Analyzing Macroeconomic Reports:

On July 27th, several important events are scheduled in the European Union and the United States. Let's start with the macroeconomic reports. It is crucial to pay attention to two publications in the US – the first estimate of GDP for the second quarter and the Core Durable Goods Orders. Both reports will be released within a 10-15 minute interval and coincide with the publication of the ECB meeting results. As a result, it will be challenging to determine the market's reaction precisely.

Recently, the market sentiment has turned bullish, meaning that strong data from America may only lead to a slight strengthening of the dollar. What will carry greater significance is not just the ECB's interest rate decision (already known) but also Christine Lagarde's speech, which is scheduled to occur later. However, as mentioned before, comprehending the market's reaction in the next few hours will be difficult. It's worth noting that the results of the Federal Reserve meeting were announced yesterday evening, and traders may continue to respond to Jerome Powell's speech during the American session.

Analyzing Fundamental Events:

The primary fundamental event on Thursday will be Christine Lagarde's speech. The ECB's interest rate decision has already been disclosed, with all three key rates increasing by 0.25%, as expected. The euro and the pound rose in the morning, continuing to respond to Powell's speech from yesterday, which is not easily categorized as "dovish." However, as it typically does, the market has already accounted for all the most "hawkish" scenarios in advance. Furthermore, it is inclined to sell the dollar. We observed a two-week correction for both currency pairs, and the trend has shifted upward. The market may again engage in its usual activity – interpreting incoming information favoring the euro and the pound. If Lagarde signals a pause or a slowdown in tightening, this could put pressure on the euro. In other situations, the euro's upward trend is likely to continue, along with a similar trend for the pound.

General Conclusions:

Thursday will witness several important events. US reports will coincide with Christine Lagarde's press conference. The market may experience considerable turbulence in the upcoming hours until late at night. Traders should be prepared for sharp reversals and substantial movements.

Key Rules of the Trading System:

- The strength of a signal is determined by the time it takes to form (rebound or breakthrough of a level). The shorter the time required, the stronger the signal.

- If two or more trades were opened near a certain level based on false signals, all subsequent signals from that level should be ignored.

- In a flat market, any pair can generate numerous false signals or not form them. In any case, it is better to stop trading at the first signs of a flat market.

- Trades are opened between the beginning of the European session and the middle of the American session, and all trades should be closed manually.

