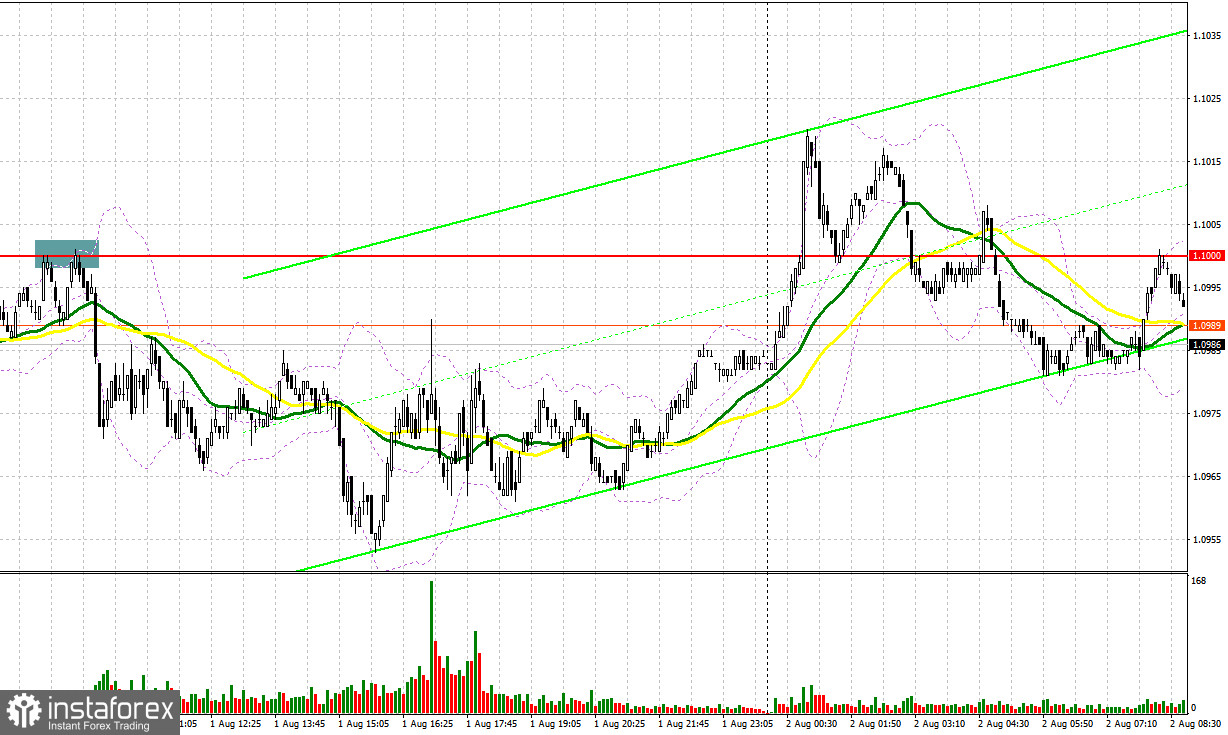

Only one market entry signal was formed yesterday. Let's examine the 5-minute chart and analyze what occurred. In my morning forecast, I highlighted the level of 1.1000 and suggested making trading decisions based on it. As I mentioned in my forecast, the rise and subsequent false breakout around 1.1000 resulted in a selling signal, leading to a decline of more than 35 points. However, we still need to reach the levels I indicated in the second half of the day.

To initiate long positions on EUR/USD, the following conditions need to be met:

The statistics indicating weak activity in the manufacturing sectors of the Eurozone and the USA balanced the market, preventing sellers from reaching the previous week's lows. This creates an opportunity to defend the psychologically significant support level of 1.1000 and anticipates further growth in the pair. Considering the absence of significant fundamental data in the first half of the day, it will likely favor EUR/USD buyers. Nevertheless, I will only consider going against the bearish trend if the price drops to a new support level at 1.0955, which emerged due to yesterday's movement. Only then, after a false breakout, a buying signal expecting an upward movement toward the resistance level of 1.1000 can be obtained. A successful breakthrough and test of this range from top to bottom will strengthen the demand for the euro, providing a chance to return to the peak of 1.1043, although major gains are not expected. The ultimate target remains around 1.1095, where I will take profits. However, euro buyers may face difficulties if EUR/USD declines and shows no activity at 1.0955, possibly in the second half of the day after the ADP report on the labor market. Only a false breakout around the next support level of 1.0911 will signal a buying opportunity. I will consider opening long positions from the rebound at 1.0871 with the target of a 30-35 point upward correction within the day.

