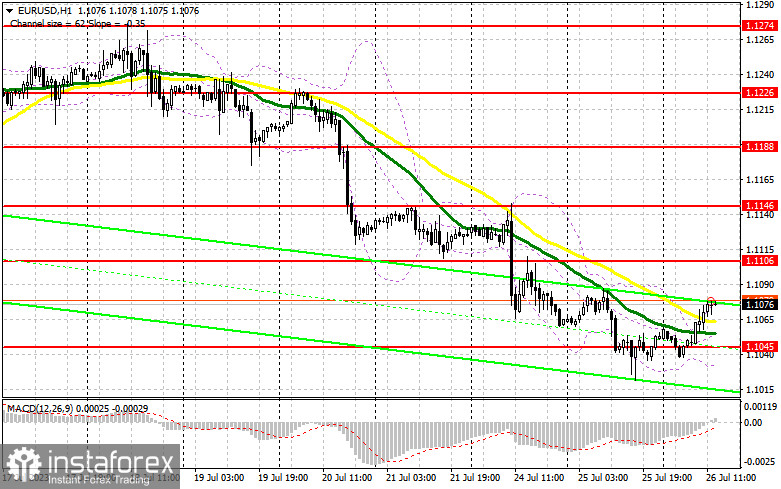

In my morning forecast, I paid attention to the level of 1.1066 and recommended making decisions on market entry with this level in focus. Let's look at the 5-minute chart and discuss what actually happened. Growth and a false breakdown at 1.1066 generated a signal to sell the euro, but EUR/USD never developed a major downward movement. Due to the lack of a fast downward movement, I decided to exit the market with minor losses. In the afternoon, the technical picture was completely revised.

What is needed to open long positions on EUR/USD

Considering that we have a Federal Reserve decision on interest rates ahead of us, it makes no sense to place support and resistance levels very close. If the Fed announces that it no longer plans to increase interest rates after a rate hike today and will look at further economic data, I'd rather prefer to buy the euro, betting on its rebound to one-year highs with their subsequent update. If the FOMC signals at least one more rate hike this autumn, still relying on the data, I'd reckon a decrease in the euro, but a major drop is unlikely to take place.

For this reason, defending the new support at 1.1045, just above which the moving averages pass, will be paramount. The decline and a false breakdown at this level after strong data on the growth of new home sales in the US, or after the Fed's decision - all this is a signal to buy with the aim of a breakout at 1.1106. A break and test from top to bottom of this range will strengthen the demand for the euro, giving a chance for a return to the high of 1.1146. The level of 1.1188 remains the highest target, where I will take profits. Its test will indicate a new bullish sequence. With the option of lower EUR/USD and no activity at 1.1045 in the afternoon, the development of the bear market will continue. Therefore, only a false breakout in the area of the next support at 1.0981 will give a signal to buy the euro. I will open long positions immediately on a dip from the low of 1.0946 with the aim of an upward correction of 30-35 pips intraday.

What is needed to open short positions on EUR/USD

The sellers took a wait-and-see approach. In case of weak reports on the US, the euro may extend its growth to the area of 1.1106, which I generally count on. I prefer to act from this level only after a false breakout, which will give a signal to sell with the prospect of a decrease in EUR/USD to a new support of 1.1045. I expect bigger buyers to appear there, so I bet on a breakout and consolidation below this zone only after the announcement of the Fed's decision on interest rates provided that the Fed maintains hawkish rhetoric. A reverse test from the bottom up to 1.1045 will help to get a sell signal, opening the door to 1.0981. The lowest target will be the area of 1.0946, where I will take profits.

If EUR/USD moves up during the American session and there are no bears at 1.1106, which also cannot be ruled out, the bulls will regain their advantage. With such market developments, I will postpone short positions until the next resistance at 1.1146. You can also sell there, but only after an unsuccessful consolidation. I will open short positions immediately on a rebound from the high of 1.1188 with the aim of a downward correction of 30-35 pips.

