EUR/USD

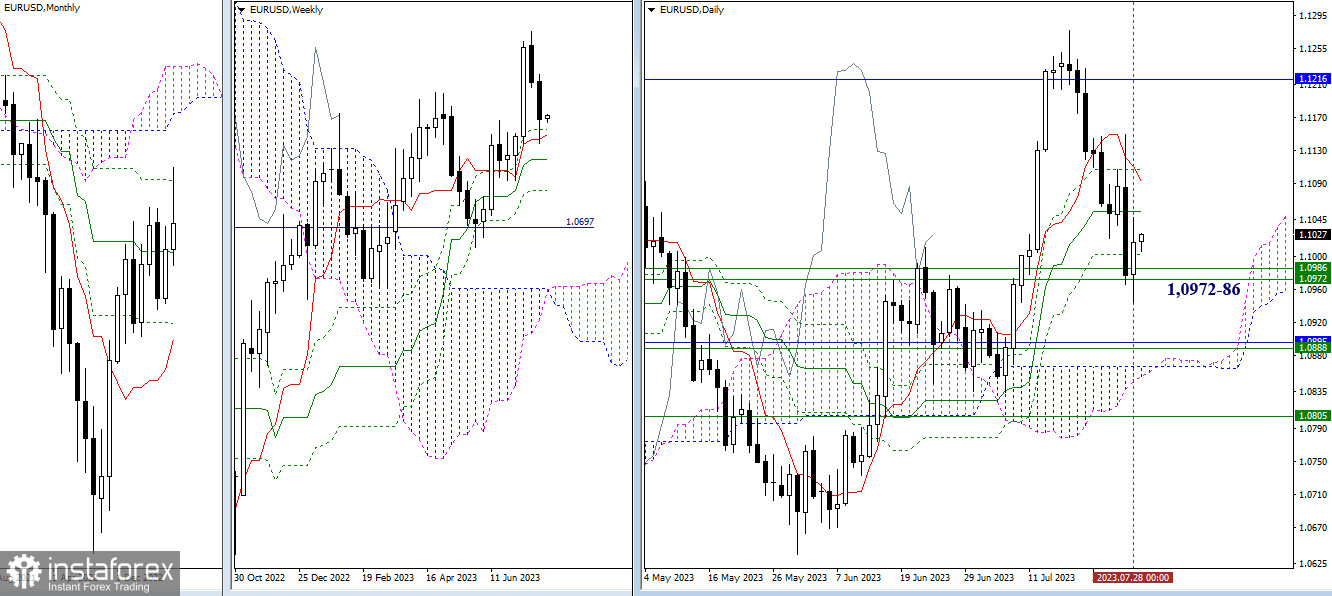

Higher timeframes

Last week, the weekly support levels of 1.0972 - 1.0986 were tested. Today marks the end of the month, and the final size of the upper shadow of the monthly candle is essential. A long upper shadow and closing in the consolidation zone of the previous several months could be a harbinger that the bulls, who showed activity and tested the final resistance of the monthly Ichimoku death cross (1.1216) in July, might lose the initiative again or return to consolidation and uncertainty. In the current situation, the nearest resistances are the daily Ichimoku cross levels (1.1055 - 1.1093 - 1.1107), and the role of the next supports is played by the area of 1.0897-95 – 1.0866 (weekly and monthly medium-term trends + daily cloud).