To initiate short positions on EUR/USD, the following conditions are required:

Sellers still have a chance to maintain a bearish market, and as long as trading remains below the psychological level of 1.1000, the advantage will be on their side. This level is crucial since, if bulls miss it, they may seek to compensate for the previous week's decline after strong US GDP data. If the pair rises, I plan to initiate short positions only after a false breakout around 1.1000, where the moving averages favoring sellers intersect. This would lead to a decline towards 1.0955, a new support level formed from yesterday's movement. Only after a successful breakthrough and consolidation below this range, along with a reverse test from bottom to top in the absence of Eurozone statistics, can we obtain a selling signal, opening the way toward 1.0911. This will signify the formation of a bearish trend. The ultimate target will be around 1.0871, where I will take profits.

Bulls will attempt to prove their presence if EUR/USD moves upwards during the European session and there are no bearish signs at 1.1000, which cannot be ruled out. I will delay short positions until the next resistance level at 1.1043 in this scenario. Selling there may also be possible, but only after an unsuccessful consolidation. I will consider opening short positions from the rebound at 1.1095 with the aim of a 30-35 point downward correction.

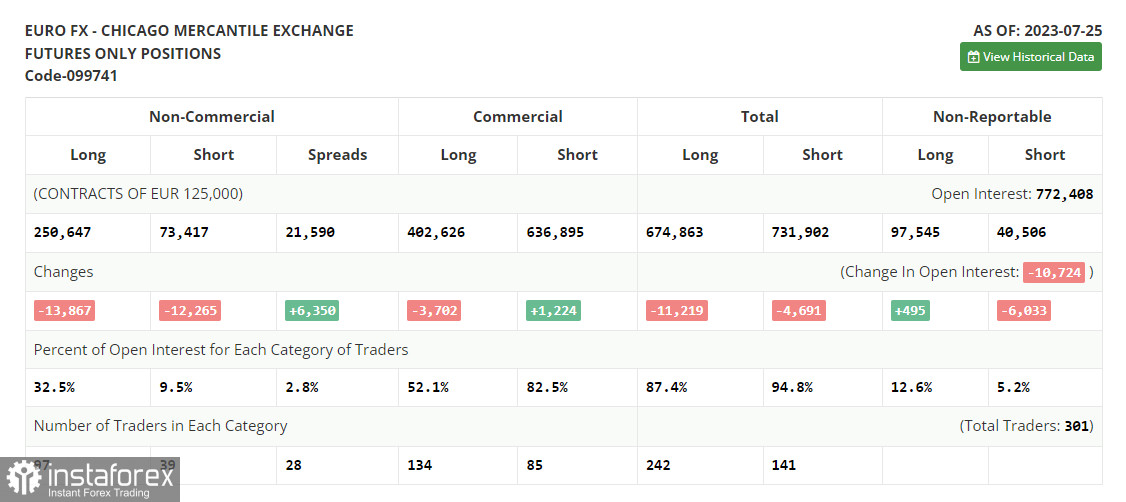

The COT report (Commitment of Traders) for July 25th revealed a sharp reduction in both long and short positions. This was a direct result of the planned meetings of the Federal Reserve System and the European Central Bank, whose outcomes still need to be reflected in these reports. The monetary policy decisions made by the regulators aligned with economists' expectations, maintaining market balance. However, this equilibrium was later disturbed by US macroeconomic statistics indicating the strength of the American economy in the 2nd quarter. Despite the downward correction, buying the euro on declines remains the optimal medium-term strategy under the current conditions. The COT report indicates that long non-commercial positions decreased by 13,867 to 250,647, while short non-commercial positions fell by 12,265 to 73,417. As a result, the spread between long and short positions increased by 6,350, favoring Euro buyers. The closing price declined to 1.1075 from 1.1300 a week earlier.

Indicator signals:

Moving averages.

Trading is carried out around the 30-day and 50-day moving averages, indicating market uncertainty.

Note: The author considers the period and prices of moving averages on the hourly chart (H1), which differs from the general definition of classical daily moving averages on the daily chart (D1).

Bollinger Bands:

In case of a decline, the lower boundary of the indicator, around 1.0955, will act as support.

Description of Indicators:

• Moving average (determines the current trend by smoothing volatility and noise). Period 50. Marked in yellow on the chart.

• Moving average (determines the current trend by smoothing volatility and noise). Period 30. Marked in green on the chart.

• MACD indicator (Moving Average Convergence/Divergence - convergence/divergence of moving averages). Fast EMA period 12. Slow EMA period 26. SMA period 9.

• Bollinger Bands (bands that indicate volatility and price levels). Period 20.

• Non-commercial traders - speculators such as individual traders, hedge funds, and large institutions using the futures market for speculative purposes and meeting specific requirements.

• Long non-commercial positions represent the total long open position of non-commercial traders.

• Short non-commercial positions represent the total short open position of non-commercial traders.

• The total non-commercial net position is the difference between non-commercial traders' short and long positions.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română