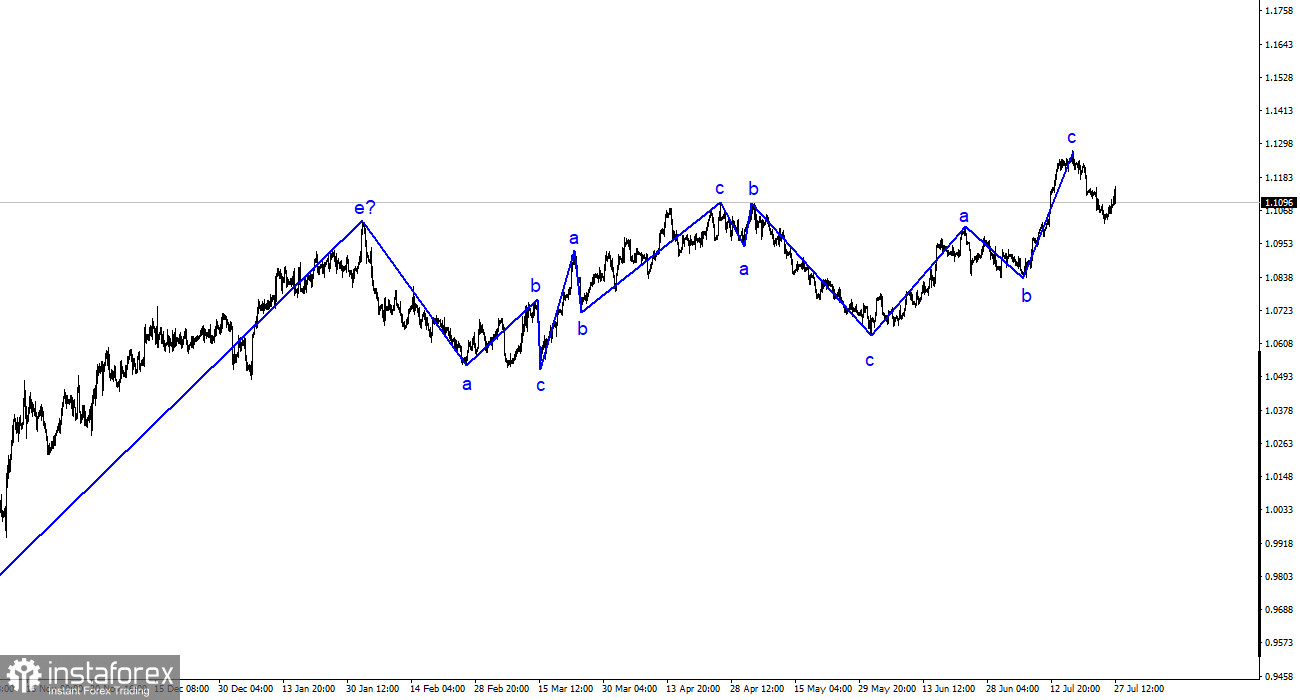

The wave analysis on the 4-hour chart for EUR/USD remains clear. The upward trend started last year and has developed into a complex structure with alternating three-wave patterns in the last six months. Recently, I have consistently mentioned my expectation for the pair to be near the 5th figure, from where the last rising three-wave structure began. While I stand by my previous statements, it is necessary to complete the construction of the rising trend section, which might already be finished.

