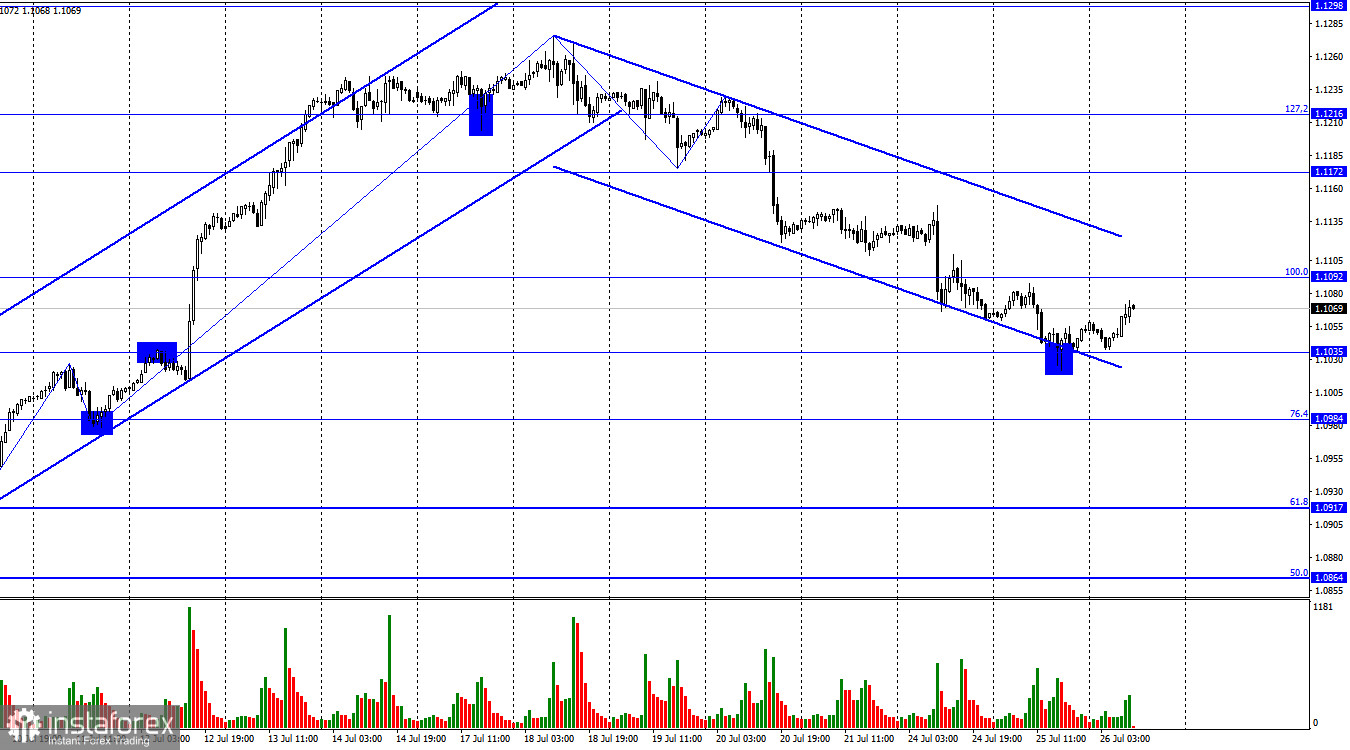

On Tuesday, the EUR/USD pair declined to 1.1035 but rebounded in favor of the EU currency. As a result, the pair started moving upward towards the 100.0% Fibonacci level at 1.1092. This growth occurs within a descending trend corridor, reflecting traders' ." If the pair's exchange rate rebounds from the 1.1092 level or the upper line of the corridor, it will favor the American currency and cause a resumption of the decline. However, a close above the corridor would change the market sentiment to "bullish."

The waves currently indicate the same - a "bearish" trend with no signs of ending. The last downward wave has been forming for five consecutive days but will likely end tonight. Once it concludes, a new downward wave is required, one that does not breach yesterday's low, before we can talk about the end of the "bearish" trend. Alternatively, if there is a close above the corridor, it could signal a shift in market sentiment.

The Federal Reserve meeting is scheduled for this evening, but let's discuss the ECB meeting, which will conclude tomorrow. I'm not particularly interested in the meeting itself, as I believe everyone is already aware that the interest rate in the Eurozone will increase by another 0.25%. However, Christine Lagarde's speech may attract much more attention. The key question on the agenda is whether the ECB plans to continue raising the rate this autumn. The "bearish" trend could quickly transform into a "bullish" one if the answer is positive.