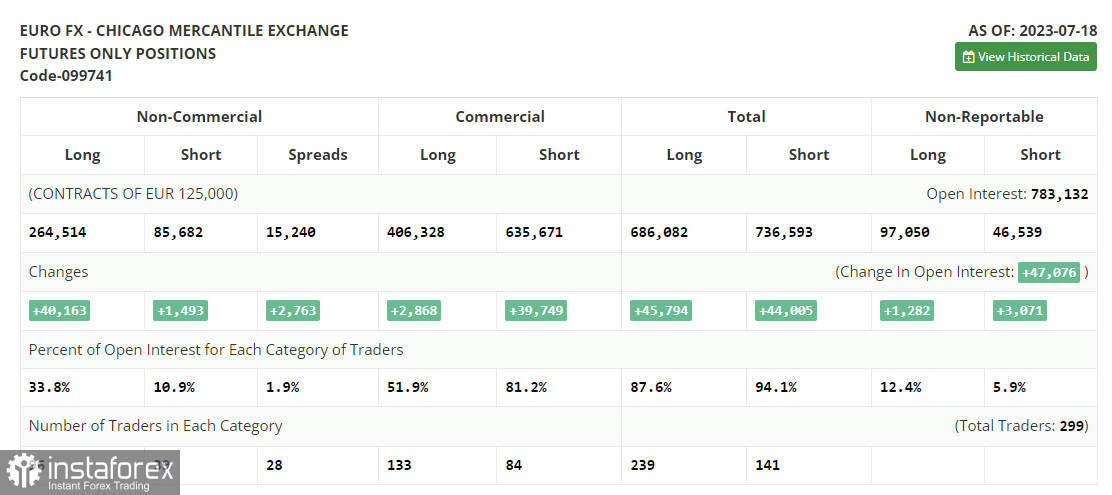

In the COT report (Commitment of Traders) for July 18, there was an increase in both long and short positions. However, there were much more buyers, which strengthened the balance of trading forces in the market in their favor. The data on the US inflation triggered buying of risky assets, including the euro. Last week, ECB policymakers stated that it would be the right time to step up with a hawkish policy in the Eurozone. Such prospects only cemented expectations and bets on further growth of the euro against the US dollar. The Federal Open Market Committee will meet this week to decide on monetary policy. Many economists expect them to announce the last rate hike in a nearly 1.5-year cycle of monetary tightening. Such prospects will further weaken the dollar. The ECB meeting is likely to be hawkish. For this reason, while the market is bullish, buying the euro on dips remains the optimal medium-term strategy. The COT report shows that long non-commercial positions rose by 40,163 to 264,514, while short non-commercial positions grew only by 1,493 to 85,682. At the end of the week, the total non-commercial net position rose to 178,000 from 140,162. EUR/USD closed last week higher at 1.1300 versus 1.1037 a week ago.

Indicators' signals

Moving Averages

The instrument is trading above the 30 and 50-day moving averages. It indicates that the buyers are making efforts to enter the market.

Note: The period and prices of the moving averages are considered by the analyst on the 1-hour chart and differ from the general definition of classic daily moving averages on the daily chart.

Bollinger Bands

In case EUR/USD extends its decline, the indicator's upper border around 1.1080 will act as resistance.

Description of indicators

- Moving average (moving average, determines the current trend by smoothing out volatility and noise). Period 50. It is marked yellow on the chart.

- Moving average (moving average, determines the current trend by smoothing out volatility and noise). Period 30. It is marked green on the chart.

- MACD indicator (Moving Average Convergence/Divergence — convergence/divergence of moving averages) Quick EMA period 12. Slow EMA period to 26. SMA period 9

- Bollinger Bands (Bollinger Bands). Period 20

- Non-commercial speculative traders, such as individual traders, hedge funds, and large institutions that use the futures market for speculative purposes and meet certain requirements.

- Long non-commercial positions represent the total long open position of non-commercial traders.

- Short non-commercial positions represent the total short open position of non-commercial traders.

- Total non-commercial net position is the difference between short and long positions of non-commercial traders.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română