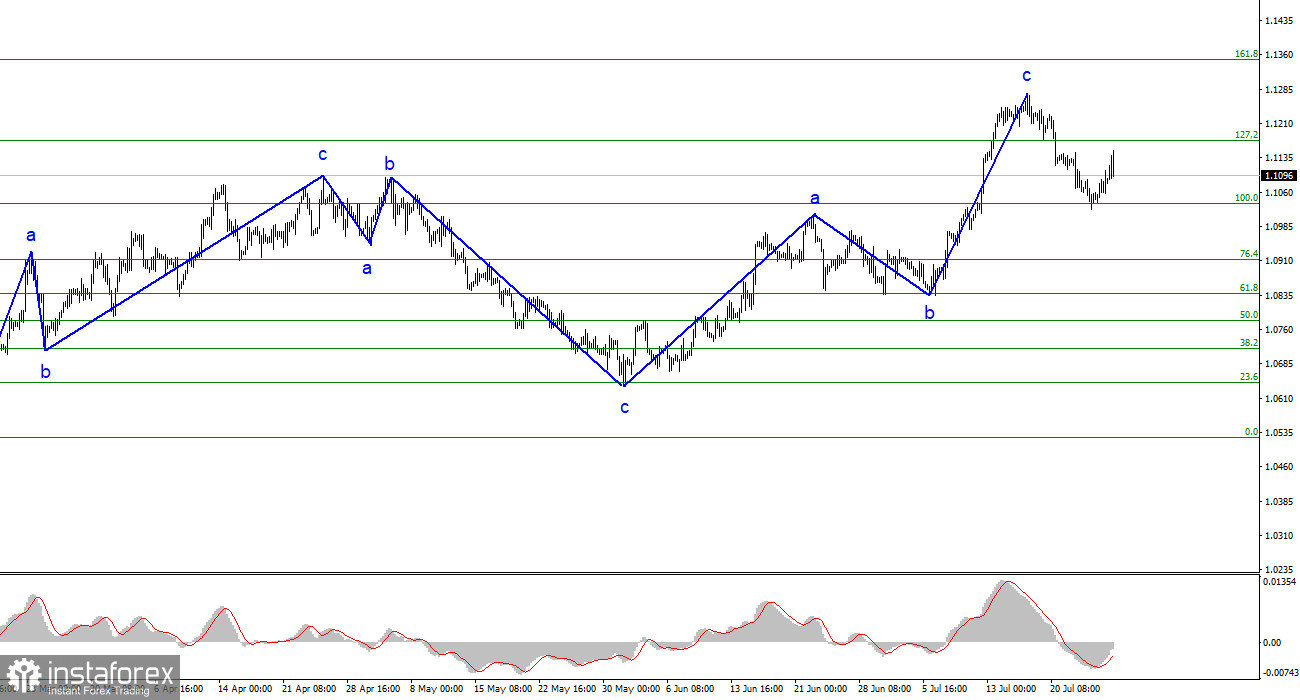

The portion of the trend that started on May 31 could take an impulsive five-wave form, but it is challenging to confirm this with certainty. The news background does not strongly support the euro's demand, and the economic statistics from the European Union remain mediocre. The successful breakthrough of the 1.1172 level, corresponding to 127.2% according to Fibonacci, indicates the market's readiness to sell, and the target of 1.1034, equivalent to 100.0% according to Fibonacci, has been reached.

The dollar is preparing for new growth but without the help of the Fed.

On Wednesday, the EUR/USD pair rose by 30 basis points, with movements remaining weak, particularly considering the evening FOMC meeting and Jerome Powell's speech. A 30-point drop in the US currency at the end of the day cannot be considered a significant market reaction. Powell's rhetoric appeared vague and ambiguous, making it difficult to understand his intentions. The interest rate increase by 25 basis points was already known to the market a month and a half ago, leaving enough time to consider the decision.

In summary, Powell's speech did not clearly indicate further tightening. The market could have reached the same conclusion without Powell's input. Powell referred to upcoming inflation, unemployment, and payroll reports, which will be released before the next meeting, guiding the decision-making process. It is currently uncertain whether the interest rate will increase again.

Therefore, the moderate decline in demand for the US dollar was justifiable. However, I had anticipated more significant and high-amplitude movements. The pair has moved away from recent lows, which may indicate a corrective wave as part of a new downtrend section or a presumed wave 4. I expect the downward trend in the pair to resume.

General Conclusions:

Based on the analysis conducted, the construction of the rising wave set is complete. Targets in the range of 1.0500-1.0600 are entirely possible, and I recommend selling the pair with these targets in mind. The a-b-c structure appears well-formed and convincing, and closing below the 1.1172 level indirectly confirms the formation of a descending trend section. Therefore, I advise selling the pair with targets below the 1.1034 level. The construction of a new descending wave may have already started or will commence in the coming days.

On a larger wave scale, the wave labeling of the rising trend has taken on an extended form but is likely completed. We have observed five upward waves, most likely forming a structure of a-b-c-d-e. The next stage may involve constructing another descending three-wave structure with two down and two up waves.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română