GDP, labor market, and inflation level data are critical for the Federal Reserve in planning credit and monetary policy parameters. If the official employment data, which will be released on Friday (at 12:30 GMT), also turn out to be strong, the Fed leaders will have an additional argument in favor of a new interest rate hike or, at the very least, maintaining it at high levels. And this is a negative factor for gold, whose quotes are highly sensitive to changes in the parameters of the credit and monetary policies of the world's major central banks, primarily the Fed.

Meanwhile, some economists still expect a pause in the Fed's monetary tightening cycle. They believe that by the end of the year or at the beginning of the next one, the Fed may even switch to a policy easing.

In this situation, with lingering geopolitical uncertainty, a relatively high level of inflation, possible economic growth issues, and in anticipation of a potential shift in the direction of the Fed's monetary policy, demand for gold will remain at high levels.

In other words, arguments in favor of gold price declines are offset by equally strong arguments in favor of their growth.

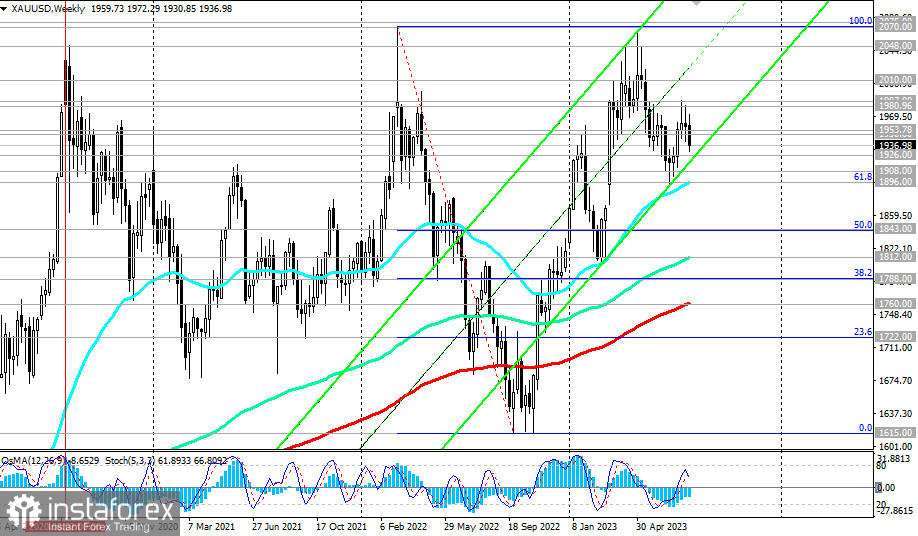

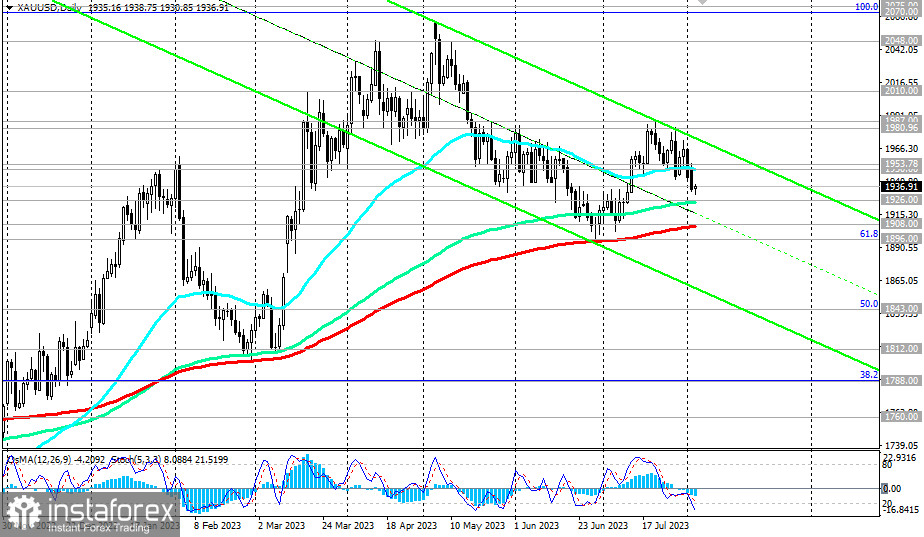

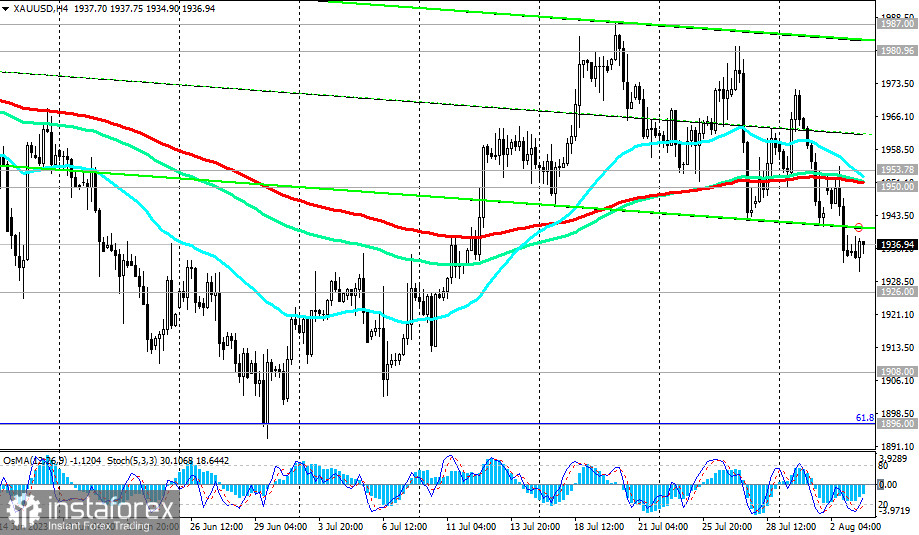

From a technical point of view, XAU/USD is trading in the short-term bearish market zone (below resistance levels at 1954.00, 1950.00) while remaining within the medium-term (above key support levels at 1926.00, 1908.00) and long-term (above support levels at 1812.00, 1800.00, 1760.00) bullish market zones.

