Gold is rising not thanks to, but in spite of it all. The USD index is going up; however, the precious metal managed to hold above the important level of $1,954 per ounce and is ready to continue its rally. The reasons for this deviation in intermarket relationships should be sought in the Forex market. Major world currencies are extremely vulnerable: the euro is falling due to the weakness of the Eurozone economy, the pound is suffering from a sharp inflation slowdown, and the yen is affected by the Bank of Japan's reluctance to change its monetary policy. In comparison, the U.S. dollar appears to be more preferable; however, it also has its Achilles' heel.

The key driver of the XAU/USD growth is the completion of the Federal Reserve's monetary tightening cycle. Despite the current advantage of maintaining a "hawkish" rhetoric for the central bank, data show that they will soon have to put an end to it. Primarily, this is due to the slowdown in consumer and producer prices in the USA. As a result, the Fed's bark today might be more dangerous than its bite. Indeed, the Fed cannot afford to raise rates too high, and investors will be closely monitoring Jerome Powell's rhetoric.

The proximity of the end of the Federal Reserve's monetary tightening cycle is not the only driver of XAU/USD growth. After a series of positive reports on the state of the U.S. economy, talks of a soft landing are becoming more frequent in the market. However, to win over inflation, a significant cooling of the labor market is usually required, which often means a recession. Expectations of a slowdown in the U.S. economy have historically supported gold prices.

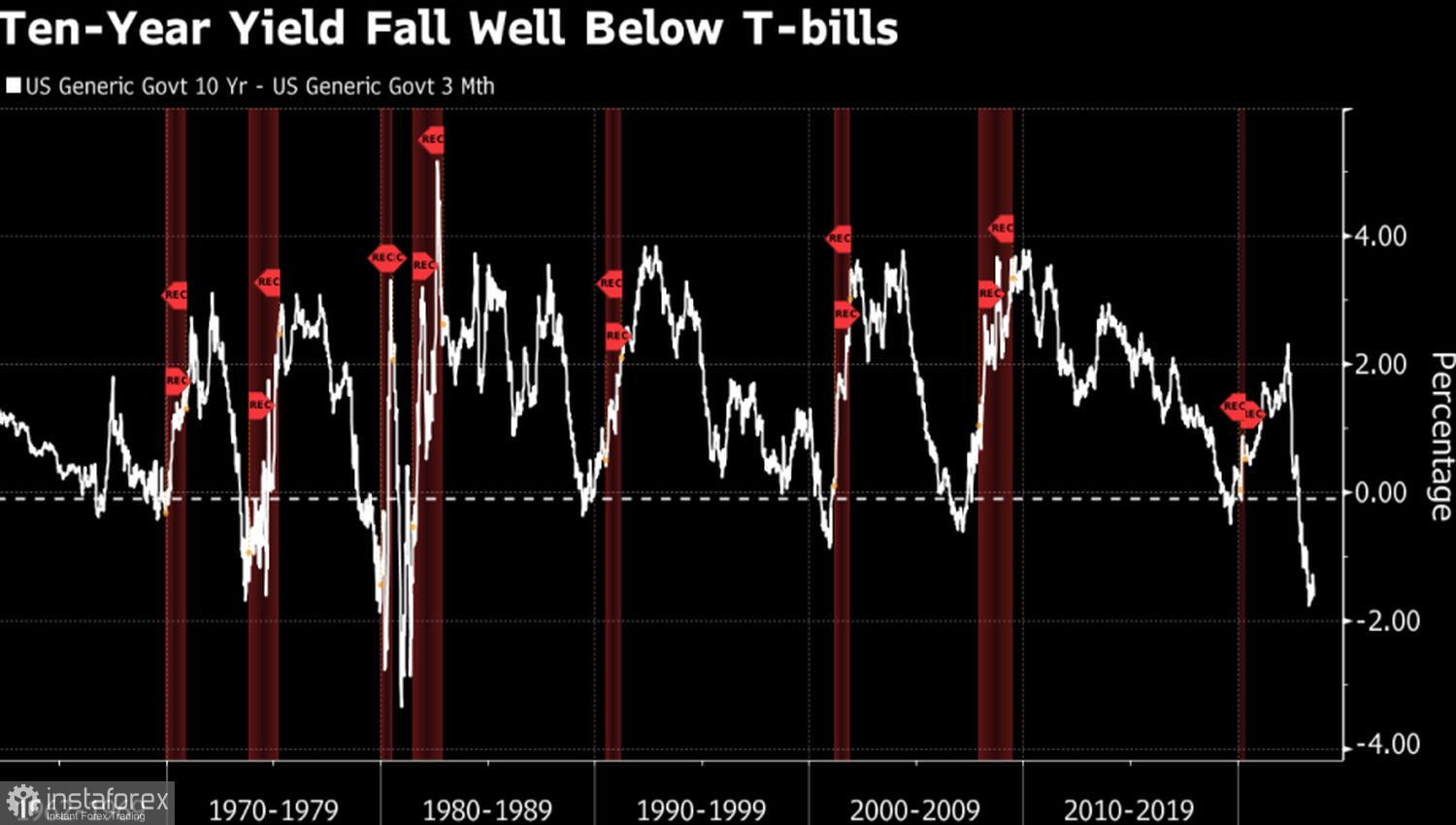

The inverted yield curve also indicates a recession. This indicator has provided accurate predictions for over half a century. If we follow its average value over the past 13 months, the decline should occur in 2023. However, the curve inverted two years before the global economic crisis of 2008–2009. Perhaps, the same will happen this time.

