Trade overview and tips for Bitcoin trading

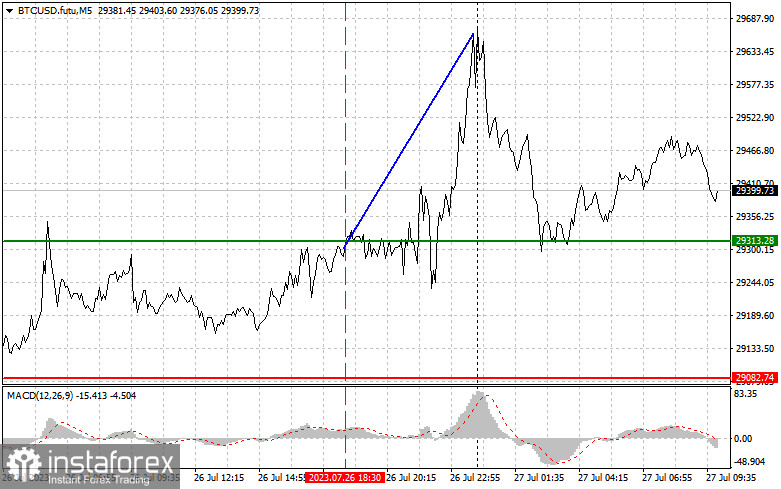

The price test of $29,313 coincided with the MACD being in the buy zone, which confirmed a good entry point for purchasing Bitcoin. Given the fairly uneventful meeting of the Federal Reserve System that followed, a wager on Bitcoin's growth was a sound choice. The upward movement was only halted near $29,680. The decisions made by the US central bank committee benefited risk assets, but Bitcoin buyers were unable to surpass weekly highs. Today, another important report on US Q2 GDP is due; a sharp decline could lead to another Bitcoin surge in an attempt to hit $29,700. If trades continue above $29,340, the market will remain in buyers' control. My preference for today is to base my trades on the execution of Scenario 1.

Buy signal

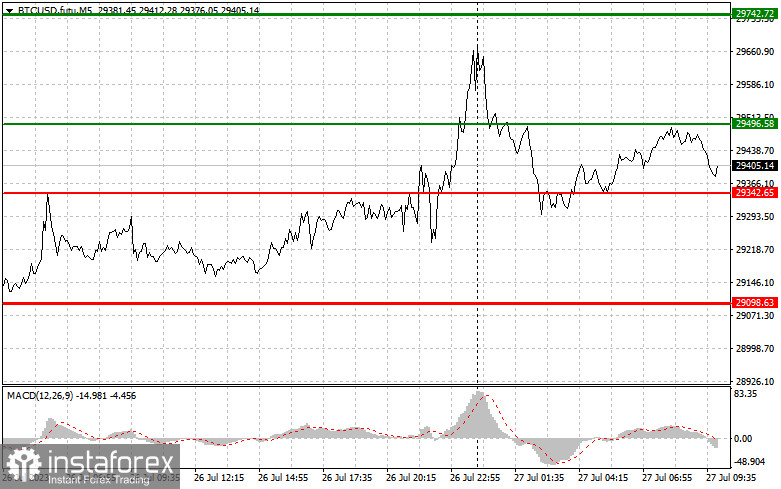

Scenario 1: Consider buying Bitcoin today once it hits the $29,496 entry point (green line on the chart), aiming for a rise to $29,740 (thicker green line on the chart). At $29,740, I recommend exiting purchases and opening sell orders. Bitcoin's substantial growth can be expected today, but only if the trading continues above $29,300. Note! Before buying, make sure the MACD indicator is above zero.

Scenario 2: It is also better to buy Bitcoin today if the level of $29,340 is tested twice. This will cap the instrument's downward potential and trigger a market reversal upward. Expect a rise to the opposite levels of $29,496 and $29,740.

Sell signal

Scenario 1: Consider selling Bitcoin today only after the $29,342 level is updated (red line on the chart), which will lead to a swift fall of the instrument. The main target for sellers will be the $29,098 level, where I recommend exiting sell orders and opening immediate buy orders in the opposite direction. Pressure on Bitcoin will increase in case of daily lows breach. Note! Before selling, be sure that the MACD indicator is below zero.

Scenario 2: You may sell Bitcoin today if the level of $29,496 is tested twice. This will limit the upward potential of the trading instrument and reverse the market. We may expect a drop to the opposite levels of $29,342 and $29,098.

On the chart:

Thin green line – entry price for buying the trading instrument.

Thick green line – potential price to set take profit orders, as further growth beyond this level is unlikely.

Thin red line – entry price for selling the trading instrument.

Thick red line – potential price to set take profit orders, as further decline below this level is unlikely.

MACD indicator. When entering the market, pay attention to the overbought and oversold zones.

Important! Beginner traders in the cryptocurrency market should be very cautious when making trading decisions. It is better to stay out of the market before important fundamental reports to avoid sudden price fluctuations. If you decide to trade during news releases, always place stop-loss orders to minimize losses. Without stop-loss orders, you can quickly lose your entire deposit, especially if you do not use proper money management and trade with large volumes.

Remember that successful trading requires a clear trading plan, similar to the one presented above. Making spontaneous decisions based on the current market situation is an inherently losing strategy for day traders.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română