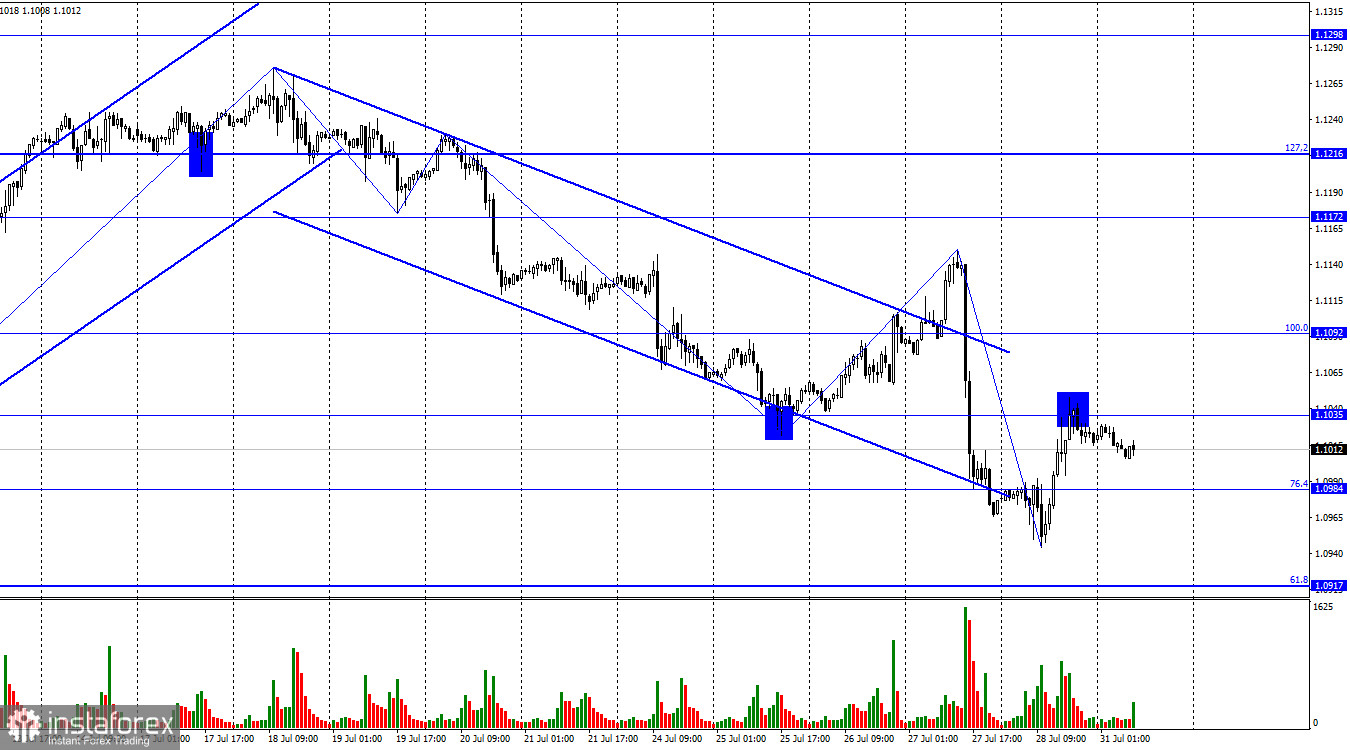

On Friday, the EUR/USD pair experienced a reversal in favor of the European currency, reaching the level of 1.1035, acting as a key level for the quotes. A rebound from this level suggests that traders can expect a reversal in favor of the US dollar and a continuation of the decline toward the levels of 1.0984 and 1.0917. If the pair closes above 1.1035, it will signal further growth towards the next corrective level of 100.0% (1.1092).

The waves observed last week indicate that the "bearish" trend remains intact. Even during the two-day rise of the European currency, there were no signs of the "bearish" trend ending. As it turned out later, the breakout of the descending trend corridor was false, and the subsequent downward wave broke the low of the previous wave. A new upward wave has formed, but it has not come close to the previous peak. There are still no signs of the "bearish" trend weakening.

The background information on Friday was rather weak but interesting. The reports on German inflation and GDP were not considered important by traders. The German economy showed weak growth in the second quarter, or rather, no growth. Inflation decreased exactly as much as traders expected. Consequently, the European currency could not gain growth momentum from these data. I think the pair rebounded after a significant decline. Nothing is preventing it from resuming the decline now.