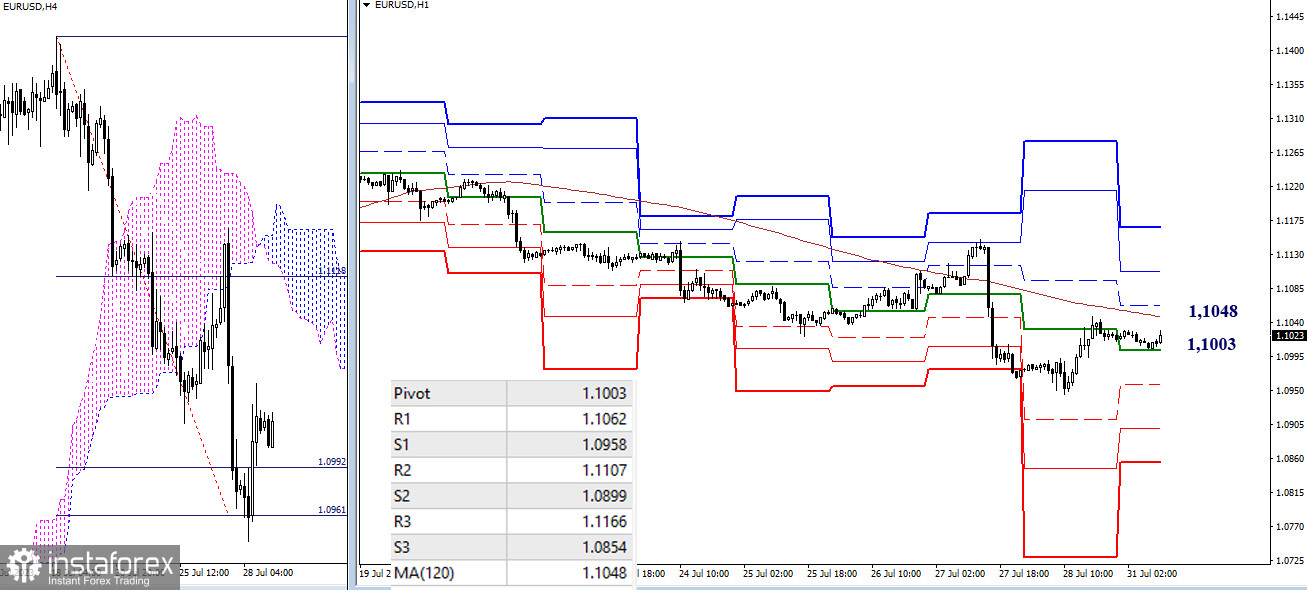

H4 - H1

After hitting the targets on the breakout of the H4 cloud, the pair started implementing an upward correction. As of writing, the central pivot point of the day (1.1003) has been passed, and ahead lies the resistance of the weekly long-term trend (1.1048). Consolidation above and a reversal of the moving average could change the current balance of power in favor of the bulls. In this case, the targets would be 1.1062 - 1.1107 - 1.1166 (resistance levels of classic pivot points). The formation of a rebound and a return to decline would bring back the relevance of the support levels of classic pivot points, today located at 1.0958 - 1.0899 - 1.0854.

