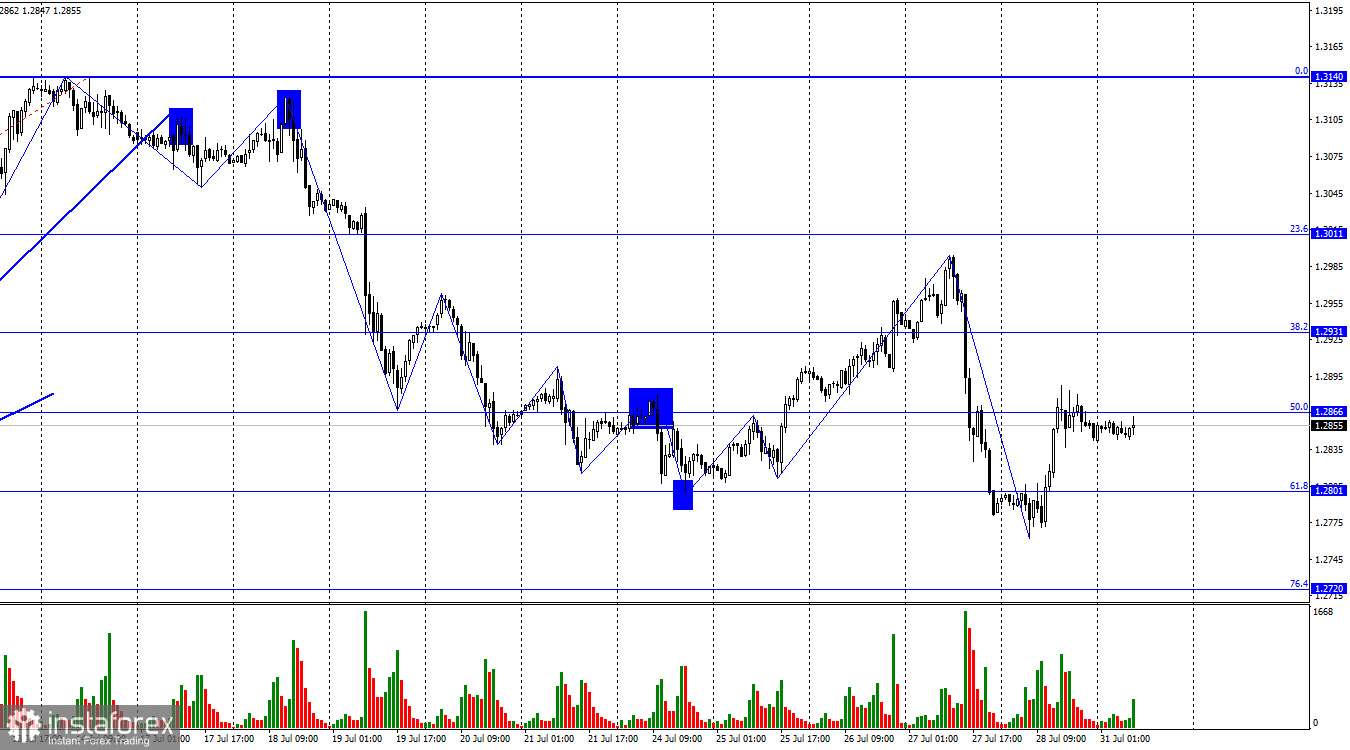

Hi, dear traders! On the 1-hour chart, on Friday the GBP/USD pair made a reversal in favor of the British and grew to 1.2866, the 50.0% correction level. The drop of the price from this level will work in favor of the US currency and GBP/USD will resume its decline in the direction of 1.2801 and 1.2720. If the instrument closes above the level of 1.2866, it will increase the chance of further growth towards 1.2931, the next correction level of 38.2%.

Last week, waves confused traders more than gave them a hint about further moves. First, a bullish trend came into being thanks to a strong upward wave. However, then an even stronger downward wave followed. For the time being, it turns out that the last two lows have been broken and the bearish trend again prevails in the market. The next bullish wave, which is already in progress, could be as large as 1.2931 and even slightly higher. Still, the overall bearish trend is in place.

This week, traders are anticipating the policy meeting of the British regulator. Last week, strong volatility in the pound sterling was triggered by the meetings of the ECB and the Federal Reserve. This week, apart from the meeting of the Bank of England, the nonfarm payrolls and unemployment reports will be released in the US on Friday. More reports on ISM business activity and the labor market will be on tap during the week. Thus, traders will have no time to be bored. The only quiet day will be Monday since the economic calendar is empty for the British pound and the US dollar. From tomorrow the market will be much more interesting, active and informative.

