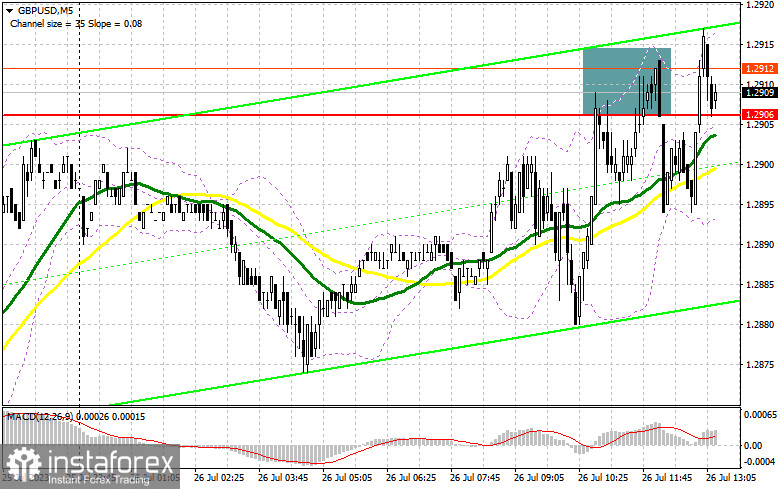

In my morning forecast I highlighted the level of 1.2906 and recommended making trading decisions with this level in mind. Let us have a look at the 5-minute chart and analyze what happened. The pair rose and performed a false breakout of 1.2906, which created an excellent sell signal. However, GBP/USD did not slide down, given ongoing bear market conditions. As a result, I closed the trade at breakeven. The technical outlook for the second half of the day has changed significantly.

When to open long positions on GBP/USD:

Given that the Federal Reserve may possibly announce the end of its rate hike cycle at today's meeting, the monetary policy gap between the Fed and the Bank of England will have a positive impact on the pound sterling. For this reason, we can expect GBP/USD to recover in the medium term. If the Fed does not rule out at least one more rate hike and state they plan to keep monitoring incoming data, the pressure on the pound sterling will return.

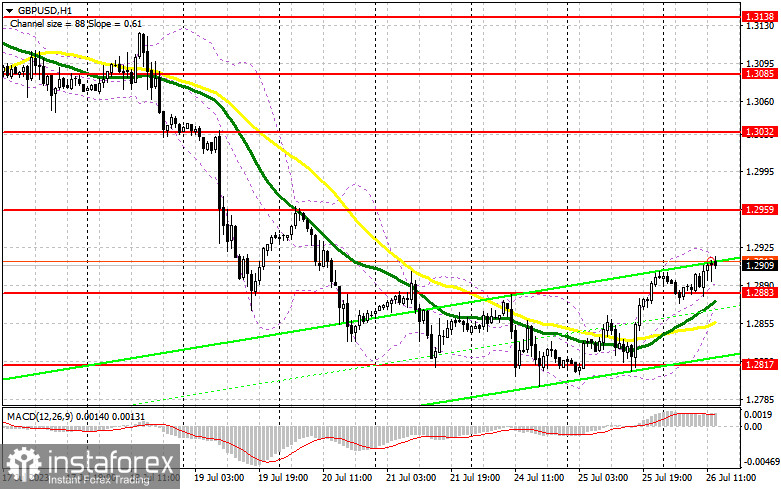

For this reason, I will not be in a hurry to go long on the pair. Positive US real estate market data may lead to a GBP correction in the second half of the day even before the publication of the Fed policy decision, so defending the nearest support at 1.2883, formed at the end of the European session, is a priority. A false breakout of this level there will give an excellent entry point, with an upside target being the resistance at 1.2959. A breakout and a downward retest of this range after the Fed's decision will create a buy signal, restoring the pound's strength and potentially sending it towards a new high of 1.3032. Without hitting that level, it will be difficult for GBP/USD bulls to count on further growth. If the pair moves above this range, a breakout to 1.3085 will be possible, where I will be taking profits.

If GBP/USD falls and there are no bulls at 1.2883, the bear market will continue to develop and the pound will perform badly. The moving averages slightly below that level are favoring the bulls. If the pair does decline, I will postpone opening long positions to 1.2817. Trades should be opened there only on a false breakout. Long positions on GBP/USD can be opened immediately on a rebound from 1.2754, targeting a correction of 30-35 pips intraday.

