Tips for trading ETH

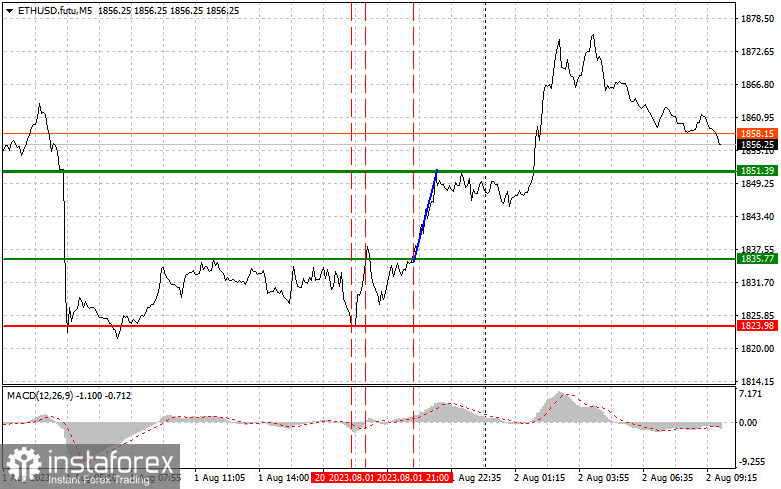

Yesterday was not the best day for trading ETC. A test of 1,823 occurred at a time when the MACD indicator was in the negative zone, which was a confirmation of the correct entry point into short positions. However, it did not decline. The first test of 1,835 took place when the MACD indicator was in the positive zone, but it also did not immediately resume growth, which led to another Stop Loss order. Only in the afternoon, after the second breakout of 1,835 as well as the confirmation of a buy signal on the MACD indicator, traders went long. ETH rose to 1,851. Speculators managed to win back the losses, but it was not possible to make a big profit. Today, during the Asian session, Ether continued to grow, adding more than 2.0%. Judging by technical indicators, a bull market became stronger. Bulls managed to protect 1,815, the lower border of the sideways channel. ETH is likely to hit 1,902, which will trigger a new uptrend. It could also appreciate above 2,000. For this reason, I am going to trade today according to scenario No. 1.

Today, during the Asian session, Ether continued to grow, adding more than 2.0%. Judging by technical indicators, a bull market became stronger. Bulls managed to protect 1,815, the lower border of the sideways channel. ETH is likely to hit 1,902, which will trigger a new uptrend. It could also appreciate above 2,000. For this reason, I am going to trade today according to scenario No. 1.

Buy signal

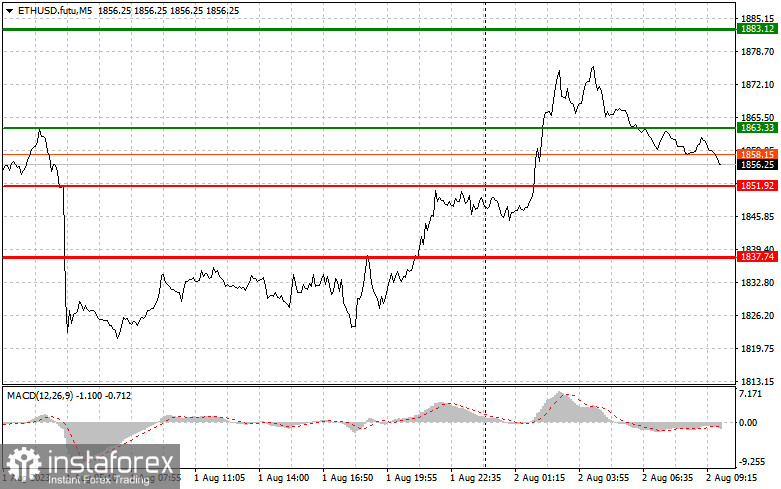

Scenario No.1: you can buy ETH today when the price reaches 1,863 (the green line on the chart) with the prospect of a rise to 1,883 (thicker green line on the chart). At 1,883, I recommend closing long positions and opening short ones in the opposite direction. Ether is likely to advance amid the resumption of an uptrend. Important! Before buying, make sure that the MACD indicator is above the zero mark and it has just started to climb from it.

Scenario No.2: you can also go long today in the case of two consecutive tests of 1,851 at a time when the MACD indicator will be in the oversold area. This will limit the downward potential of the trading instrument and could lead to a market reversal. It may advance to the levels of 1,863 and 1,883.

Sell signal

Scenario No. 1: it is possible to sell Ether today only if the price touches 1,851(the red line on the chart), which may lead to a rapid decline. The key level is located at 1,837 where I recommend exiting sales as well as opening long positions in the opposite direction. The pressure on Ether will increase if it fails to rise above 1,863. Important! Before selling, make sure that the MACD indicator is below the zero mark and it has just started to dip from it.

Scenario No. 2: you can also sell ETH today in the case of two consecutive tests of 1,863 at a time when the MACD indicator will be in the overbought area. This will limit the upward potential of the trading instrument and lead to a market reversal. The instrument is projected to slide to the levels of 1,851 and 1,837. What's on chart:

What's on chart:

The thin green line is the entry point where you can buy a trading instrument;

The thick green line is the estimated price where you can place a Take Profit order or lock in profits manually as ETH is unlikely to rise above this level;

The thin red line is the entry point where you can sell the trading instrument ;

The thick red line is the estimated price where you can place a Take Profit order or lock in profits manually as the price is unlikely to decline below this level;

The MACD indicator. When entering the market, it is important to pay attention to overbought and oversold zones.

Important. Novice traders need to make very careful decisions when entering the market. Before the release of important fundamental reports, it is better to stay out of the market to avoid losses due to sharp fluctuations in the exchange rate. If you decide to trade during the news release, always place Stop Loss orders to minimize losses. Without placing Stop Loss orders, you can lose the entire deposit very quickly, especially if you do not use money management but trade in large volumes. Remember that for successful trading it is necessary to have a clear trading plan, following the example of the one I presented above. Relying on spontaneous trading decisions based on the current market situation is a losing strategy of an intraday trader.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română