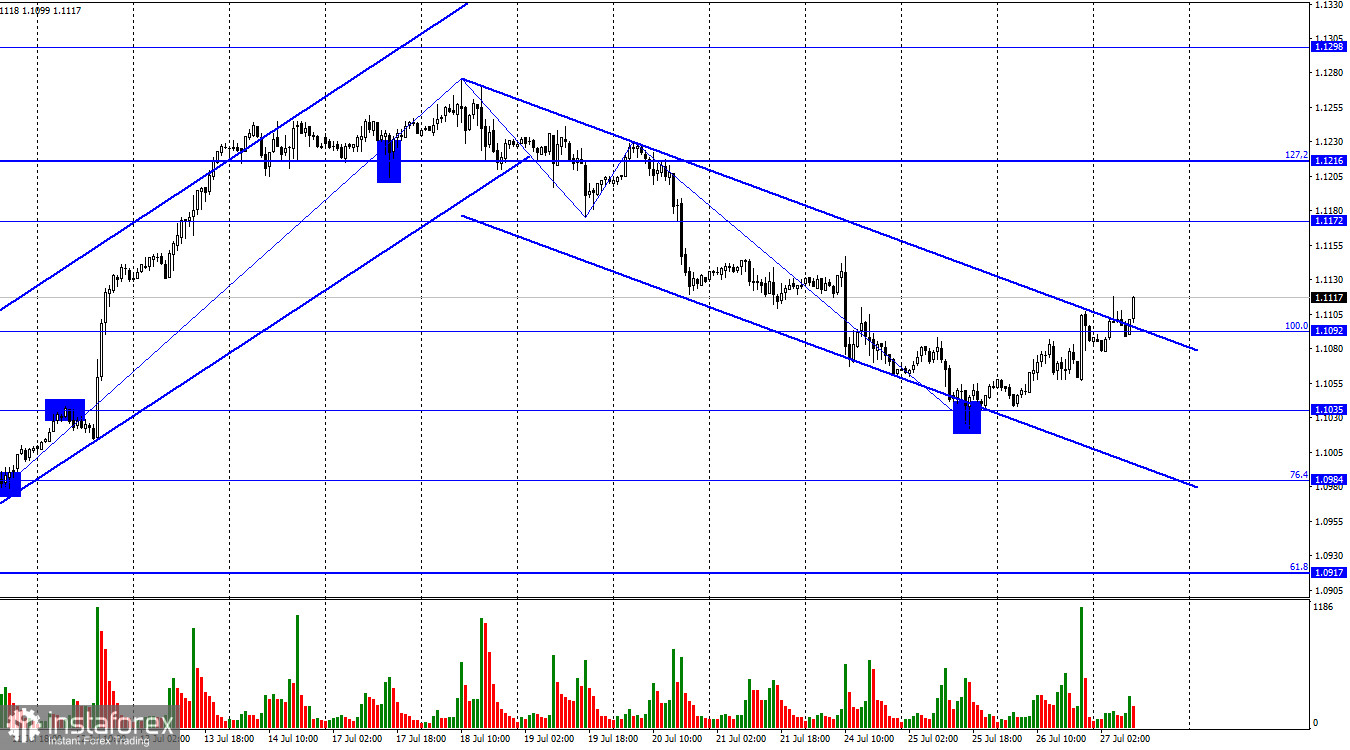

On Wednesday, the EUR/USD pair continued upward after rebounding from the 1.1035 level. As a result, it consolidated above the descending trend corridor, shifting the market sentiment to bullish. The upward trend can proceed towards the next level at 1.1172 and possibly even higher.

The waves are not providing any new signals at the moment. As mentioned yesterday, we are waiting for either a breakout above the peak of the last wave or a new downward wave that does not breach the previous low. Currently, neither of these scenarios has occurred. Moreover, the situation could be more favorable as the pair must reach 1.1216 to surpass the last peak. That's a considerable distance, but fortunately, a close above the descending corridor indicates a setback for bearish ambitions.

The information background of the previous day was dominated by the FOMC meeting and Jerome Powell's speech. Powell's comments were very cautious, as he did not directly answer whether the Fed would raise rates again. He only stated that the decision would be made from meeting to meeting and that the possibility of rate hikes is not ruled out. We will learn about the ECB's decision in a few hours, although there is little suspense. Traders are confident that the European regulator will raise rates by 0.25%. Thus, as yesterday, the main focus will be on the press conference with the central bank president, Christine Lagarde. Whether the euro will be able to continue its upward trend will depend on her words. On Thursday morning, bullish traders will be assertive, anticipating "hawkish" rhetoric. However, Lagarde may disappoint them.