When to open short positions on GBP/USD:

Bears are taking a wait-and-see stance today. It is very important for them to keep the pair below 1.2959, as missing this level as well, all hopes for further correction will vanish. The formation of a false breakout at 1.2959 after the publication of the Fed policy decision and hawkish comments of Jerome Powell would form a sell signal targeting a decline to the support at 1.2883, which was formed today. A breakout and an upward retest of this range will create an entry point for short positions, targeting 1.2817. A more distant target will be the low of 1.2754, where I will take profits. If GBP/USD rises and bears are absent at 1.2959 in the second half of the day, they will completely lose control over the market. In this case, only a false breakout near 1.3032 will form an entry point to short positions, expecting the pound to move down. If there is no activity there as well, I advise selling GBP/USD immediately if it bounces off 1.3085 targeting an intraday downward correction of 30-35 pips.

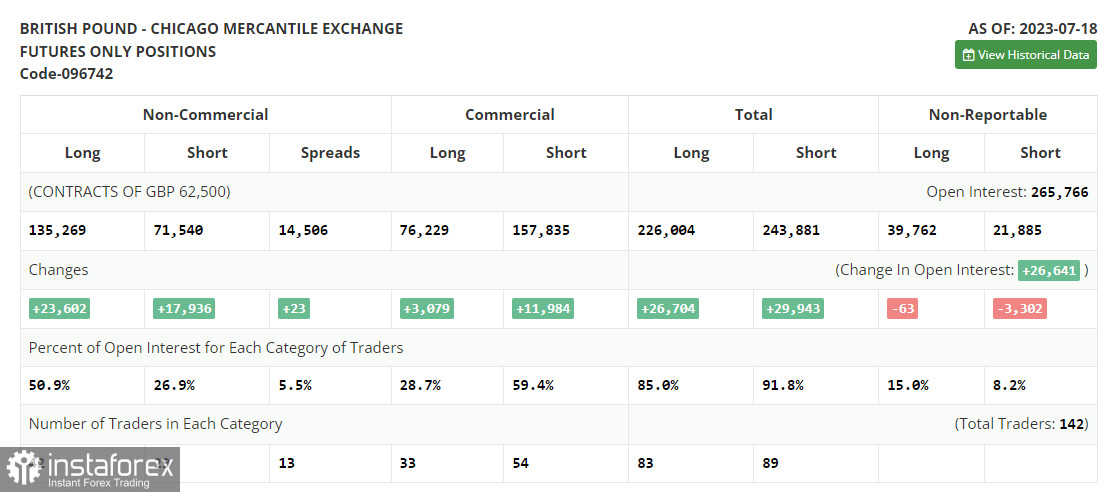

According to the COT report (Commitment of Traders) for July 18th, there was a significant increase in both long and short positions. Traders started returning to the market after the release of several fundamental data releases, indicating the UK economy is in a somewhat stable state, which is gradually sagging under the pressure of high interest rates. The sharp decline in inflation in the US prompted a GBP upsurge. However, its overbought condition, coupled with the central bank's hawkish policies, raises concerns about future labor and housing market problems in the UK. Bearish are taking advantage of this by increasing their short positions at any opportune moment, as evident from the COT report. Recent PMI reports also point to growing issues. This week, the Federal Reserve will hold its policy meeting, and if there's an announcement about concluding the cycle of interest rate hikes, the pound sterling may rise again. Buying the pound on dips remains the optimal strategy. According to the latest COT report, non-commercial long positions increased by 23,602 to 135,269, while non-commercial short positions jumped by 17,936 to 71,540. This led to another upward surge in the non-commercial net position, which reached 63,729 compared to 58,063 the previous week. The weekly price rose to 1.3049 from 1.2932.

Indicator signals:

Moving Averages

Trading is carried out above the 30-day and 50-day moving averages, indicating that GBP/USD bulls are returning to the market.

Note: The author considers the period and prices of the moving averages on the 1-hour chart (H1), which differ from the standard definition of classical daily moving averages on the daily chart (D1).

Bollinger Bands

If the pair declines, the lower boundary of the indicator around 1.2880 will act as support.

Description of indicators

Moving average (moving average, determines the current trend by smoothing out volatility and noise). Period 50. It is marked yellow on the chart. Moving average (moving average, determines the current trend by smoothing out volatility and noise). Period 30. It is marked green on the chart. MACD indicator (Moving Average Convergence/Divergence - convergence/divergence of moving averages) Quick EMA period 12. Slow EMA period to 26. SMA period 9 Bollinger Bands (Bollinger Bands). Period 20 Non-commercial speculative traders, such as individual traders, hedge funds, and large institutions that use the futures market for speculative purposes and meet certain requirements. Long non-commercial positions represent the total long open position of non-commercial traders. Short non-commercial positions represent the total short open position of non-commercial traders. Total non-commercial net position is the difference between the short and long positions of non-commercial traders. English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română