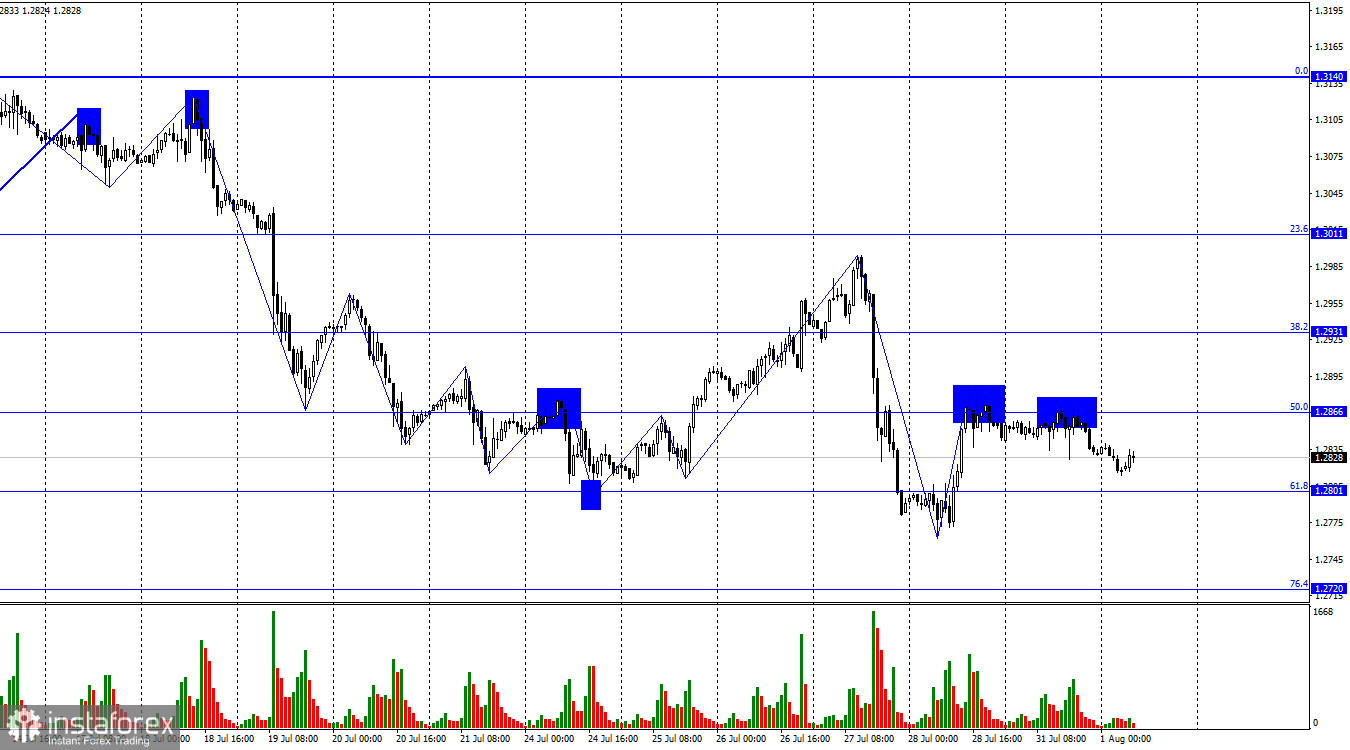

The GBP/USD pair on the hourly chart executed a new rebound from the Fibonacci level of 1.2866 (50.0%) on Monday. A reversal in favor of the US dollar occurred, and a decline toward the corrective level of 61.8% (1.2801) started. A rebound of the pair's rate from this level will allow traders to expect a reversal in favor of the pound and a return to the level of 1.2866. Closing below 1.2801 will increase the probability of further decline toward the next Fibonacci level of 76.4% (1.2720).