Therefore, it is logical to assume a rebound in the zone of support levels at 1926.00 (144 EMA on the daily chart), 1908.00 (200 EMA on the daily chart), and a resumption of growth. A confirming signal would be a break above resistance levels at 1950.00 (50 EMA on the daily chart, 200 EMA on the 4-hour chart) and 1954.00 (200 EMA on the 1-hour chart).

With further growth, XAU/USD may attempt to break the psychological level of $2000.00 per ounce, which, in turn, could trigger another wave of frantic demand for gold and a rise in its quotes towards recent record highs near the $2070.00 per ounce mark.

In an alternative scenario, the price may break key support levels at 1908.00, 1896.00 (61.8% Fibonacci level in the downward correction wave from its peak at $2070.00 to its low at $1615.00 and 50 EMA on the weekly chart) and head deeper into the downward channel on the daily chart towards its lower boundary and the $1843.00 mark (50.0% Fibonacci level).

A break of this level would open the way to a deeper decline towards key long-term support levels at 1812.00 (144 EMA on the weekly chart), 1788.00 (38.2% Fibonacci level), and 1760.00 (200 EMA on the weekly chart), which separate the long-term bullish trend of gold from the bearish one.

However, our main scenario is still associated with an increase in gold quotes and the XAU/USD pair, and around the support level of 1926.00 (144 EMA on the daily chart), one should expect a rebound and a resumption of growth.

Nevertheless, much will also depend on today's and tomorrow's statistical data from the USA.

Support levels: 1926.00, 1908.00, 1900.00, 1896.00, 1843.00, 1812.00, 1800.00, 1788.00, 1760.00

Resistance levels: 1950.00, 1954.00, 1980.00, 1987.00, 2000.00, 2010.00, 2048.00, 2070.00

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română