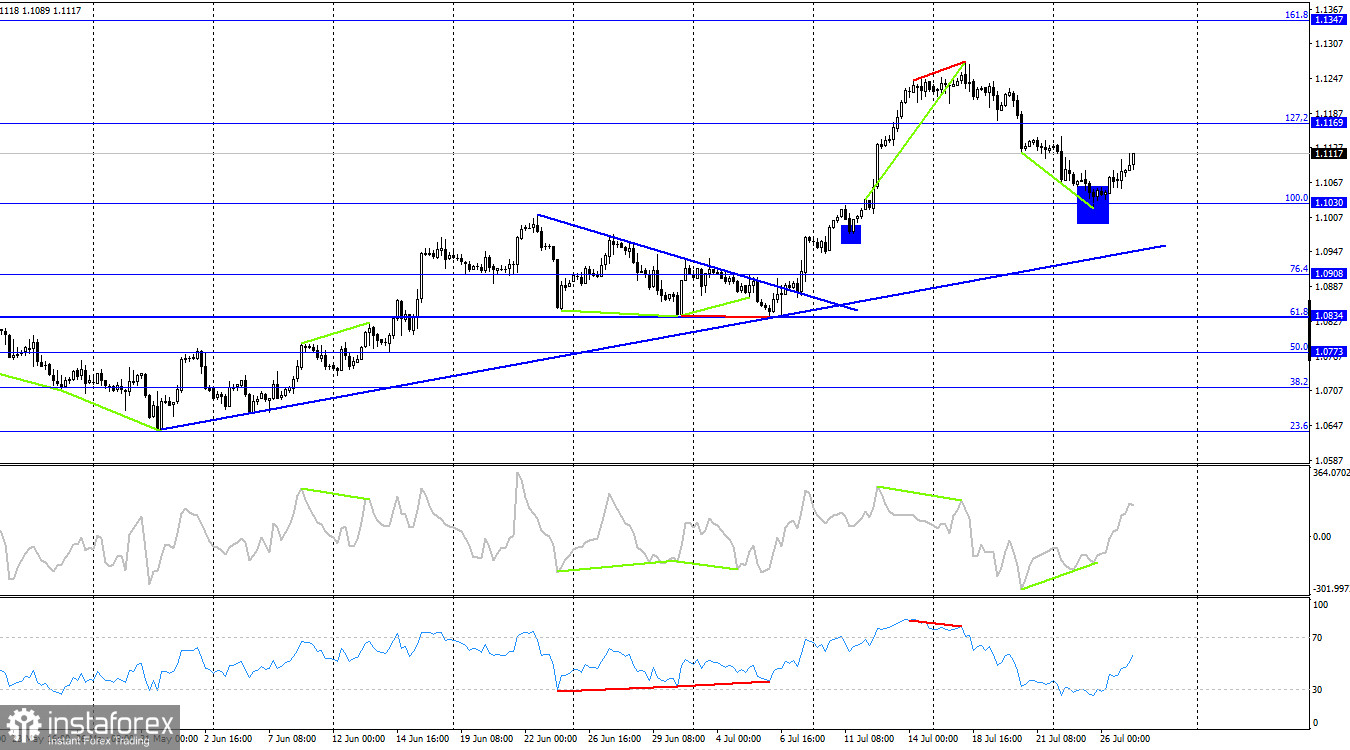

On the 4-hour chart, the pair experienced a rebound from the corrective level of 100.0% (1.1030) and reversed in favor of the euro. Consequently, a new upward movement has begun towards the corrective level of 127.2% (1.1169). The ascending trendline still signals a bullish trend. The "bullish" divergence on the CCI indicator has also supported the bullish traders. Both charts show significantly more signals to buy than to sell.

