A few hours ago, the European Central Bank (ECB) raised its interest rates by 25 basis points, as expected by the market, causing no surprise. Nevertheless, the euro and the pound experienced a significant decline, with the euro losing 120 points from its peak during the day and the pound losing 115 points at the time of writing this article. Analyzing the wave analysis, everything is proceeding as planned. We observed an upward corrective wave within new descending wave sets, signaling that we can now proceed to build new downward waves. However, it is important to understand why the euro and pound fell in response to the ECB's rate hike decision.

As is often the case, the market expects one thing while the regulator offers something else. Traders try to predict not only the rate decision but also the central bank's rhetoric and promises, which only sometimes leads to accurate predictions. It is possible that many traders expected to hear from Lagarde today about a guaranteed rate hike in September, but such assurance still needs to be provided. The official accompanying statement from the ECB mentioned the regulator's commitment to ensure stable inflation at 2% and its intention to maintain it in the restrictive zone until inflation returns to 2% "in a timely manner." The markets seemed dissatisfied with the vague term "timely" as it lacked clarity.

The ECB's letter also stated that future decisions would be based on economic data, considering core inflation dynamics. As a result, the market was burdened with inflated expectations. Although the ECB's rate is likely to continue rising, predicting the pace remains difficult.

Perhaps this outcome was intentional. It is no secret that both the ECB and the Bank of England are nearing the end of their monetary policy tightening phase, and it is plausible that several future rate increases are already factored into market prices. If this is the case, the dollar unexpectedly gains an advantage. This advantage should establish a descending three-wave set for both pairs. As for what needs to happen for the construction of a new upward trend section to begin, it is difficult to speculate. Perhaps only an announcement from the Federal Reserve that they are ready to start lowering the interest rate could trigger such a shift. However, we should not expect such statements before November.

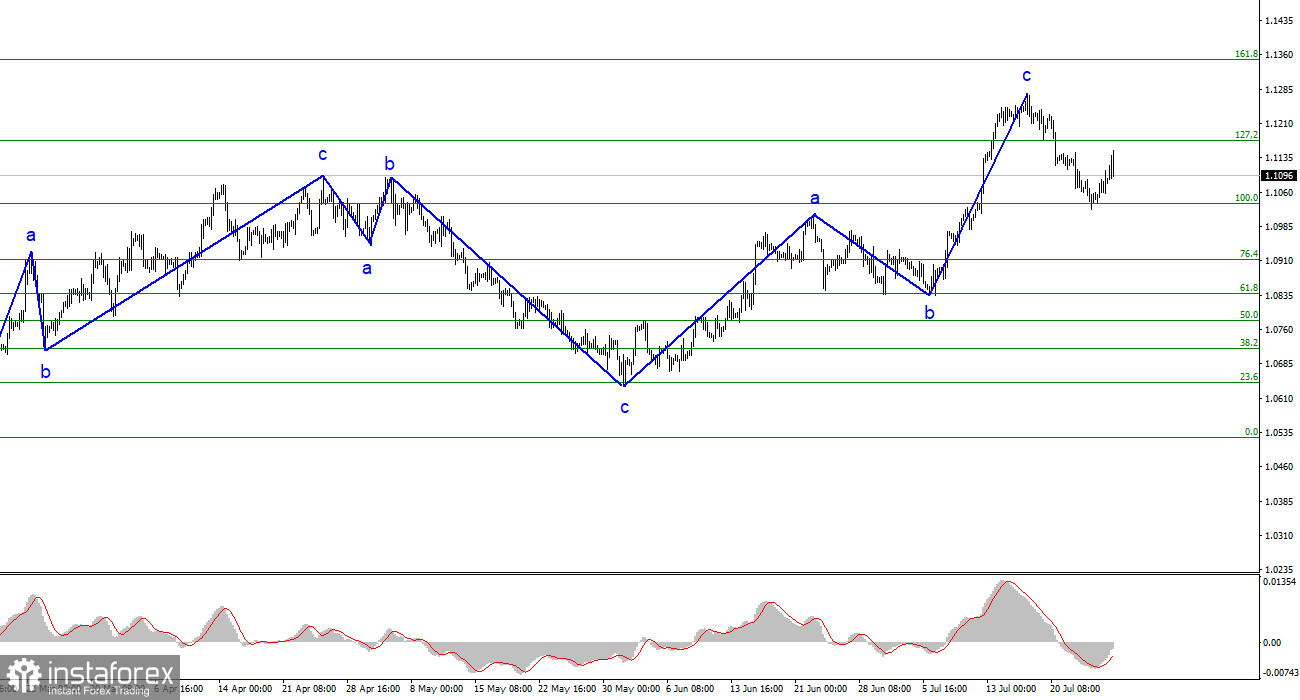

Based on the analysis conducted, the construction of the upward wave set is complete. Targets in the range of 1.0500-1.0600 are entirely achievable. I recommend selling the pair with these targets in mind. The a-b-c structure looks well-formed and convincing, and the closing below the 1.1172 level indirectly confirms the formation of a descending trend section. Therefore, I continue to advise selling the pair with targets located below the 1.1034 level. The construction of a new descending wave may have already begun or will commence in the coming days.

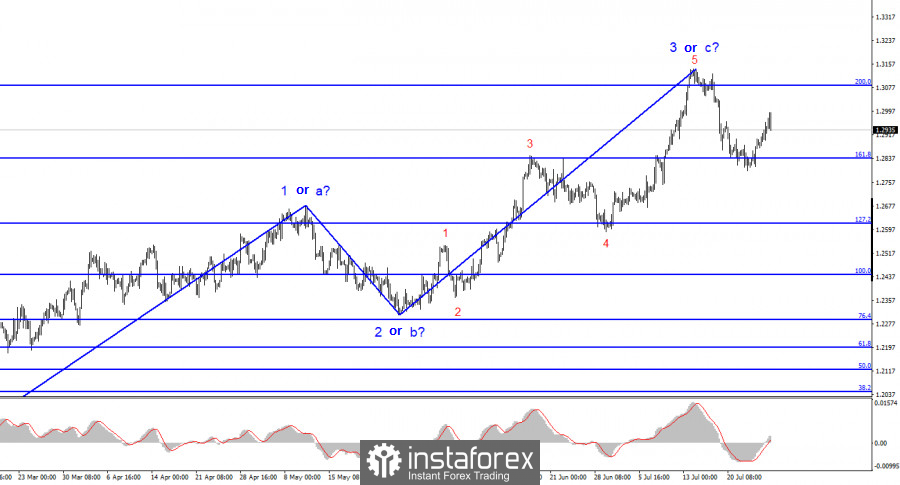

Regarding the GBP/USD pair, the wave pattern suggests a decline in the upcoming weeks. As I mentioned in my recent reviews, readers could have taken sell positions when the 1.3084 level (top-down) was successfully breached. Although the 1.2840 level was not surpassed, the upward corrective wave may have already concluded. Consequently, I anticipate a resumption of the decline. The current wave has descended below the peak of wave 3 in 5, indicating the construction of a descending trend section. As a result, selling positions can be taken based on MACD signals "down" or any other reversal signals pointing downward.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română