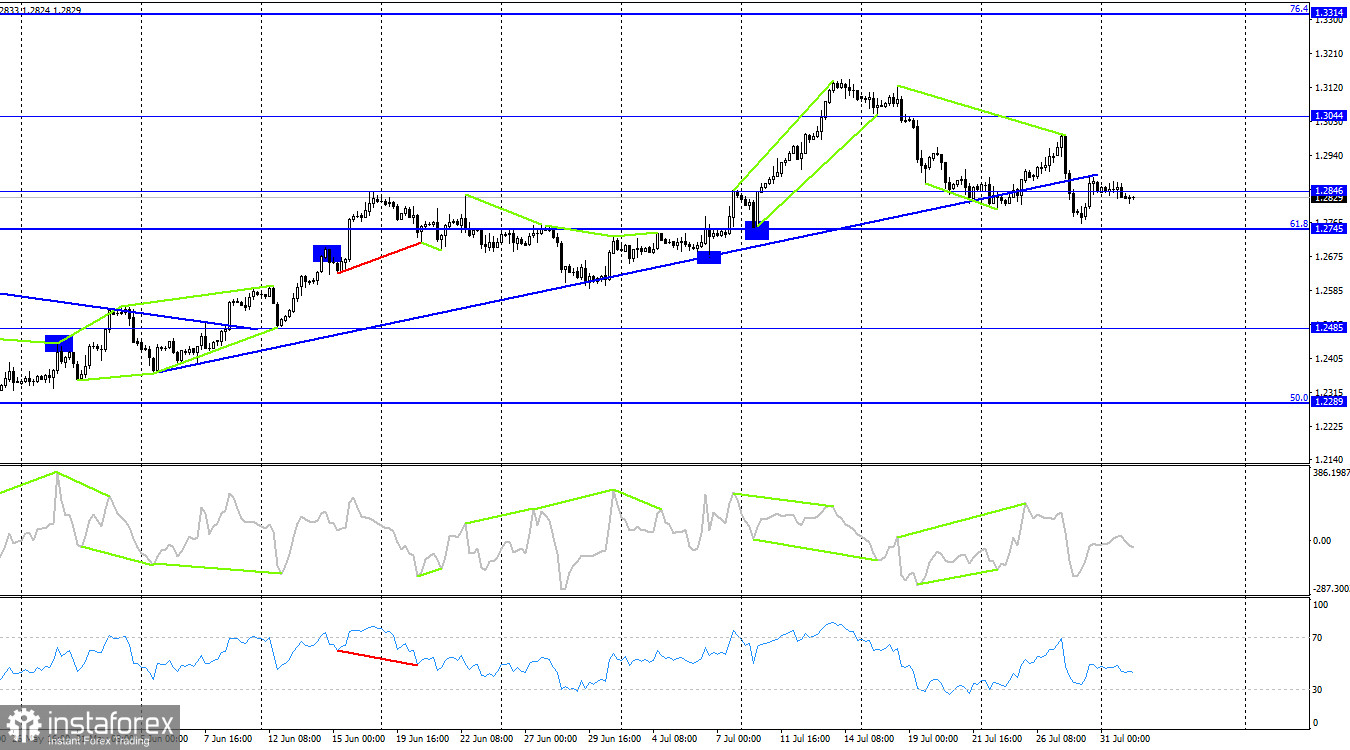

Waves again indicate a "bearish" trend, but there are a few "buts." I want to remind you that everything was heading towards a new "bullish" trend last week, but on Thursday, there was a significant drop in quotes, during which the last two lows were broken. At the moment, it looks more like a horizontal trend. We do not have confirmations in the form of breaking the last low. Yesterday's pound decline may end around 1.2801, after which traders will try to start a "bullish" trend again. Only strong statistics from the US can hinder this.

Today, two reports from the US may lead to more active movement of the pound. The ISM Manufacturing PMI is expected to be below 50.0 again but may slightly increase to 46.8 points. The actual value may be lower, as business activity has been declining in many countries due to stricter COVID-19 measures. Nevertheless, a stronger value will help the bears.

The Job Openings report has a forecast of 9.6 million, which is lower than the May value. This report may also show a weaker value, as Federal Reserve members have talked about increasing unemployment and a cooling economy for months. The economy is currently doing fine, but unemployment is gradually rising.

On the 4-hour chart, the pair closed below the ascending trendline, which changes everything in our chart pattern. We should expect a decline in the pair, even if we see a temporary pullback upwards. And we have already seen such a pullback. The "bearish" divergence worked in favor of the US currency yesterday but did not cause a significant decline in quotes. There are no new emerging divergences for any of the indicators.