This week, the currency pair may form a new series of waves that will not answer the question about the direction of the trend. You need to be ready for this. The reports may turn out to be different in nature, and the market may give the opposite response to them.

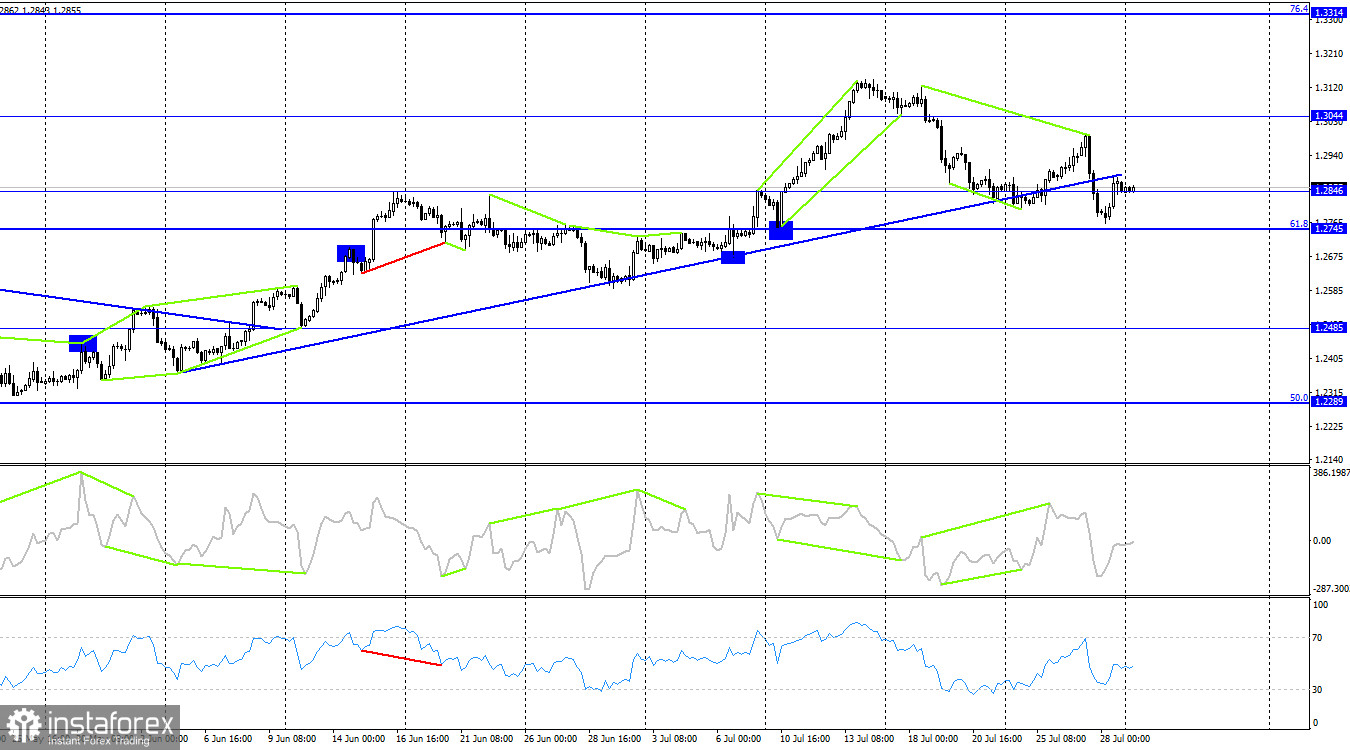

On the 4-hour chart, GBP/USD closed below the ascending trend line. Thus, we have to revise completely our technical picture. Now we should expect the price to fall, even if before that we see an upward retracement. Indeed, we have already seen it. Bearish divergence happened yesterday in favor of the US currency, but it did not cause a strong fall in the price. New brewing divergences are not detected today in any indicator.