In the European Union, on Friday, Gediminas Simkus, a representative of the ECB's Board of Directors, said the rate hike in July may be the last in the current cycle. "We are close to the peak of interest rates or may already be at it," believes the ECB manager. However, he noted that the pause in September does not mean that there will be no further rate increases.

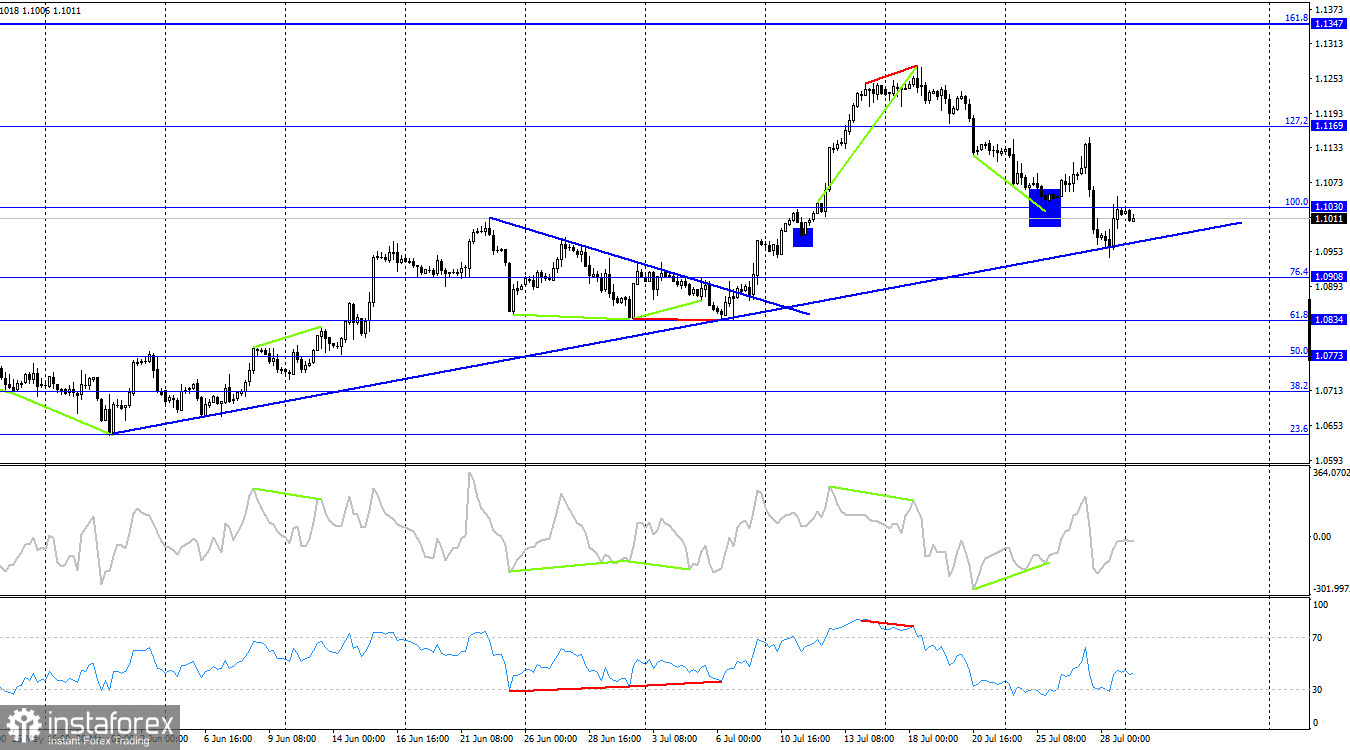

On the 4-hour chart, the pair experienced a reversal in favor of the US dollar, declining towards the ascending trendline. A rebound from this trendline allows for pair growth, but it failed to close above the level of 100.0% (1.1030). Closing below the trendline would favor a further decline in quotes toward the Fibonacci level of 76.4% (1.0908). At the moment, no visible divergences are observed in any indicator.