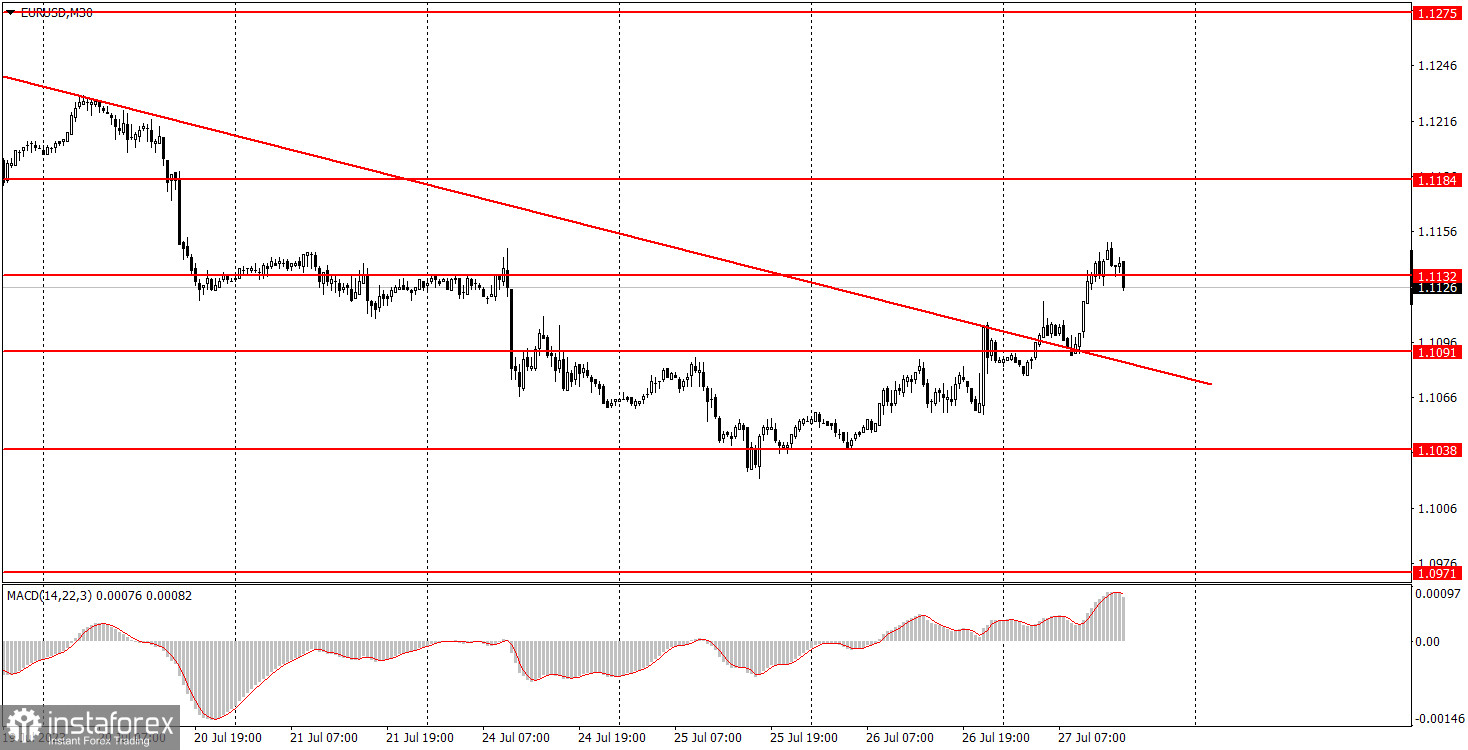

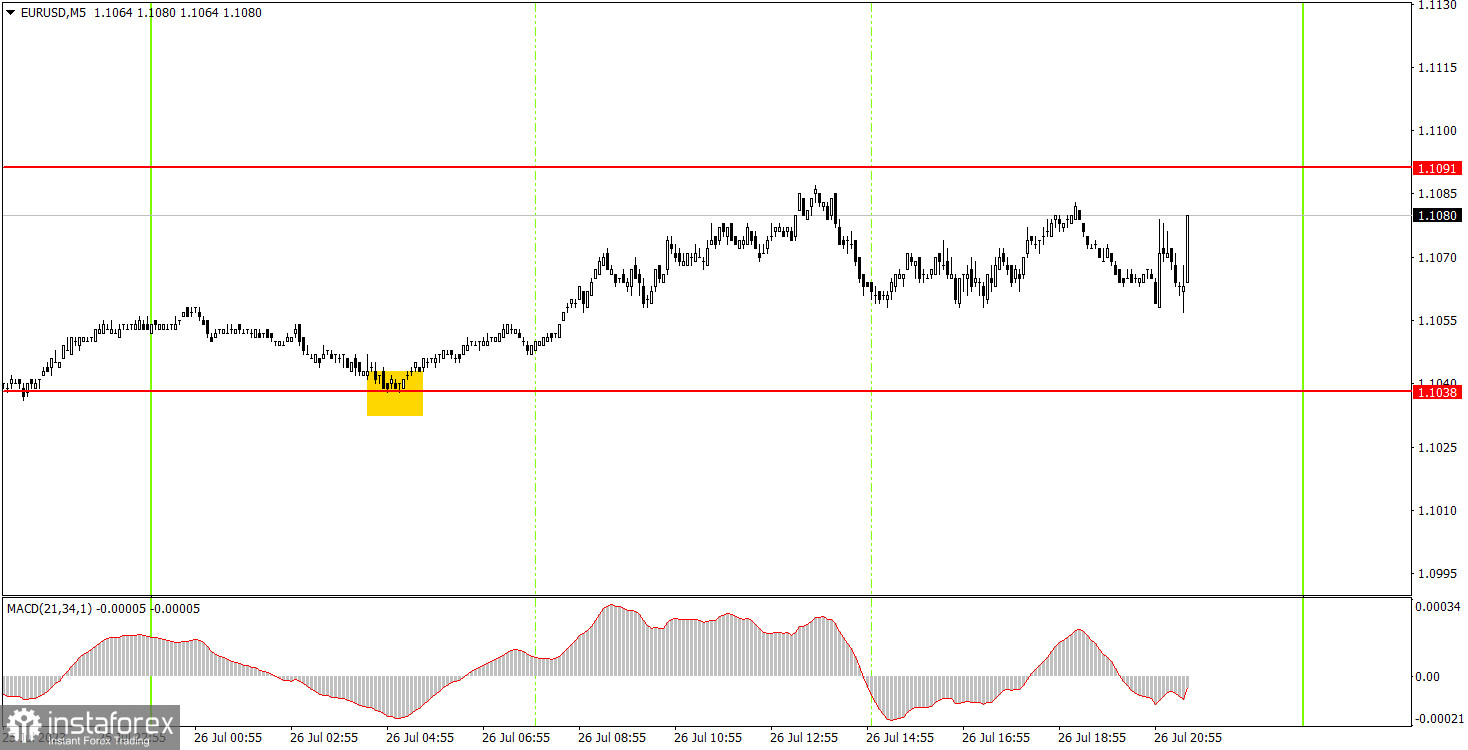

- On the 30-minute timeframe, trades based on MACD indicator signals can be executed only when there is good volatility and a confirmed trend supported by a trendline or channel.

- If two levels are located too close to each other (within 5 to 15 pips), they should be considered as a support or resistance area.

Chart Elements:

Support and resistance levels are the targets when opening buy or sell positions. Take Profit levels can be placed around them.

Red lines represent channels or trendlines that indicate the current trend and show the preferred trading direction.

The MACD Indicator (14, 22, 3) – histogram and signal line – serves as an auxiliary indicator that can also be used as a source of signals.

Important speeches and reports, always listed in the news calendar, can significantly influence currency pairs' movement. Therefore, during their release, it is advisable to trade with extreme caution or exit the market to avoid sharp price reversals against the previous movement.

Beginners trading in the forex market should remember that only some trades will be profitable. Developing a clear strategy and practicing proper money management is key to success in trading over the long term.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română