***

GBP/USD

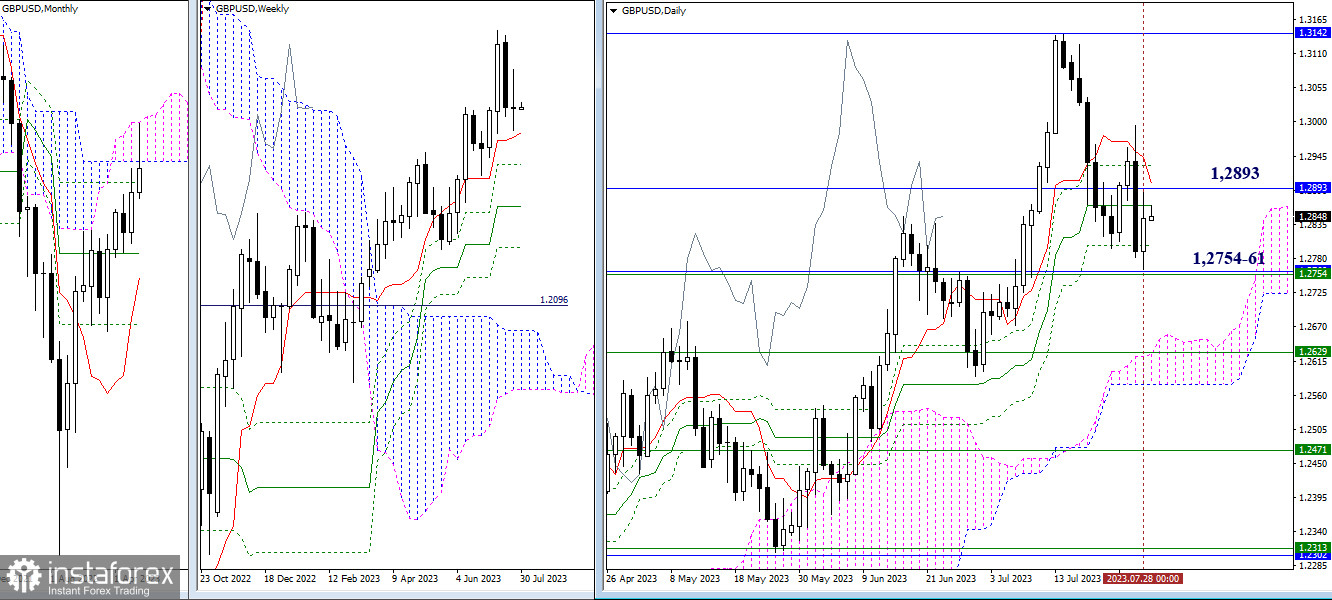

Higher timeframes

Last week, the pair closed with a candle of uncertainty, indicating some rebound from the encountered supports of 1.2754 - 1.2761 (weekly short-term trend + monthly Fibo Kijun). At the moment, the area of attraction is the range of 1.2866 - 1.2893 - 1.2931 (daily cross levels + lower boundary of the monthly cloud). Closing below the monthly cloud in July may contribute to the formation of a rebound from the resistance of the monthly cloud, leading to subsequent decline. Consolidation within the monthly cloud will make the bulls strive for its upper boundary, aiming to break it for a bullish zone relative to the cloud.

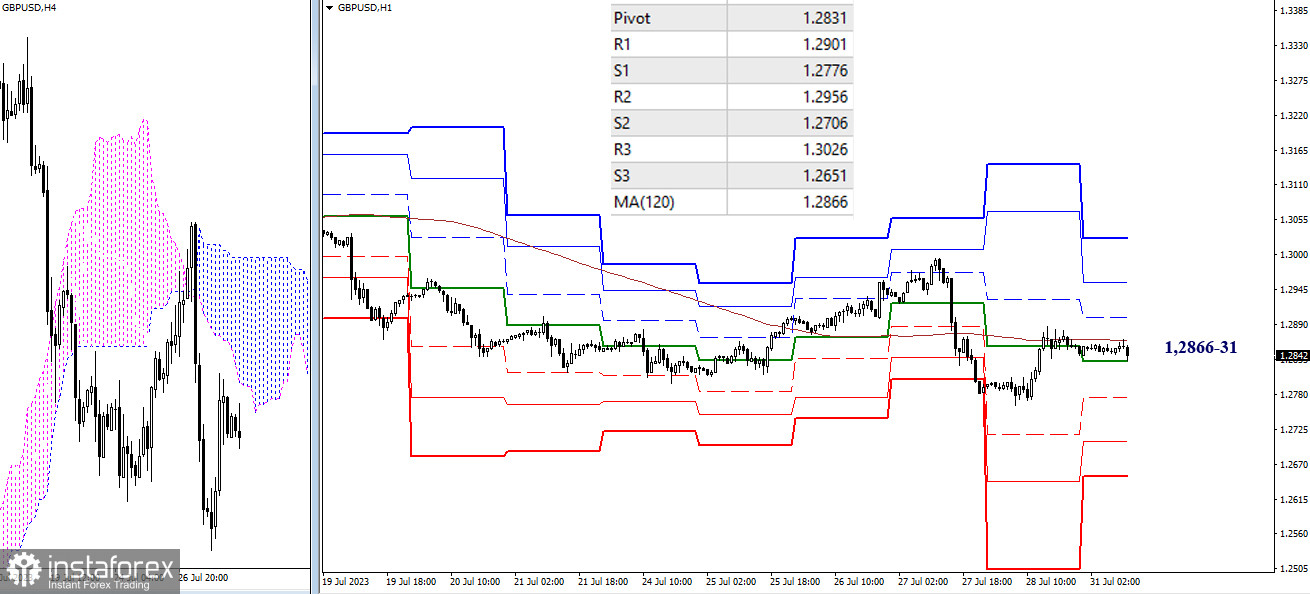

H4 - H1

The pair has been under the resistance of the weekly long-term trend (1.2866) for quite some time. This situation can be referred to as uncertainty. Positioning below or above the weekly long-term trend favors one side or the other, and directed movement will develop an advantage. Today, the targets for intraday movements could be the resistances (1.2901 - 1.2956 - 1.3026) and supports (1.2776 - 1.2706 - 1.2651) of classic pivot points.

***

The technical analysis of the situation uses:

Higher timeframes - Ichimoku Kinko Hyo (9.26.52) + Fibo Kijun levels

Lower timeframes - H1 - Pivot Points (classic) + Moving Average 120 (weekly long-term trend)

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română