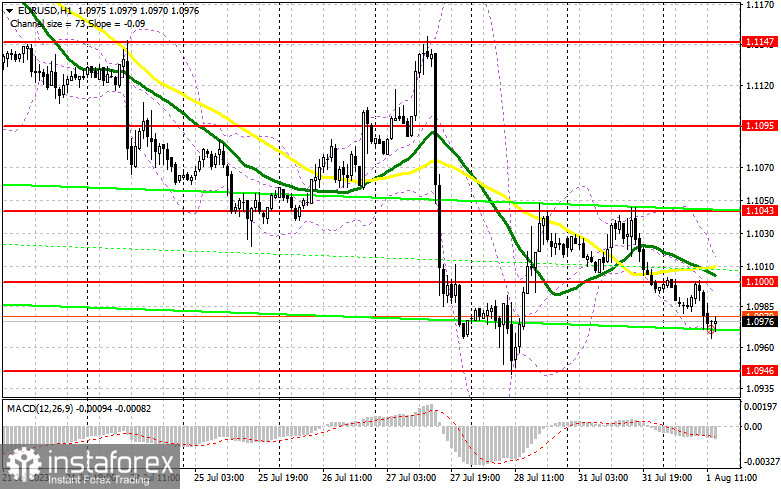

The morning forecast focused on the 1.1000 level, and the false breakout around 1.1000 resulted in a sell signal, as I mentioned in my forecast, leading to a decline of more than 35 points. The technical picture remained unchanged for the second half of the day.

To open long positions on EUR/USD, the following is required:

Considering that the manufacturing activity data in the eurozone countries for July of this year didn't bring much joy, pressure on the euro has persisted. The decline in the pair will continue, especially if strong data on the ISM manufacturing index and changes in US construction spending are released. I prefer to act on opening long positions in the second half of the day only from the weekly minimum of 1.0946. A false breakout formation will signal a buying opportunity, allowing for a return to growth and a target of 1.1000, above which the pair failed to break earlier. There are also moving averages playing in favor of sellers. Breaking and testing the upper boundary of this range will strengthen demand for the euro, providing a chance to reach 1.1043. The ultimate target remains in the area of 1.1095, indicating a new upward trend formation. I will take profit there. If EUR/USD declines and there are no buyers at 1.0946 during the American session, bears will act more actively, expecting a downward trend formation. Therefore, the formation of a false breakout around the next support at 1.0911, similar to what I discussed above, will give a signal to buy the euro. I will initiate long positions immediately on the rebound from the 1.0871 minimum, with a 30-35 point upward correction target within the day.

To open short positions on EUR/USD, the following is required:

Sellers did an excellent job with the tasks set in the morning, but full capitulation of buyers has yet to occur. The focus is now on the second half of the day and similar reports on manufacturing activity in the US. In the case of an increase, bears can still count on resistance at 1.1000, where the pair has declined once today. Protecting this level remains a priority. A failed consolidation there, similar to what I discussed above, will give a signal to sell and may push EUR/USD to 1.0946. Much depends on this level; a return below it may trigger stop-loss orders for many players. Consolidation below this range and a reverse test from below upwards will lead directly to 1.0911. The farthest target will be the minimum at 1.0871, where I will take profit. In the case of an upward movement of EUR/USD during the American session and the absence of bears at 1.1000, the situation will return under the control of buyers, keeping the chances for a pair recovery. In that case, I will postpone short positions until the next resistance at 1.1043. Selling may also be possible, but only after a failed consolidation. I will open short positions immediately on the rebound from the 1.1095 maximum, with a 30-35 point downward correction target.

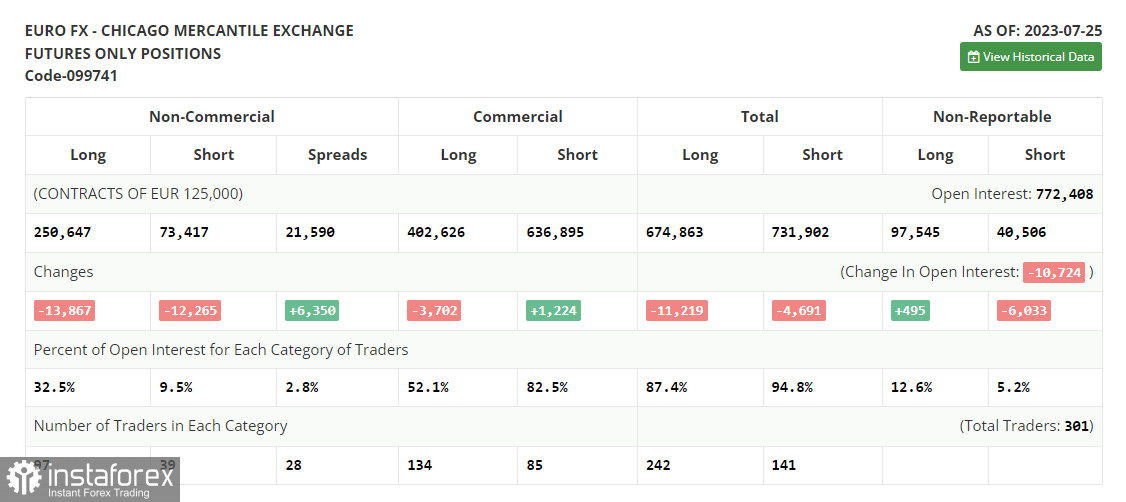

The July 25th COT report (Commitment of Traders) significantly reduced both long and short positions. This decrease was a clear result of the planned meetings held by the Federal Reserve System and the European Central Bank, and their outcomes still need to be reflected in these reports. The decisions made by regulators regarding monetary policy aligned with economists' expectations, which helped maintain market balance. However, this balance was later disrupted by macroeconomic statistics from the US, which indicated the strength of the American economy in the 2nd quarter. Despite the downward correction, the optimal medium-term strategy in the current conditions remains to buy the euro when it declines. According to the COT report, non-commercial long positions decreased by 13,867 to 250,647, while non-commercial short positions fell by 12,265 to 73,417. As a result, the spread between long and short positions increased by 6,350, which favored euro buyers. The closing price decreased to 1.1075 from 1.1300 a week earlier.

Indicator Signals:

Moving Averages:

Trading occurs below the 30-day and 50-day moving averages, indicating a further decline in the pair.

Note: The author considers the period and prices of moving averages on the hourly chart (H1), which differs from the general definition of classical daily moving averages on the daily chart (D1).

Bollinger Bands:

In the event of an upward movement, the upper boundary of the indicator around 1.1010 will act as resistance.

Description of Indicators:

• Moving Average (determines the current trend by smoothing out volatility and noise). Period 50. Marked in yellow on the chart.

• Moving Average (determines the current trend by smoothing out volatility and noise). Period 30. Marked in green on the chart.

• MACD Indicator (Moving Average Convergence/Divergence - indicates the convergence/divergence of moving averages). Fast EMA period 12. Slow EMA period 26. SMA period 9.

• Bollinger Bands. Period 20.

• Non-commercial traders - speculators such as individual traders, hedge funds, and large institutions using the futures market for speculative purposes and meeting specific requirements.

• Non-commercial long positions represent the total long open positions of non-commercial traders.

• Non-commercial short positions represent the total short open positions of non-commercial traders.

• The total non-commercial net position is the difference between non-commercial traders' short and long positions.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română