It will also be interesting to learn if the ECB intends to increase the pace of balance sheet reduction under the quantitative tightening program, which also affects inflation by reducing it. If the pace is increased, there may not be a need to raise the rate too high.

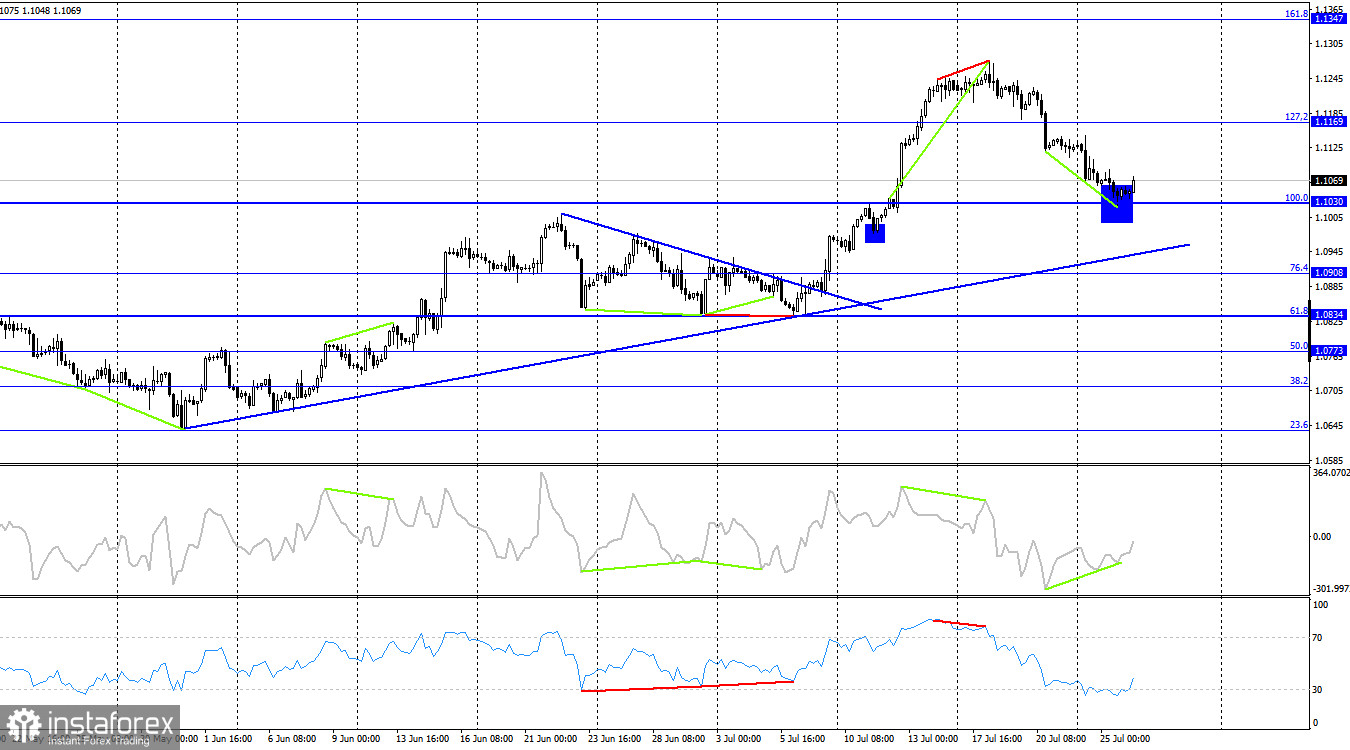

On the 4-hour chart, the pair experienced a decline to the 100.0% correction level at 1.1030. A rebound of the pair's exchange rate from this level would favor the European currency and lead to a resumption of growth towards the corrective level of 127.2% (1.1169). The ascending trendline continues to indicate a "bullish" trend. The "bullish" divergence on the CCI indicator also suggests a possible rise in the euro currency in the coming days.