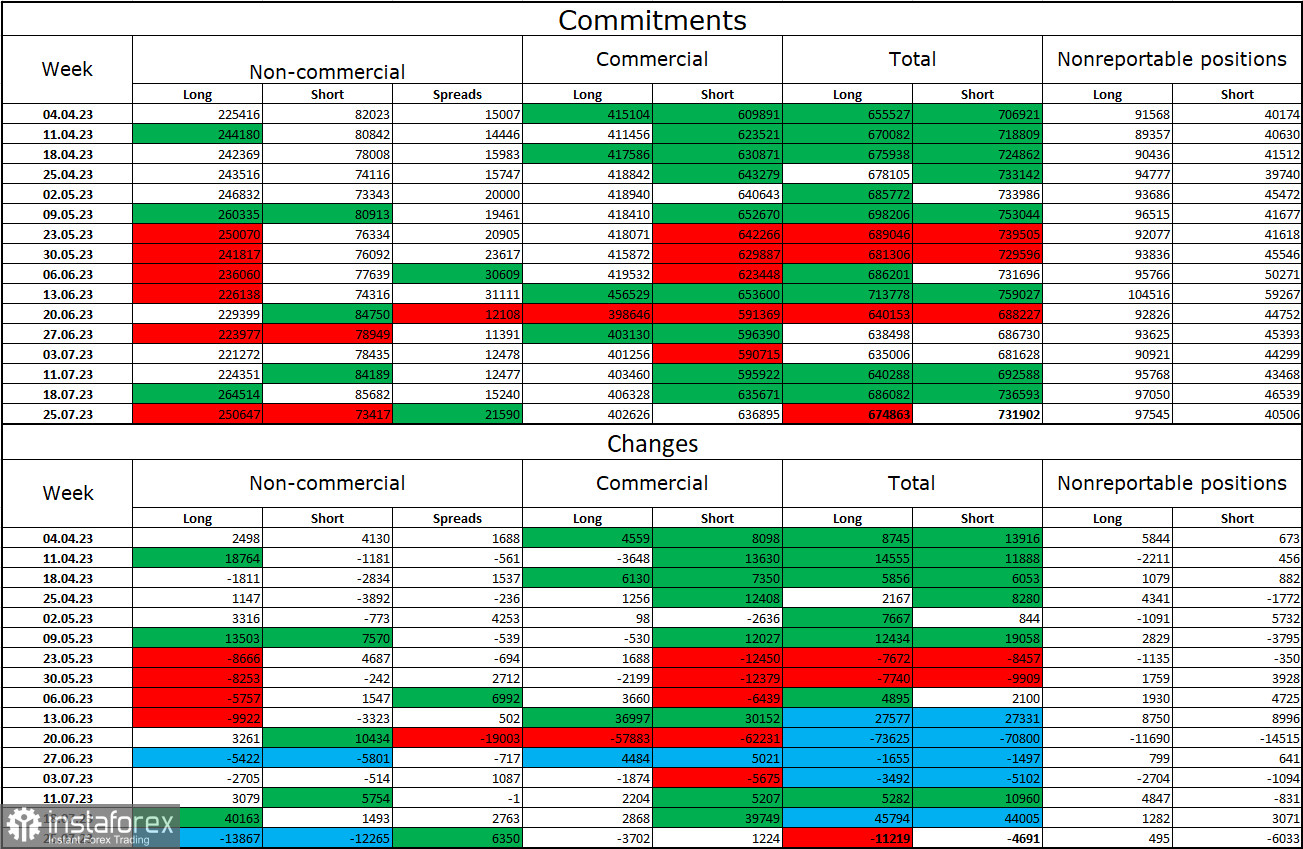

Commitments of Traders (COT) report:

During the last reporting week, speculators closed 13,867 long contracts and 12,265 short contracts. The sentiment among major traders remains bullish, but it has slightly weakened over the past week. Speculators hold a total of 250,000 long contracts and only 73,000 short contracts. Although bullish sentiment persists, the situation may change in the opposite direction soon. The significant number of open long contracts suggests buyers might soon start closing their positions, indicating a strong bias toward bulls. The current figures indicate a potential decline in the euro currency in the upcoming weeks. Additionally, the ECB's signals about the imminent completion of the tightening of monetary policy further support this perspective.

Economic Calendar for the USA and the European Union:

European Union - GDP in the second quarter (09:00 UTC).

European Union - Consumer Price Index (CPI) (09:00 UTC).

On July 31, the economic calendar includes two crucial entries. The impact of the background information on traders' sentiment for the rest of the day will likely be moderate.

Forecast for EUR/USD and Trading Advice:

Selling opportunities exist today on a rebound from 1.1035 on the hourly chart, with targets at 1.0984 and 1.0917. Buying the pair is possible now if it consolidates above the level of 1.1035 on the hourly chart, with targets at 1.1092 and 1.1172.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română