Dynamics of the yield curve

Expectations of the deteriorating state of the U.S. economy and the proximity of the end of the Federal Reserve's monetary tightening cycle allow speculators to build up long positions in gold. As of the week ending July 18, asset managers have brought their net long positions on the precious metal to their highest levels since March 2022. While some speculate on the future direction of XAU/USD quotes, these investors are actively buying.

Gold is also supported by an improvement in the physical metal market conditions. Its consumption in China from January to June increased by 16.4% and reached 554.9 tons. The demand for gold bars and coins showed the most significant growth, rising by 30.1% to 146.1 tons.

The rally of XAU/USD just before the announcement of the results of the July FOMC meeting shows that the "bulls" are not afraid of the Federal Reserve. Whatever it says, the policy of data dependence supports the precious metal. Naturally, as long as the statistics indicate a slowdown in inflation.

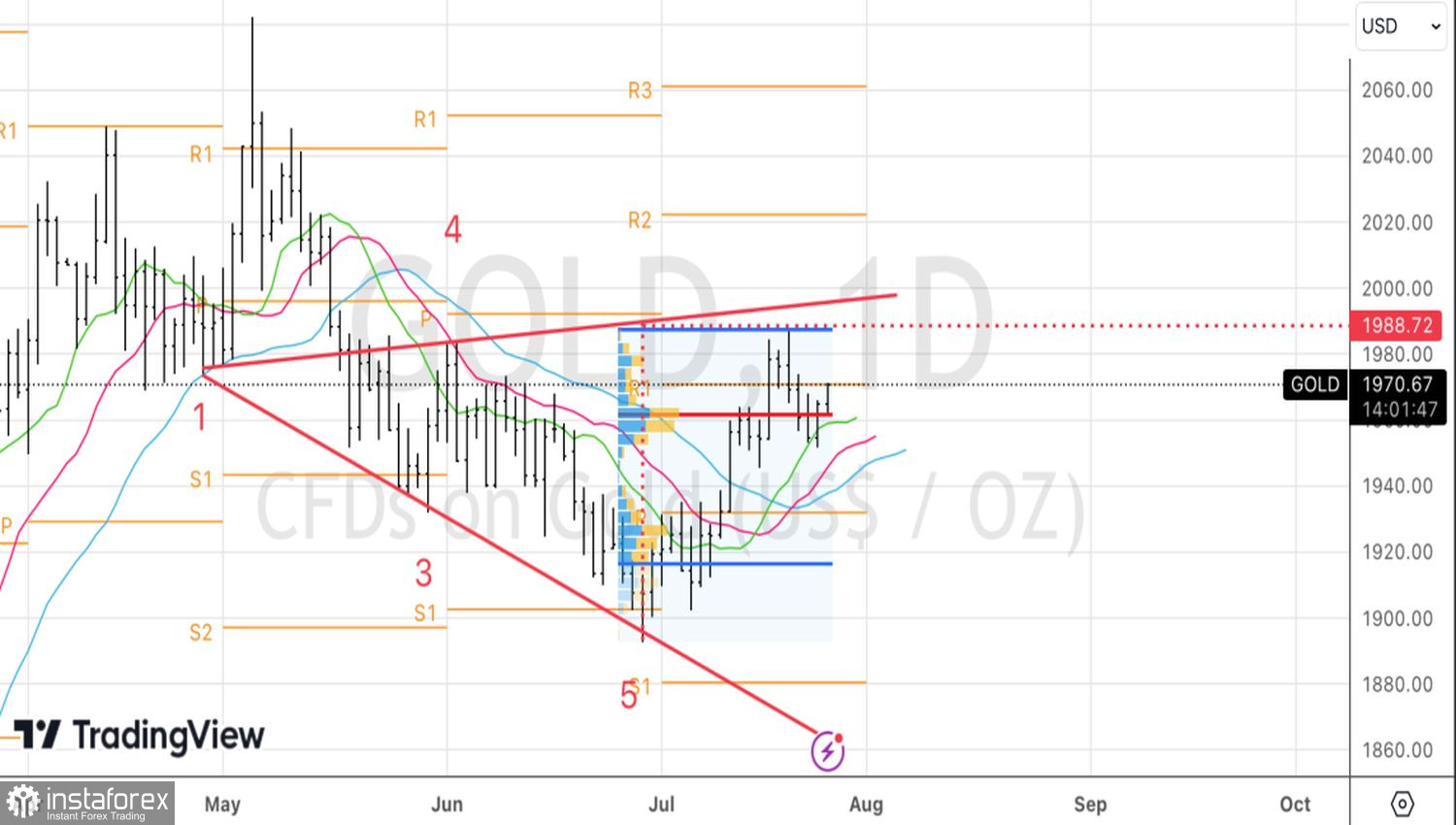

Technically, on the daily chart of gold, the realization of the Wolfe Wave pattern continues. Its targets at $1,990 and $1,998 per ounce remain relevant. Moreover, the rebound from the $1,954 level allowed us to increase previously established long positions.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română