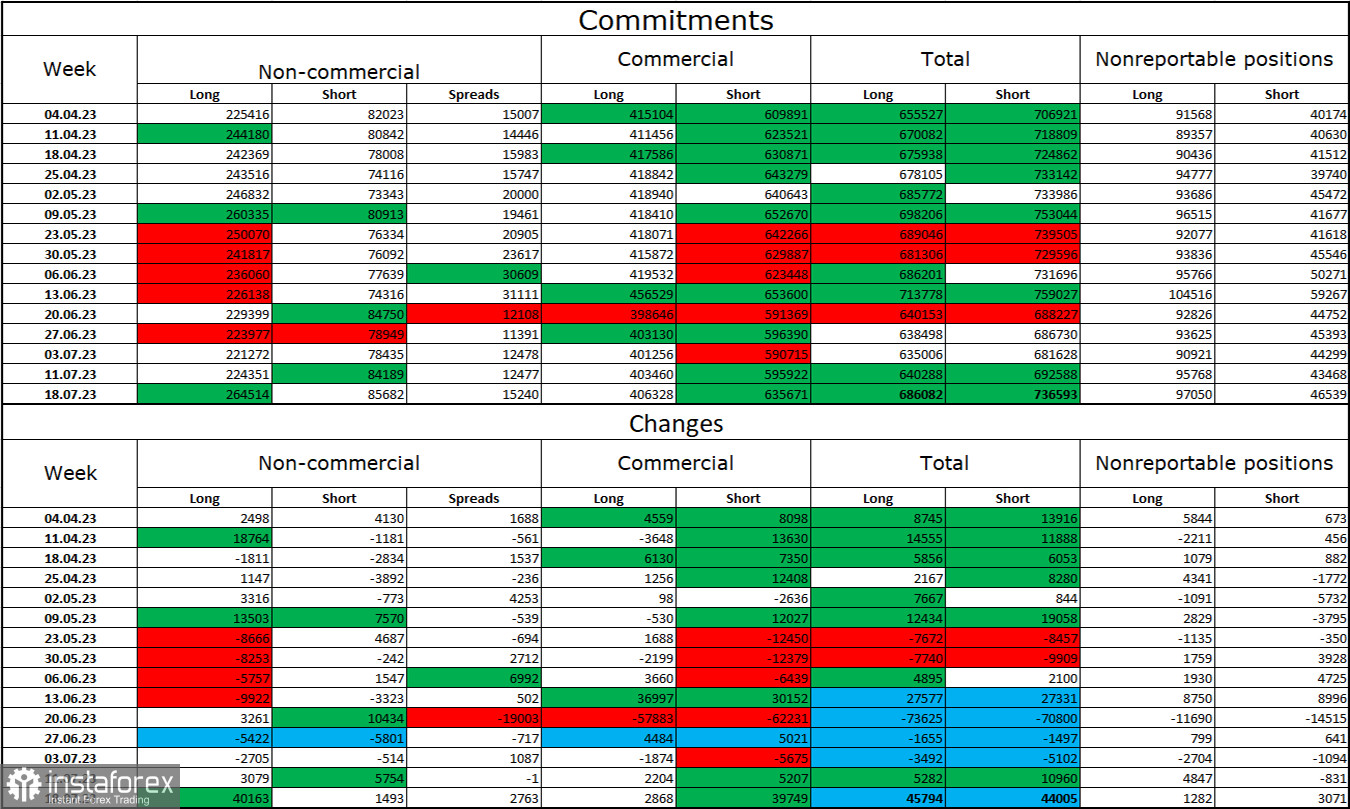

Commitments of Traders (COT) Report:

During the last reporting week, speculators opened 40,163 long contracts and 1,493 short contracts. The sentiment among major traders remains "bullish" and has strengthened once again. The total number of long contracts held by speculators now amounts to 264,000, while short contracts total only 85,000. The "bullish" sentiment persists, but I believe the situation may change in the opposite direction soon. The high value of open long contracts suggests that buyers may start closing them soon - there is a strong bias towards the bulls. The current figures allow for a decline in the euro currency in the coming weeks, especially considering the significant rise two weeks ago.

News Calendar for the USA and the European Union:

USA - Building Permits (12:00 UTC).

USA - New Home Sales (14:00 UTC).

USA - Federal Reserve Interest Rate Decision (18:00 UTC).

USA - FOMC Statement (18:00 UTC).

USA - FOMC Press Conference (18:30 UTC).

The economic events calendar for July 26 includes several significant entries in the USA, with the key event being the FOMC meeting. The information background's impact on trader sentiment for the rest of the day can be highly significant.

Forecast and Trader Advice for EUR/USD:

Selling opportunities were present with a confirmation below the level of 1.1216 on the hourly chart, targeting 1.1172, 1.1092, 1.1035, and 1.0984. All targets, except the last one, have been reached, and it is currently a favorable time to close sales. Consider buying the pair with a target of 1.1092 on a bounce from the 1.1035 level on the hourly chart. A close above the 1.1092 level and the trend corridor will support holding onto purchases with a target of 1.1172.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română