, but confidently speaking about it now takes a lot of work. The news background needs to be stronger for the euro currency, sometimes even weak, to maintain stable demand, and the economic statistics from the European Union continue to be mediocre. A successful attempt to break through the level of 1.1172, corresponding to 127.2% on Fibonacci, indicated the market's readiness to sell.

Business activity indices did not significantly affect market sentiment.

The exchange rate of the euro/dollar pair remained unchanged on Thursday, with movements limited to a weak range of not more than 25 basis points. Throughout the day, the market could have shown interest in various reports and events, but none influenced market sentiment enough to result in more active pair trading. The demand for the euro currency continues to decrease, but this decline is happening slowly. However, this pace of decline in the pair is acceptable. The wave analysis is accurate, and there are strong indications for the quote's decline to continue.

Let's take a closer look at the indices. In the EU's service sector, the index decreased from 52 to 50.9, while the market expected a value of 51.1. In Germany, the index decreased from 54.1 to 52.3. In the USA, it decreased from 54.4 to 52.3. The ISM index decreased from 53.9 to 52.7. Thus, all four business activity indices for the service sectors declined in July. Considering the impact of monetary policy on almost all economic processes, the decline in business activity raises no questions. It is unsurprising to see such indicators when lending and investing conditions are becoming increasingly stringent in Europe and the USA.

The demand for the dollar or euro did not increase today because all four business activity indices showed the same dynamics. We are witnessing the construction of another three-wave structure, but this time it is descending, and its first wave may be completed soon. Even the Bank of England meeting today did not significantly affect the movement. This means that tomorrow's day can become crucial with its payrolls and unemployment data in the USA.

In conclusion, based on the conducted analysis, the construction of the ascending wave set is complete. I still find targets in the range of 1.0500-1.0600 quite realistic, and with these targets in mind, I recommend selling the pair. The a-b-c structure appears complete and convincing, and the closure below the 1.1172 mark indirectly confirms the construction of a descending trend segment. Therefore, I recommend selling the pair with targets around the 1.0836 mark and lower. The construction of the descending trend segment will continue.

On a larger wave scale, the wave labeling of the ascending trend segment has taken an extended form but is likely complete. We have observed five upward waves, most likely forming the structure of a-b-c-d-e. Following that, the pair built four three-wave structures: two downward and two upward. It has likely entered the stage of constructing another descending three-wave structure.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română