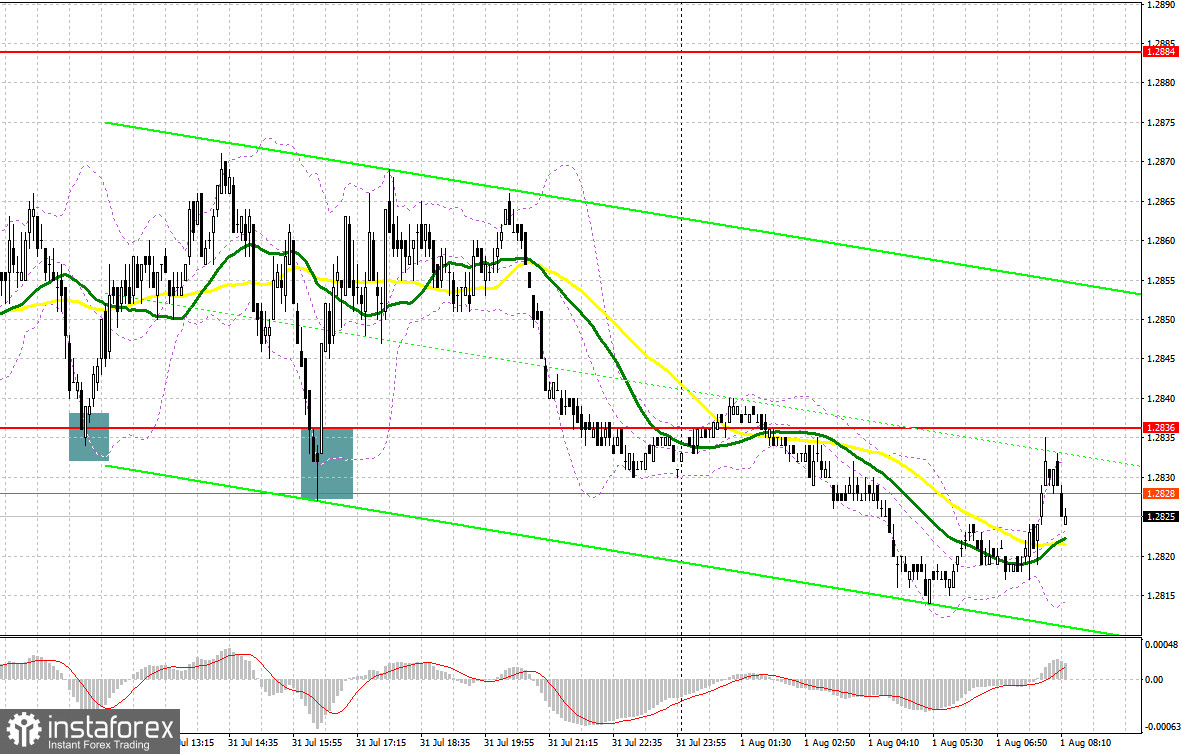

Yesterday, several excellent market entry signals were generated. Let's examine the 5-minute chart and analyze the events. In my morning forecast, I emphasized the importance of the level at 1.2836 and recommended using it as a basis for entry decisions. The subsequent decline and formation of a false breakout at that level resulted in a signal to initiate long positions, leading to a 20-point upward movement. Later in the day, a similar buying signal emerged from 1.2836, causing a surge of over 20 points from the entry point, although 1.2884 was not reached.

For opening long positions on GBP/USD, the following steps are required:

Before delving into the pound's technical analysis, let's look at the developments in the futures market. According to the COT report on July 25th, both long and short positions decreased as traders closed their positions ahead of the significant Federal Reserve meeting, which could have resulted in various outcomes. Consequently, there have been no major changes in the market since the regulator raised rates, leaving room for another upward move. However, it's worth noting that this report still needs to reflect the new positions of traders who re-entered the market after the committee meeting. Strong data on the American economy likely tilted the balance in favor of pound sellers and dollar buyers. Nevertheless, buying the pound during declines remains the optimal strategy, considering the diverging policies of central banks that will impact the prospects of the US dollar. The latest COT report shows that non-commercial long positions decreased by 28,771 to 105,498, while non-commercial short positions fell by 25,037 to 46,503. As a result, the spread between long and short positions narrowed by only 163. The weekly price declined and reached 1.2837 against 1.3049.

Today, important data on the UK manufacturing sector's business activity index and the Nationwide house price index are expected. Weak indicators, as predicted by economists, will likely increase pressure on the pair, leading to further selling. Therefore, I will only act during declines towards the nearest support level at 1.2803, established by the end of last Friday. This level will provide an excellent entry point with a target for growth towards the resistance at 1.2842, just above which the moving averages are positioned, favoring sellers. A breakout and a retest from above this range will form an additional selling signal, strengthening the pound and allowing it to reach a new high at 1.2884. GBP/USD buyers must reach this level to anticipate further growth. In the event of a breakout above this range, we can consider a surge towards 1.2923, where I will take profit. If GBP/USD declines and there is a lack of buyers at 1.2803, the bearish market will continue, worsening the pound's situation. In such a scenario, I will postpone long positions until 1.2765, with purchases only occurring on a false breakout. Long positions on GBP/USD can be initiated immediately on a rebound from 1.2717, targeting a 30-35 points correction within the day.

To open short positions on GBP/USD, the following is required:

Yesterday, bears did everything they could, and today's weak statistics for the UK may help them return to the lows of the previous week. During the first half of the day, keeping the pair below 1.2842, where the moving averages are situated, is crucial. The formation of a false breakout at this level will serve as a selling signal, targeting a decline toward support at 1.2803. A breakout and subsequent retest from below this range will provide an entry point for selling, with a target for renewal at 1.2765. The ultimate target will be the minimum at 1.2717, where I will take profit. However, a decline to this level will only occur in the case of very strong data from the US, which we will discuss in more detail in the second half of the day. If GBP/USD rises and there are no bears at 1.2842, buyers will have an opportunity to return to the highs of the previous Friday. In such a scenario, only a false breakout around the next resistance level at 1.2884 will be a selling entry point. If there is a lack of activity, I recommend selling GBP/USD from 1.2923, targeting a rebound of the pair downwards by 30-35 points within the day.

Indicator signals:

Moving averages.

Trading is conducted below the 30 and 50 moving averages, indicating a further decline of the pair.

Note: The author considers the period and prices of the moving averages on the hourly chart (H1), which differ from the general definition of classical daily moving averages on the daily chart (D1).

Bollinger Bands

In case of an upward movement, the upper boundary of the indicator around 1.2870 will act as resistance. In case of a decline in the pair, the lower boundary of the indicator, around 1.2803, will provide support.

Description of indicators:

• Moving average (determines the current trend by smoothing volatility and noise). Period 50. Marked in yellow on the chart.

• Moving average (determines the current trend by smoothing volatility and noise). Period 30. Marked in green on the chart.

• MACD indicator (Moving Average Convergence/Divergence) - Fast EMA period 12. Slow EMA period 26. SMA period 9.

• Bollinger Bands (Bollinger Bands). Period 20.

• Non-commercial traders - speculators, such as individual traders, hedge funds, and large institutions, using the futures market for speculative purposes and meeting specific requirements.

• Non-commercial long positions represent the total long open position of non-commercial traders.

• Non-commercial short positions represent the total short open position of non-commercial traders.

• The total non-commercial net position is the difference between non-commercial traders' short and long positions.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română