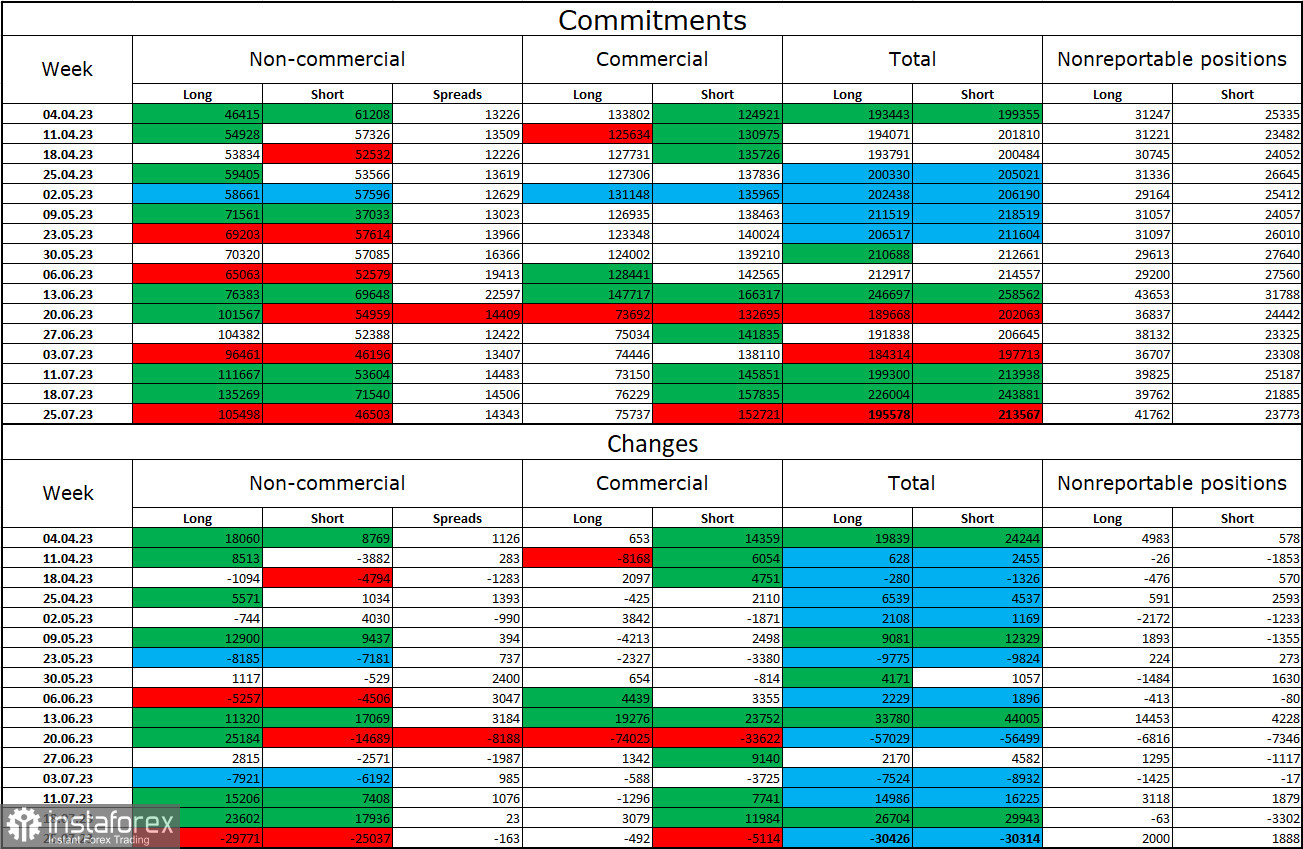

Commitments of Traders (COT)

The sentiment of the non-commercial category of traders has become less bullish over the last reporting week. The number of long contracts held by speculators decreased by 29,771 whereas the number of short contracts dropped by 25,037. The overall sentiment of market makers remains entirely bullish. A two-fold gap has been formed between the number of long and short contracts: 105,000 against 46,000. From my viewpoint, the British has good prospects for steady growth, but the information background from the UK is not always encouraging. Thus, graphical analysis hints at a trend reversal so that the bears can take the lead for a while. It is becoming more and more difficult to count on a new strong bullish sequence in GBP/USD. The market still does not take into account many factors supporting the US dollar. The pound sterling has recently been growing only on the expectations of a new series of rate hikes by the Bank of England.

Economic calendar for US and UK on July 31, 2023

On Monday, the economic calendar is absolutely empty. It means that the information background does not matter anything to GBP/USD.

Outlook for GBP/USD and trading tips

I would recommend opening new short positions at a bounce from 1.2866 on the 1-hour chart with targets at 1.2801 and 1.2720. Alternatively, buy positions could be opened after the price closes above 1.2866 on the 1-hour chart with targets at 1.2931 and 1.3011.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română