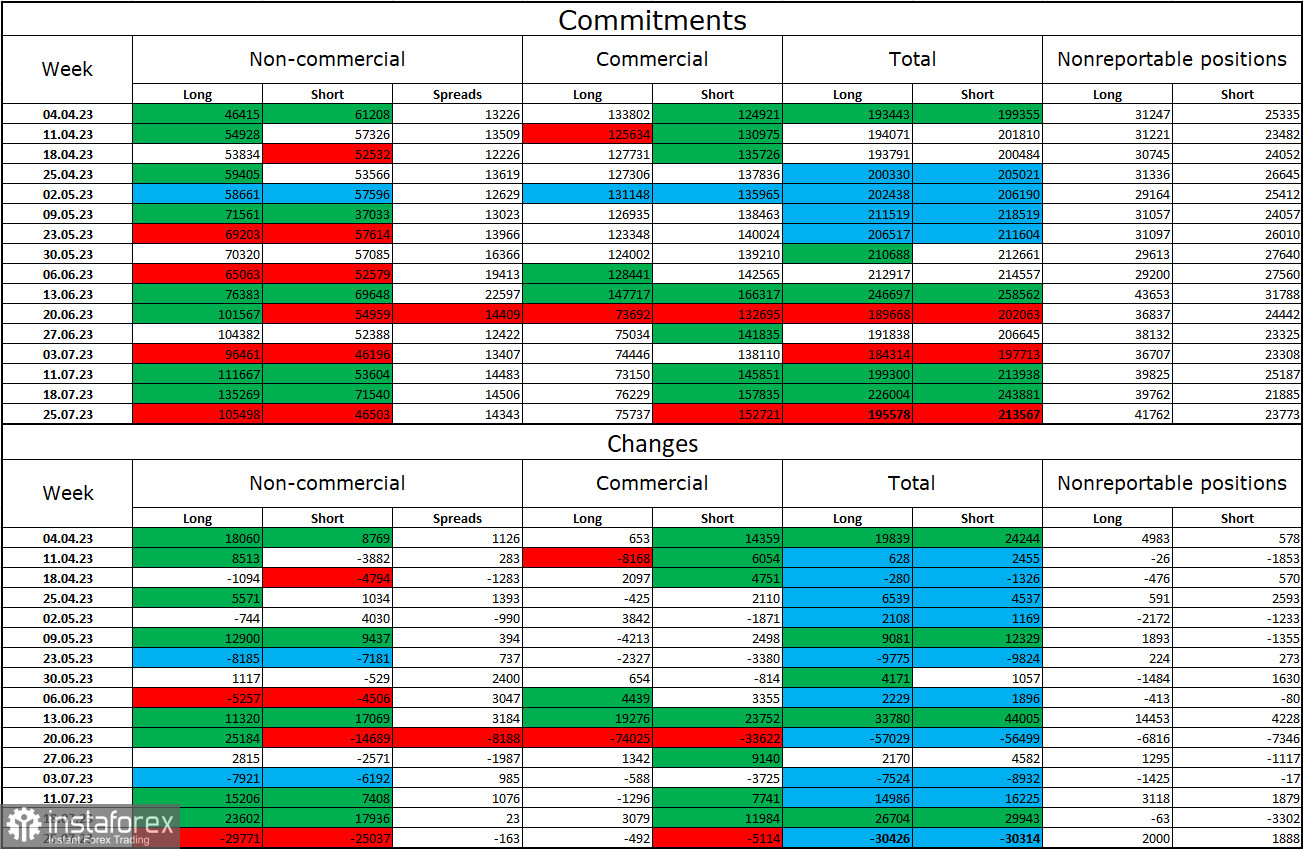

Commitments of Traders (COT) Report:

The sentiment of the "Non-commercial" trader category became less "bullish" over the last reporting week. The number of long contracts held by speculators decreased by 29,771 units, and the number of short contracts decreased by 25,037. The overall sentiment of major players remains fully "bullish," with a double gap between the number of long and short contracts: 105,000 versus 46,000. The pound has good prospects for continued growth. Still, the information background from the UK is not always encouraging, and the chart analysis hints at a trend reversal - bears may take the initiative. Counting on a new strong rise of the British pound is becoming increasingly difficult. The market has yet to price in many dollar-supporting factors, while the pound has been rising lately based on expectations of further rate hikes by the Bank of England.

News calendar for the US and the UK:

United Kingdom - Manufacturing Purchasing Managers' Index (PMI) (08:30 UTC).

United States - Institute for Supply Management (ISM) Manufacturing Purchasing Managers' Index (PMI) (14:00 UTC).

United States - Job Openings and Labor Turnover Survey (JOLTS) (14:00 UTC).

On Tuesday, there are several entries in the economic events calendar. The impact of the information background for the rest of the day might have moderate strength.

Regarding the GBP/USD forecast and trader recommendations:

I advised selling the pound when it rebounds from the 1.2866 level on the hourly chart, targeting 1.2801 and 1.2720. These positions can be kept open until buy signals emerge. Buying the pound is an option when it rebounds from the 1.2801 level on the hourly chart, targeting 1.2866 and 1.2931.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română