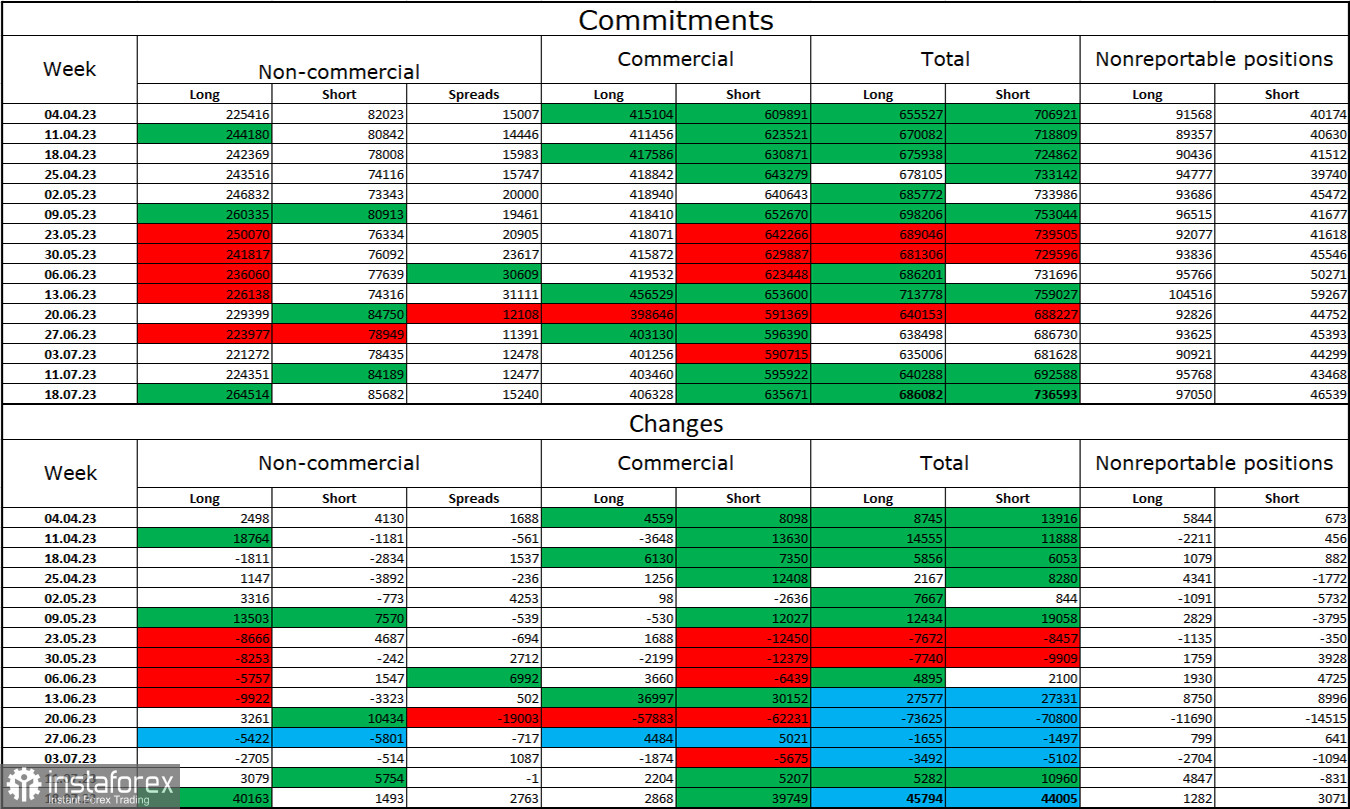

Commitments of Traders (COT) report:

During the last reporting week, speculators opened 40,163 long contracts and 1,493 short contracts. The sentiment among major traders remains bullish and has strengthened once again. The total number of long contracts held by speculators now amounts to 264 thousand, while short contracts are only 85 thousand. The bullish sentiment remains, but the situation will eventually shift in the opposite direction soon. The high value of open long contracts suggests that buyers may start closing them soon due to an excessive bias towards the bulls. The current figures allow for a decline in the euro in the coming weeks, especially considering the strong growth seen two weeks earlier.

Economic Calendar for the US and European Union:

EU - Decision on Interest Rates (12:15 to 15:00 UTC).

EU - ECB Monetary Policy Statement (12:15 to 15:00 UTC).

US - Core Durable Goods Orders (12:30 UTC).

US - GDP for the second quarter (12:30 UTC).

US - Initial Jobless Claims (12:30 UTC).

EU - ECB Press Conference (14:15 UTC).

The economic calendar for July 27th includes several significant events. The most important one is the ECB meeting. The information background's impact on trader sentiment for the rest of the day could be highly significant.

Forecast for EUR/USD and trader advice:

I do not recommend initiating new sell positions, as both charts indicate a shift toward bullish. This implies that any potential declines may be very weak and short-lived. During the ECB meeting, the euro might experience a drop. However, obtaining a clear graphical signal for selling during that time could take time and effort. For the EUR/USD pair, I suggest buying with targets at 1.1092 and 1.1172 on the hourly chart, with a rebound from the 1.1035 level. You can keep your positions open until the ECB meeting and Lagarde's speech. Afterward, the decision will depend on the prevailing circumstances.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română